Immediately after the Russia-Ukraine war broke out on February 24, 2022, a series of European and American businesses simultaneously announced to limit operations or leave the Russian market in response to Moscow's military action against Kyiv, as well as to avoid sanctions. However, more than a year has passed but only very few Western businesses have done this. Currently, there are still many European companies from mid-sized to blue-chip companies (large and powerful companies) that remain in the Russian market.

Surprising reality

A study by the University of St. Gallen (Switzerland) published in February showed that between February and November 2022, less than 9% of European Union (EU) and G7 companies divested at least one subsidiary in Russia. The companies that withdrew were mainly those with lower profits and a higher workforce than those that remained.

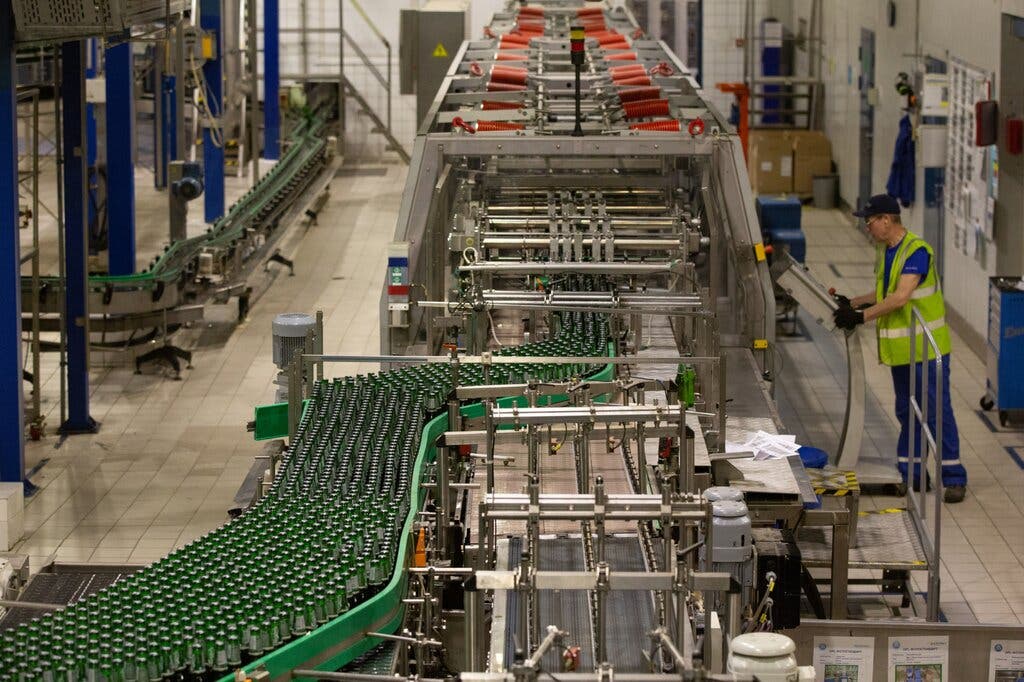

Carlsberg factory in St. Petersburg

Recently, the Kyiv School of Economics (KSE) statistics show that out of 3,141 foreign companies in Russia that were monitored, only about 211 companies left the Russian market (less than 7%) since the outbreak of hostilities. Meanwhile, 468 companies announced plans to withdraw, 1,228 companies stayed and more than 1,200 companies reduced the scale of operations or left the option open. Of the remaining companies, 19.5% were from Germany, 12.4% were from the US, 7% were from Japan.

According to The Washington Post , as soon as the war broke out, Coca-Cola announced that it was "suspending its operations in Russia." However, Coca-Cola HBC, a Swiss-based bottled water company with a 23.2% stake held by Coca-Cola, converted its Russian subsidiary Coca-Cola HBC Eurasia into Multon Partners in August 2022. Multon Partners continues to operate 10 factories in Russia that produce drinks under other names such as Dobry Cola, Rich and Moya Semya.

Meanwhile, PepsiCo , despite announcing it would stop selling Pepsi-Cola, Mirinda, and 7-Up in Russia and produce only essential items like dairy products for humanitarian reasons, continues to sell potato chips in the country. Similarly, Unilever is also selling Magnum ice cream in Russia. Although Swedish furniture giant Ikea announced it was leaving Russia, its Mega shopping centers continue to operate there. Pharmaceutical giant Pfizer has stopped investing in Russia but continues to sell a limited range of products and transfers profits to Ukrainian humanitarian groups. Hotel chains Accor and Marriott also said they have suspended opening new locations in Russia, but existing locations managed by third parties remain open.

Some other companies are even leaving open the possibility of returning to the Russian market. Carlsberg aims to cease operations in Russia by mid-2023, but CEO Cees 't Hart said the company is working on a buyout clause that could allow it to return to the Russian market later.

The sign of an Apple store in Moscow in a photo taken in 2021

Dilemma

The reason why many Western companies are hesitant or unable to leave the Russian market comes from many reasons, including both subjective and objective.

First, the Russian government has done everything it can to stem the tide of Western companies leaving the market. The process of leaving Russia is relatively complicated and time-consuming, with the Kremlin issuing regulations that require Western companies to seek permission from the Russian state if they want to sell assets. Russia also confiscates assets and prohibits foreign banks and energy companies from selling shares without the personal approval of President Vladimir Putin.

In December 2022, the Russian Finance Ministry announced a number of measures against the sale of assets by investors from "unfriendly countries", including a 50% discount on the sale price and a 10% tax.

A former McDonald's restaurant in St. Petersburg

For example, just four days after the war broke out, Shell announced that it would leave Russia and sell its nearly 27.5 percent stake in Novatek’s Sakhalin-2 liquefied natural gas (LNG) facility in the Far East for $1.6 billion. However, in early April, Russian media reported that President Putin had only allowed Shell to receive $1.2 billion from the sale. Moreover, moving Shell’s money out of Russia is not an easy task.

Many foreign companies are unable to leave Russia in the usual way, said Andrii Onopriienko, project manager at KSE. Pressure from Russian policies has forced them to “hold their breath and wait.” However, the longer companies wait, the more complicated and expensive their efforts to leave the Russian market will become. Many companies will lose the ability to sell their businesses, continue to incur losses, and may eventually have their assets nationalized or be bought out at a bargain price.

Second, the divestment efforts of Western companies are more complicated than expected. In addition to the Russian government's "hand-tying" regulations as mentioned above, some Western companies do not want to risk giving market share to companies from China, India, Turkey or Latin American countries, which are "eyeing" their assets and shares in Russia. Lawyer Olivier Attias of the August Debouzy Law Firm based in Paris (France), assessed that Russia is a big market for many companies, so the decision to "leave" is very difficult and the process of "leaving" is even more difficult.

Third, Western companies are heavily dependent on doing business in Russia and the costs of exiting are likely to be greater than those of staying. The Russian economy is still performing better than expected, shrinking by only 2.1% in 2022 and the long-term opportunities for Western companies in this market are considered to be huge.

Fourth, Russian consumers still have a strong appetite for Western brands. Although BMW, Mercedes, and Apple have announced they will stop selling in Russia, their products and those of other Western luxury brands remain popular in Russia, including black market imports. Ivan Fedyakov of the market research firm INFOLine says Russians know that there is no substitute for a BMW, Mercedes, or iPhone.

A former Renault factory in Moscow

Challenges for those who stay

Leaving the Russian market is very complicated and not as easy as initially stated because it involves many issues. However, staying in the Russian market also causes many challenges for Western businesses.

Many Western companies that have not left face accusations of undermining US and Western efforts to increase pressure on the Russian economy through sanctions. "The tax money paid by foreign companies is partly helping Moscow maintain its military activities, while allowing Russians to enjoy amenities and a quality of life that is not much different from before," Mr. Onopriienko said.

Auchan supermarket in Moscow. French supermarket chain keeps 230 stores in Russia open

Furthermore, Western companies selling food or personal products are vulnerable to being implicated in the war effort, especially as Russia moves toward a “war economy.” For example, French corn and bean producer Bonduelle was forced to deny allegations in December 2022 that it had supplied canned food to the Russian military after images of Russian soldiers holding the company’s products appeared on social media.

In addition, according to Bloomberg, multinational companies are said to have lost a lot of human resources because of local employees joining the army and emigrating. Although Kremlin spokesman Dmitry Peskov denied that businesses would be forced to participate in the military campaign, some reports said that during the partial mobilization last fall, many notices were sent to foreign companies - where Russians worked.

Experts predict that the more intense war situation in the coming time will cause Western businesses remaining in the Russian market to continue to face more difficulties and challenges.

Source link

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)