Vietcap Securities Corporation (HOSE: VCI) has just published an analysis report on GELEX Group Corporation (HOSE: GEX).

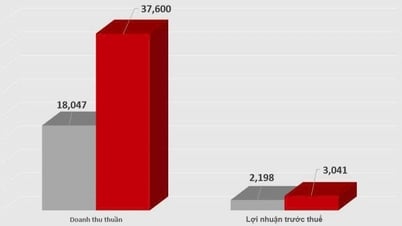

Vietcap forecasts that GELEX's revenue for the whole year of 2024 will reach VND32,017 billion, up 7% compared to the results of 2023. Increased revenue from the electrical equipment segment is forecast to offset the decrease in industrial park land handover. In GELEX's revenue structure in 2024, Vietcap forecasts electrical equipment revenue to grow 21% year-on-year to VND19,183 billion, driven by most of GELEX Electric's subsidiaries exceeding the plan. Meanwhile, the construction materials and industrial park leasing & services segments will decrease by 6% and 14% to VND7,455 billion and VND3,757 billion, respectively. Vietcap also reduced its forecast for industrial park land handover in 2024 from 152 hectares to 139 hectares, as the leased area in the first 9 months of 2024 reached only 85 hectares, lower than expected. GELEX's pre-tax profit and after-tax profit in 2024 are forecast by Vietcap to reach VND2,798 billion and VND2,102 billion, up 100% and 143% respectively compared to 2023. Profit after tax after minority interests reached VND1,174 billion, up 255%, mainly driven by VND1,100 billion in pre-tax profit from divestment from the energy portfolio, as well as profit growth from the electrical equipment segment. In 2025, Vietcap forecasts GELEX's consolidated revenue to increase by 14% compared to 2024, reaching VND36,641 billion. GEX's revenue will grow in all segments, except for the power generation segment. Of which, the electrical equipment segment will continue to increase by 14% compared to 2024 to VND 21,814 billion, while the component business segments will continue to recover with the largest contribution from CADIVI (growth of 15%). Construction materials are forecast to increase by 18% to VND 8,780 billion, based on the recovery expectation of the real estate sector. Industrial park rental and service revenue is forecast to increase by 26% to VND 4,741 billion. Mainly due to the average industrial park rental price increasing by 21% with new contributions from Thuan Thanh (Bac Ninh) and Song Cong (Thai Nguyen) industrial parks. Driven by expansion and recovery in all segments, GELEX's gross profit is forecast to increase by 25% over the same period to VND 6,736 billion. Despite strong revenue growth, GELEX's financial income is estimated to decrease by 88% compared to 2024, down from VND 1,457 billion to VND 179 billion, mainly due to no longer recording the divestment profit from the energy portfolio in 2024. Minus taxes and fees, Vietcap forecasts GELEX's 2025 after-tax profit to reach VND 1,921 billion, down 9% compared to the 2024 forecast. However, the after-tax profit after minority interests of the core segment still reached VND 1,093 billion, up 124% over the same period, mainly thanks to the growth of core profit in all segments. Source: https://mekongasean.vn/doanh-thu-gelex-nam-2025-duoc-du-bao-vuot-36000-ty-do-ng-37231.html

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)