In the current corporate bond market, credit institutions are still the main issuer. In the issuance structure in July 2025, credit institutions continue to play a key role, accounting for 88.5% of the total issuance value. In the first 7 months of 2025, banks have mobilized nearly VND 238.4 trillion through the bond channel, a sharp increase of 84% over the same period last year and accounting for about 78% of the total issuance value of the whole industry in 2024.

With this role, the prospect of credit growth in the last months of the year and the policy of removing credit room in the coming time are assessed by experts as positive signals for the corporate bond market.

Speaking at Bond Highlights Newsletter No. 8/2025 , Ms. Tran Thi Kieu Oanh, Head of Financial Services Research and Consulting, FiinGroup, provided additional comments on the prospects of this capital mobilization channel.

|

| Ms. Tran Thi Kieu Oanh, Head of Financial Services Research and Consulting, FiinGroup |

Madam, what will be the credit growth outlook from now until the end of the year?

In the first 6 months of the year alone, credit growth across the system has reached about 10%, higher than the same period in previous years. The Government's target of achieving economic growth of 8-10% means credit growth will be about 18-20%. With the current figures, I believe that the banking industry can absolutely achieve that credit growth target, and may even exceed it.

Currently, banks are still the main investment group in the corporate bond market. With the current credit growth prospects and the policy of eliminating credit “room” in the coming time, how is it expected to affect this investment group? Will this open up opportunities for banks to increase issuance and investment in corporate bonds?

In essence, banks investing in corporate bonds is also a form of indirect credit. When a business has reached its loan limit or does not meet certain conditions for direct loans, banks can provide capital through the bond channel.

Therefore, the bank's bond investment balance is still included in the credit balance and is still affected by the general credit room.

Recently, the corporate bond market has slowed down, and corporate bond investment by the banking sector has also decreased sharply. However, the decrease here is not due to credit room limitations but due to concerns about liquidity and weakened market confidence, especially after the volatile period of 2022-2023.

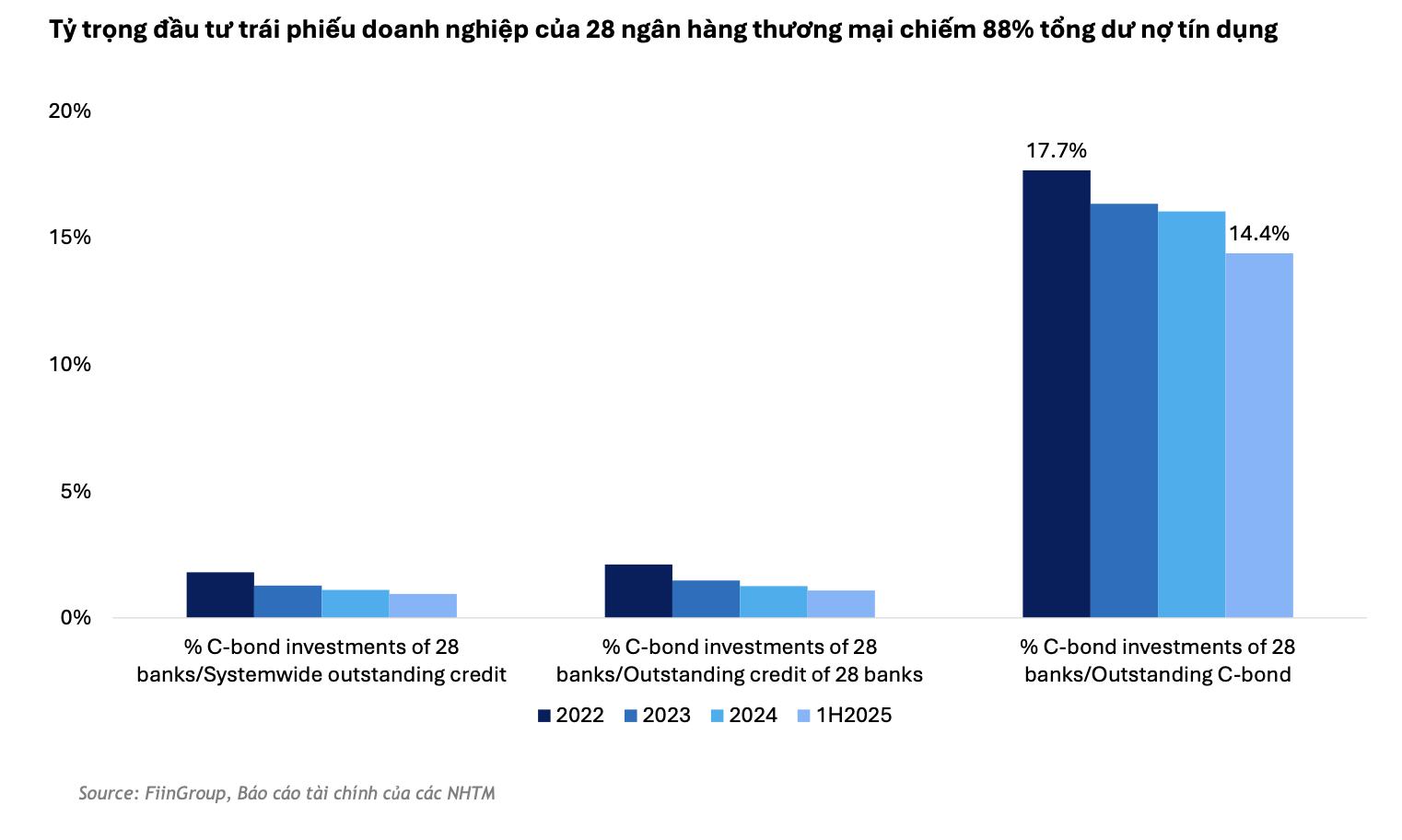

Some figures compiled by Fingroup show that the proportion of banks holding corporate bonds compared to the total outstanding corporate bond balance has decreased from about 17.7% in 2022 to about 14.4% at the end of June 2025.

|

| Source: FiinGroup |

If the policy of removing credit room is applied, banks will have more room to return more strongly to the bond channel, but capital flows should be selective and focused on transparent businesses with healthy finances and cash flows from clear projects, especially in areas such as infrastructure, energy, logistics, etc.

In addition, in the context of the average NIM of banks tending to narrow in recent times, according to our figures, it is about 3.82% in 2022 down to 3.07% by the end of the first quarter of 2025 (the average of 28 commercial banks accounts for about 88% of outstanding loans of the whole system), if the corporate bond channel is managed, this is also a reasonable investment channel for banks to optimize and diversify yields.

What changes can stronger participation of banks in the bond market make to the liquidity and size of Vietnam's bond market, given that the size of Vietnam's bond market is still modest compared to other countries in the region?

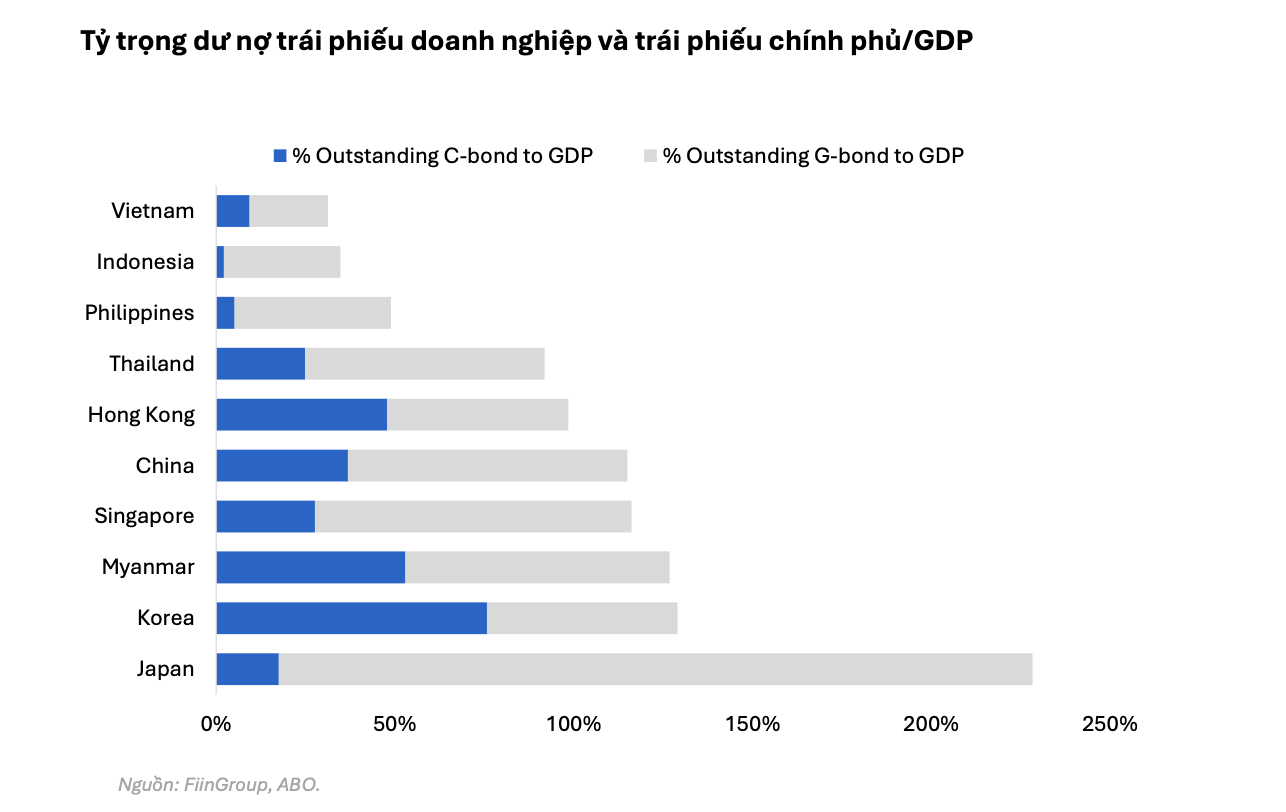

Currently, the size of Vietnam's corporate bond market only fluctuates around 10-12% of GDP, or about 1.1-1.2 million billion VND, much lower than other countries in the region.

Meanwhile, the Government 's target is to increase corporate bond debt to at least 25% of GDP by 2030. The reality shows that we are still quite far from the target.

|

The size of Vietnam's corporate bond market is currently only 10-12% of GDP, far from the target of 25% of GDP by 2030. |

Our view remains cautious given the fragile state of investor confidence. In our base case, this target is considered quite optimistic, unless reforms are implemented vigorously and institutional capital inflows are strong enough.

The bright spots are the regulations being implemented and aimed at such as mandatory credit rating, information transparency and bond trading centralization mechanism. Next is the huge capital demand, especially for infrastructure, urban areas and energy - these will be the natural driving forces to promote the growth of the corporate bond market in the coming time.

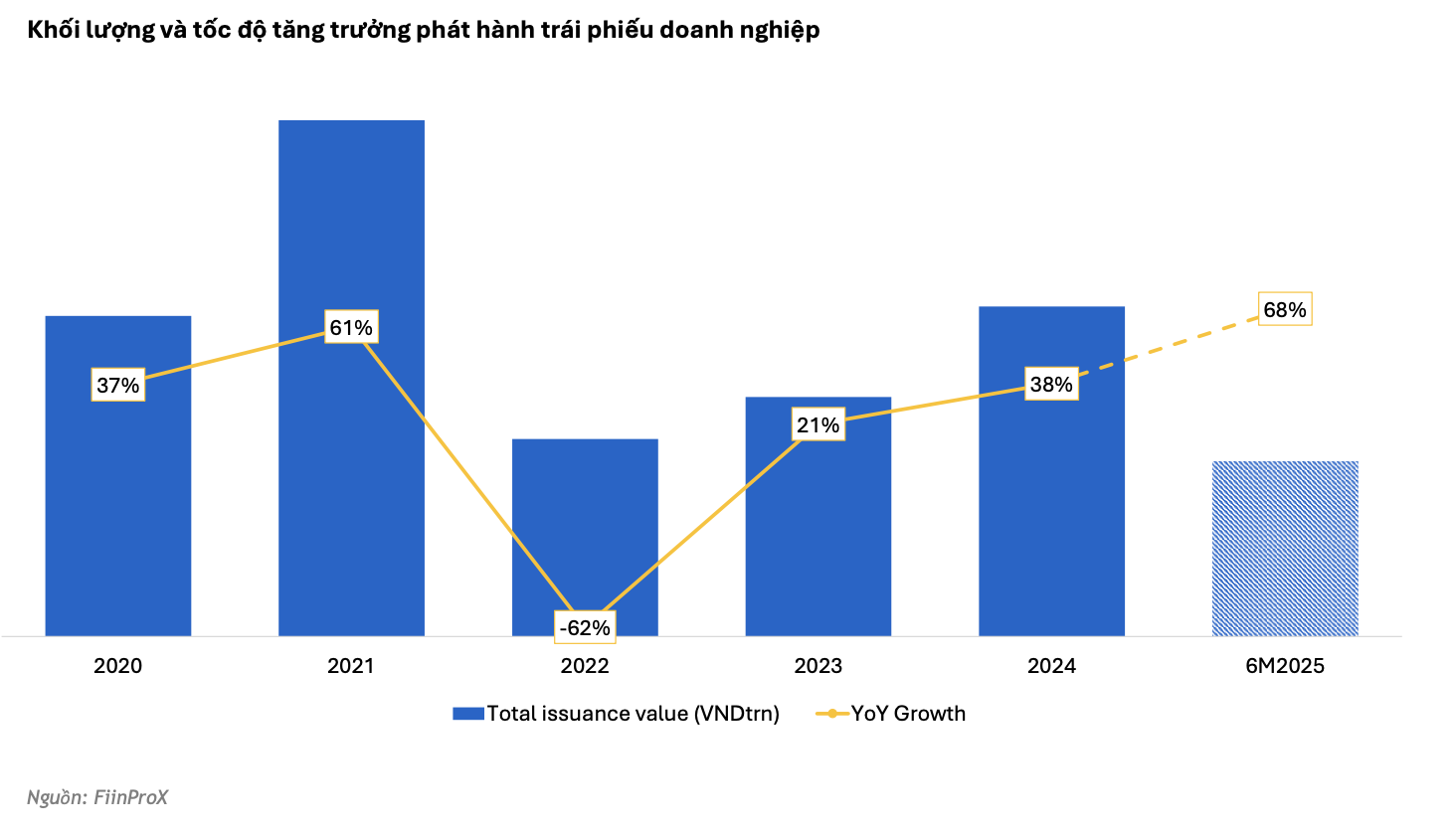

Another positive point is that the value of corporate bond issuance is recovering. After a decline of about 62% due to the confidence crisis in 2022, corporate bond issuance has increased again. Notably, about more than 70% of corporate bond issuance in the first 6 months of the year belonged to the banking sector, reflecting its role as a leader in primary liquidity.

|

| The recovery of the corporate bond channel |

When the credit room mechanism is lifted, large banks with good capital foundation and good management capacity will have the conditions to increase the proportion of both investment and issuance. From there, market liquidity will be improved, confidence will be restored and spread to other institutional investors. This will be the key driving force for the corporate bond market to get closer to the target of 25% of GDP as set by the Government for 2030.

Many people are concerned that when banks participate too much in corporate bonds, capital flows will mainly circulate within the credit system, rather than creating new resources from outside. How do you view this issue?

This assessment is well-founded when we see that the recovery of the corporate bond market in recent times has mainly relied on banks.

If only calculating in the first 6 months of 2025, the amount of corporate bonds issued by the banking sector is about over 70%, while the proportion of non-banking enterprises is below 30%.

This will create concerns about long-term capital for production and business enterprises will be limited and somewhere still depend on bank credit. But the bigger risk lies in the quality of the issuer and the pressure of maturity. Many large corporations, especially real estate corporations, have quite high leverage ratios and weak interest payment capacity.

The pressure to mature corporate bonds in 2026-2027 is up to 370 trillion VND, of which the real estate group accounts for about 60-70%.

Looking back at 2023, the overdue debt of corporate bonds reached nearly 65 trillion VND and of which 77% belonged to the real estate sector. However, the good news is that this number has decreased sharply, to less than 18 trillion VND and real estate accounts for about 41-48%.

Therefore, I think that banks should only play the role of an initial support to help increase liquidity and increase market standards, spreading market confidence to other investor groups. In the long term, we need to develop more institutional investors, such as insurance, investment funds, pension funds and diversify the issuance industry beyond real estate and infrastructure, while standardizing the bond structure. Only then will the corporate bond market escape its "dependence" on the banking group and become a sustainable capital mobilization channel.

Source: https://baodautu.vn/dong-luc-then-chot-de-thi-truong-trai-phieu-doanh-nghiep-tien-gan-muc-tieu-25-gdp-d375646.html

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)