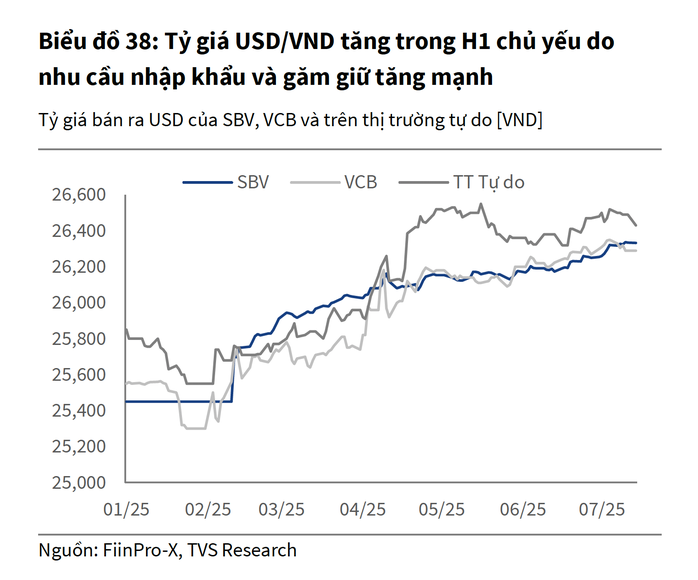

On the morning of July 29, the State Bank announced the central exchange rate at 25,206 VND/USD, an increase of 24 VND compared to yesterday. This is the third consecutive session that the central exchange rate has increased sharply, showing a clear trend of fluctuations in the foreign exchange market.

With a fluctuation range of ±5%, the USD exchange rate at commercial banks will range from 23,945 to 26,466 VND/USD.

At commercial banks, the USD price continued to increase this morning. Vietcombank listed the USD at 26,040 VND for buying and 26,400 VND for selling, up 30 VND compared to the previous session.

Sacombank raised the USD selling price to 26,405 VND, while buying at 26,045 VND. Other banks such as Eximbank and BIDV also increased their trading prices, bringing the USD close to the ceiling of the trading range.

This is the third consecutive day that the USD/VND exchange rate has increased sharply after many relatively stable sessions. Since the beginning of the year, the central exchange rate has increased by about 3.5%, while the USD price at commercial banks has increased by nearly 3.2%.

Not only in the banking system, the USD price in the free market is also following closely, fluctuating around 26,370 VND/USD for buying and 26,450 VND for selling - approaching the official listed price level.

USD prices at commercial banks have increased in recent days.

The increase in the USD price in Vietnam took place in the context of the greenback's strong recovery in the international market. The USD Index (DXY) - measuring the strength of the USD against a basket of 6 major currencies - increased to 98.6 points, up more than 1% in just the past few days.

The US dollar strengthened due to expectations that the US Federal Reserve (Fed) will maintain tight monetary policy in the coming time, along with investors' safe-haven sentiment against global geopolitical and economic fluctuations.

Exchange rate is expected to cool down

The USD/VND exchange rate is under pressure to increase in the short term, but many experts predict it will soon stabilize thanks to a solid economic foundation and flexible management policies. According to Maybank Securities, the trade surplus and positive FDI inflows in the first 6 months of the year are factors supporting the USD supply, helping to reduce pressure on the exchange rate. The trade agreement with the US also contributes to stabilizing market sentiment.

The State Bank is expected to continue to operate flexibly, especially controlling the VND - USD interest rate difference to keep the exchange rate stable.

Experts from Thien Viet Securities (TVS) forecast that the USD/VND exchange rate will increase by about 3.5% for the whole year, but the pressure will decrease in the second half of the year thanks to strong increases in remittances and FDI capital.

However, risks remain, including the possibility that the Fed will not lower interest rates, a lower-than-expected trade surplus and geopolitical tensions that increase demand for USD. These factors may impact the exchange rate in the coming time.

Source: https://nld.com.vn/du-bao-moi-nhat-ve-ti-gia-19625072910254146.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)