Vietnam Export Import Commercial Joint Stock Bank (Eximbank, stock code: EIB) has just issued a press release regarding documents recently circulated on social networks.

Specifically, over the past few days, on social networking sites, there has been a widespread image with the content "Urgent petition and reflection on serious risks leading to unsafe operations and the risk of collapse of the Eximbank system". The circulated image has only one first page and has no signature or seal.

Eximbank affirms that the above-mentioned document circulating on social networks is not a document of this bank and does not originate from the bank. The document has not been authenticated and its origin is unknown. Eximbank is requesting the competent authorities to support the verification and clarification of the motive for the act of spreading the above document.

The bank affirms that it is still operating stably, safely and effectively, meeting the diverse financial needs of customers and partners. Financial figures are always transparent and independently audited.

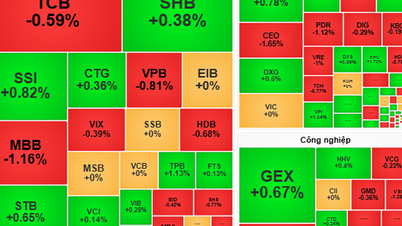

Previously, the trading session on October 14 recorded nearly 100 million EIB shares (equivalent to 5.35% of Eximbank's capital) being traded through order matching and negotiation methods. This liquidity level is also the highest in nearly 2 years of EIB, since the session on November 17, 2022.

Specifically, 57 million EIB shares (3.06% of capital) were traded by negotiation. These transactions had a total value of VND1,049 billion, equivalent to an average transaction value of VND18,400/share. For the order matching method, 42.6 million EIB shares were traded with a total value of VND778 billion.

EIB stock price since the beginning of the year (Source: TradingView).

At the end of the session on October 14, EIB shares fell 4.45% compared to the reference price to VND18,250/share. This is also the stock code with the sharpest decrease in the banking group.

Recently, Eximbank's Board of Directors also announced the decision to convene an extraordinary general meeting of shareholders.

The meeting is to approve the change of headquarters location and other matters under its authority. The expected date is November 28 in Hanoi . For the first time in history, Eximbank will hold an extraordinary general meeting of shareholders in Hanoi, instead of taking place in Ho Chi Minh City as usual. The bank has not yet announced the specific meeting location.

The new location chosen for the head office has not been mentioned in the proposal. Meanwhile, Eximbank's current head office is located at Vincom Center building, 72 Le Thanh Ton, Ben Nghe ward, District 1, Ho Chi Minh City. At the annual general meeting of shareholders in April, Eximbank had a plan to move its head office. However, this proposal was not approved by the general meeting of shareholders.

Eximbank convened an extraordinary shareholders' meeting in the context that in early August, Gelex Group Joint Stock Company (Gelex, stock code: GEX) bought back nearly 175 million EIB shares, equivalent to 10% of the bank's charter capital and became the largest shareholder.

Gelex Group is currently headquartered in Le Dai Hanh ward, Hai Ba Trung district, Hanoi.

According to the list of shareholders owning 1% or more of charter capital at Eximbank updated to August 13, in addition to Gelex Group, VIX Securities Joint Stock Company owns 62.3 million shares, equivalent to 3.58% of Eximbank's capital.

Source: https://dantri.com.vn/kinh-doanh/eximbank-len-tieng-ve-tai-lieu-nong-lan-truyen-tren-mang-xa-hoi-20241015204113459.htm

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

Comment (0)