The coffee market on October 16, 2025, recorded a clear differentiation between the two major exchanges, with Robusta increasing slightly on the London exchange while Arabica decreased sharply on the New York exchange. The price of domestic Vietnamese coffee increased again to 114,500 VND/kg.

Coffee prices today in the domestic market on October 16, 2025

| Local | Price (VND/kg) | Fluctuation (VND/kg) |

|---|---|---|

| Prices in localities | ||

| Dak Lak | 114,500 | ▲700 |

| Lam Dong | 113,700 - 114,500 | ▲700 |

| Gia Lai | 114,200 | ▲700 |

On October 16, the coffee market in the Central Highlands recorded a slight upward trend, fluctuating around 113,700 - 114,500 VND/kg. Specifically, in Lam Dong, coffee prices were traded at 113,700 - 114,500 VND/kg, an increase of 700 VND/kg compared to the previous session. The highest price reached 114,500 VND/kg.

Next, Dak Lak, a land famous for high-quality coffee, recorded a price of 114,500 VND/kg, an increase of 700 VND/kg compared to the previous session. Same price peak position as Lam Dong

Gia Lai is also not out of the price increase trend, with the price reaching 114,200 VND/kg, an increase of 700 VND/kg compared to the previous session.

According to expert Nguyen Quang Binh, the coffee market in recent days has been affected by the US government not being fully operational, leading to a lack of analytical data, causing the gold and Arabica coffee markets to be heavily shorted. However, information about the tariff negotiations between Brazil and the US announced by President Luiz Inacio Lula da Silva has promoted the sell-off, pushing Arabica prices down sharply.

Online coffee prices on October 16, 2025 in the world market

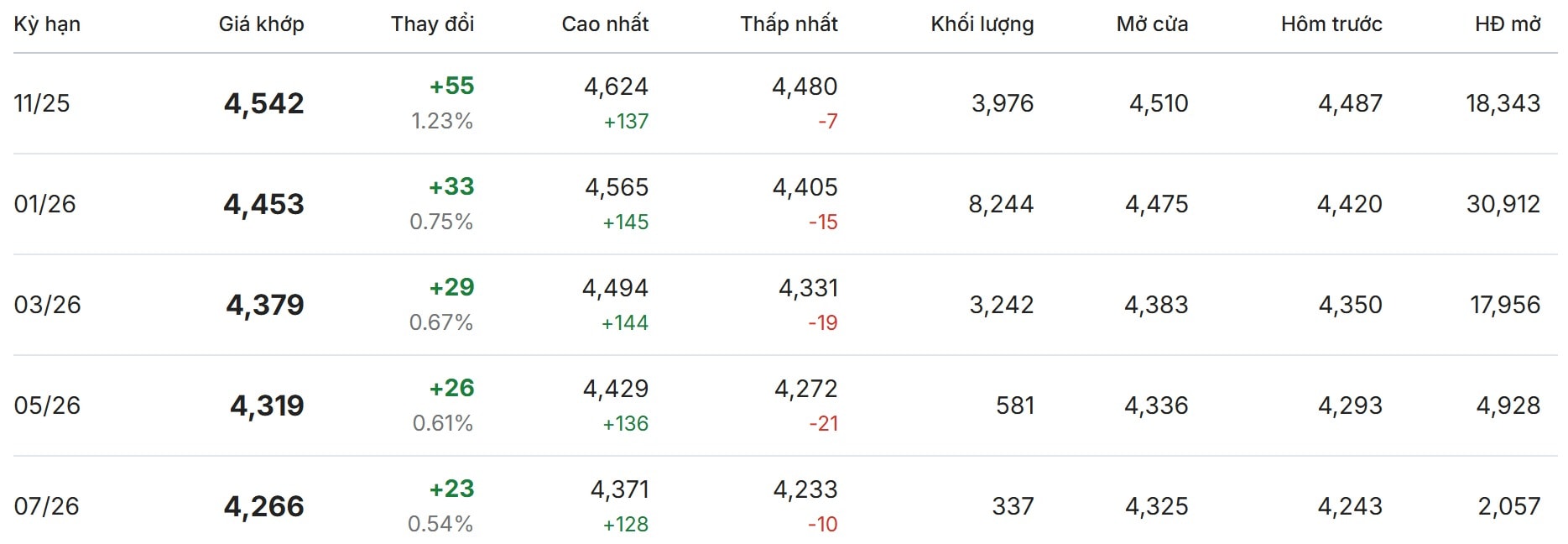

On the London exchange today, October 16, Robusta online coffee prices recorded a slight increase in all terms. All terms showed price increases compared to the previous session. Specifically:

The November 25 contract closed at $4,542/ton, up $55/ton (or +1.23%) from the previous session. This was the contract with the highest price and also recorded the strongest increase.

Immediately after that, the January 26 contract closed at 4,453 USD/ton, up 33 USD/ton (equivalent to +0.75%).

The remaining terms all maintained an increasing trend in price:

The March 26 contract had a matching price of 4,379 USD/ton, up 29 USD/ton (equivalent to +0.67%).

May 26 futures closed at $4,319/ton, up $26/ton (or +0.61%).

The July 26 contract closed at $4,266/mt, the lowest price among the traded contracts, up $23/mt (or +0.54%). Despite the lowest price, this upward trend reflects the overall stability in the market.

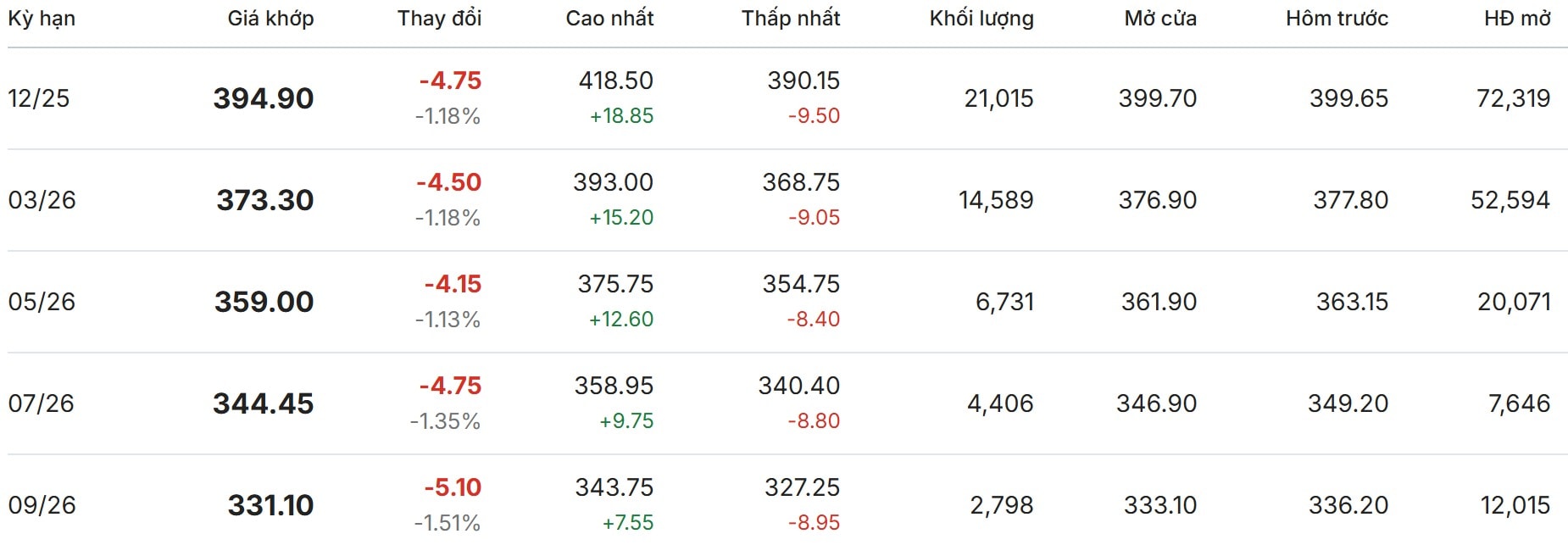

On the New York Stock Exchange this morning, October 16, the price of Arabica coffee closed at a high of 394.90 US cents/pound (12/25 term) and a low of 331.10 US cents/pound (09/26 term). All terms recorded a price decrease. Specifically:

The December 25 contract closed at a session high of 394.90 US cents/pound, down 4.75 US cents/pound (-1.18%). This was a leading price, but under slight downward pressure.

The March 26 futures contract also remained at 373.30 US cents/pound, down 4.50 US cents/pound (-1.18%).

The remaining maturities all show decreasing prices over time:

The May 26 contract had a closing price of 359.00 US cents/pound, down 4.15 US cents/pound (-1.13%).

The July 26 contract reached 344.45 US cents/pound, down 4.75 US cents/pound (equivalent to -1.35%).

The September 26 contract closed at 331.10 US cents/pound, down 5.10 US cents/pound (-1.51%), the lowest price among the traded contracts.

Coffee price assessment and forecast

Based on current price data and forecast reports from reputable organizations such as World Bank, Reuters and USDA (updated to June 2025), the coffee price outlook for 2025-2026 shows a clear differentiation between Arabica and Robusta, with a general trend of increasing in the short term (late 2025) before adjusting downwards due to improved supply.

Arabica is expected to surge more than 50% from 2024 in 2025, thanks to a prolonged drought in Brazil (2025/26 production forecast down to 40.55 million bags) and a high probability of La Niña, pushing inventories to record lows. However, by the end of 2025, prices could fall 30% to around $2.95/lb as demand is held back by record highs and Colombian production recovers. Prices could stabilize or fall another 8-15% in 2026, averaging around $7.25/kg (Statista/World Bank), as the 2026/27 Brazilian crop is expected to be bumper. Risks: Adverse weather could push prices to $3.29/lb in Q1 2025 and $3.58/lb in 2026 (Trading Economics).

Robusta is forecast to increase by nearly 25% in 2025 thanks to a weak USD and stable demand, but with strong downward pressure from supply from Vietnam (up 6.9% to 31 million bags in 2025/26) and Brazil (24.5 million bags). Prices are expected to fall 28% to $4,200/tonne by the end of 2025 (Reuters), and fall further by 9% in 2026 (World Bank), averaging around $2-3/kg. Heavy rains in the Central Highlands in October 2025 will support yields, adding to downward pressure.

Overall, the coffee market will be highly volatile in the short term (next 3-6 months), with domestic prices in Vietnam (mainly Robusta) fluctuating at VND110,000-120,000/kg, supported by increased exports but held back by the new crop. Longer term (2026+), prices will be more stable thanks to a 4-7% increase in global production (USDA), but weather and trade risks (US-China, Brazil tariffs) may reverse. Investors should closely monitor Brazilian weather reports and ICE inventories to adjust their strategies.

Source: https://baodanang.vn/gia-ca-phe-hom-nay-16-10-2025-arabica-lao-thang-dung-giam-gan-1-51-sau-tin-dam-phan-brazil-my-3306435.html

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

Comment (0)