Domestic steel prices on April 12 continued to be stable compared to the previous session, with no new fluctuations recorded. Meanwhile, iron ore prices on the international market are showing a sideways trend, but overall for the week, they are still slightly decreasing due to the impact of trade tensions between the US and China.

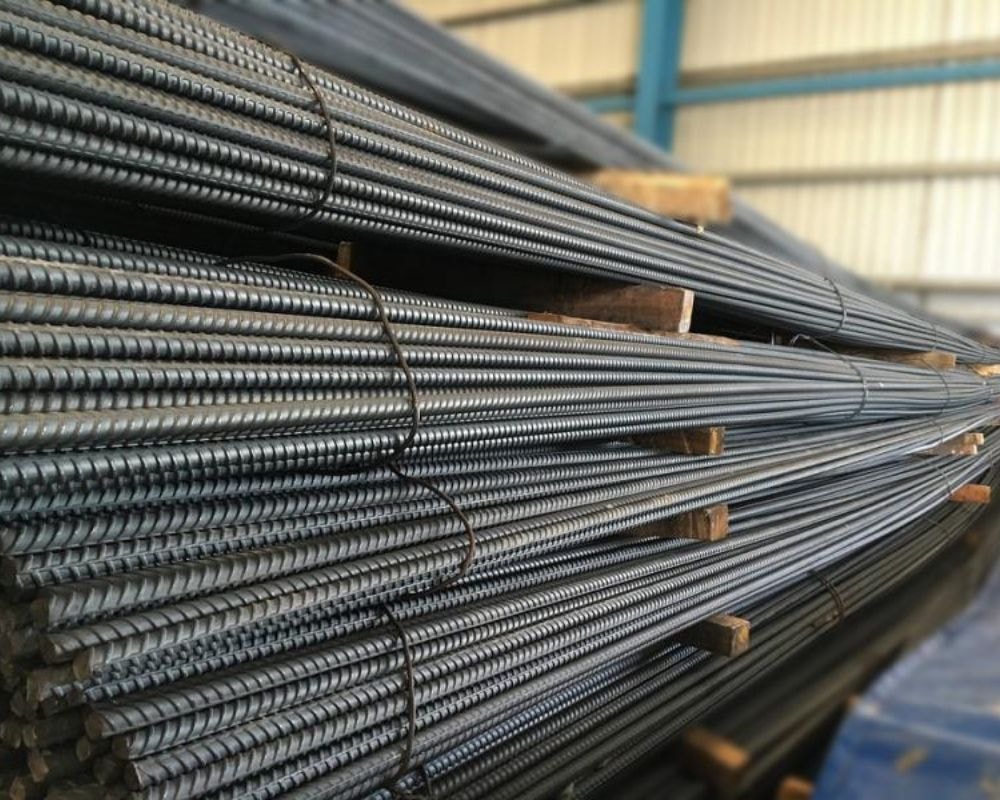

In the Northern market, steel prices of major brands remain at the same level. Specifically, Hoa Phat Steel listed CB240 rolled steel at 13,550 VND/kg and D10 CB300 ribbed steel at 13,600 VND/kg. Brands such as Viet Y, Viet Duc, Viet Sing or VAS all maintained their selling prices in the range of 13,330 - 13,800 VND/kg depending on the type and product line.

In the Central region, steel prices are slightly differentiated between brands. Hoa Phat Steel is listed at VND 13,630/kg for CB240 and VND 13,750/kg for D10 CB300. Meanwhile, Viet Duc Steel is priced significantly higher, with CB240 at VND 13,800/kg and D10 CB300 at VND 14,200/kg – the highest in the region. VAS Steel in the Central region is currently sold at VND 13,740/kg for CB240 and VND 13,790/kg for D10 CB300.

In the South, steel prices are generally quite stable. Hoa Phat Steel maintains prices of VND13,550/kg for CB240 and VND13,650/kg for D10 CB300. VAS brand in this region lists lower prices, VND13,380/kg and VND13,480/kg for the two product lines mentioned above.

Although steel prices have not fluctuated significantly at present, the market is closely monitoring international developments, especially trade policies and steel consumption demand in the second half of April.

Steel prices on the Chinese exchange continued to fluctuate slightly in the session on April 12. On the Shanghai exchange, the price of rebar for delivery in November 2025 edged up 3 yuan to 3,141 yuan per ton.

Meanwhile, iron ore futures prices, although fluctuating around a stable level, are still falling for the whole week due to escalating trade tensions between the US and China. These are the two largest economies in the world and also the leading iron ore consuming countries, so any fluctuations from them will have a strong impact on the market of raw materials for steel production.

On the Dalian Commodity Exchange, the most-traded September iron ore contract ended the session up 0.71% at 708 yuan a tonne, or about $96.70. However, for the week, the decline was nearly 4.8%.

On the Singapore Exchange, the benchmark iron ore price for May also fell slightly by 0.14% to $97 per ton. The decline since the beginning of the week is 4.8%, clearly reflecting the market's lingering concerns.

Tensions escalated after US President Donald Trump decided to raise import tariffs on Chinese goods to 125%. In response, Beijing also increased tariffs from 34% to 84% on US goods, pushing the trade war to a new level.

Experts at ANZ bank warn that if the situation does not cool down soon, the global economy could face the risk of recession. Despite some short-term hopes after Mr. Trump announced a 90-day pause on additional tariffs for partners who do not retaliate, sentiment in the metal market remains under pressure.

However, several factors have helped limit the decline in iron ore prices, including positive signs from demand. Hot metal output – an indicator of iron ore demand – rose for a seventh consecutive week, averaging 2.4 million tonnes a day on April 10, the highest in 17 months, according to data from research firm Mysteel.

Some other input products of the steel industry such as metallurgical coal and coking coal continued to decrease, losing 2.72% and 1.42% respectively.

Meanwhile, most steel products on the Shanghai Futures Exchange had positive developments. Rebar rose 0.26%, stainless steel rose 0.4%, and wire rod rose 0.21%. Hot-rolled coil only fell slightly by 0.12%. These figures show that the steel market is still struggling in a volatile context.

Source: https://baoquangnam.vn/gia-thep-hom-nay-12-4-2025-gia-thep-tren-san-thuong-hai-tang-nhe-3152609.html

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)