(NLDO) - If you buy to hold for the long term, you should wait for periods when gold prices decline. Gold prices are expected to increase sharply in the first half of the year and cool down by the end of 2025.

On January 31 (the third day of Tet), the world gold price broke the highest mark of 2,790 USD/ounce set in October last year and set a new record at 2,797 USD/ounce.

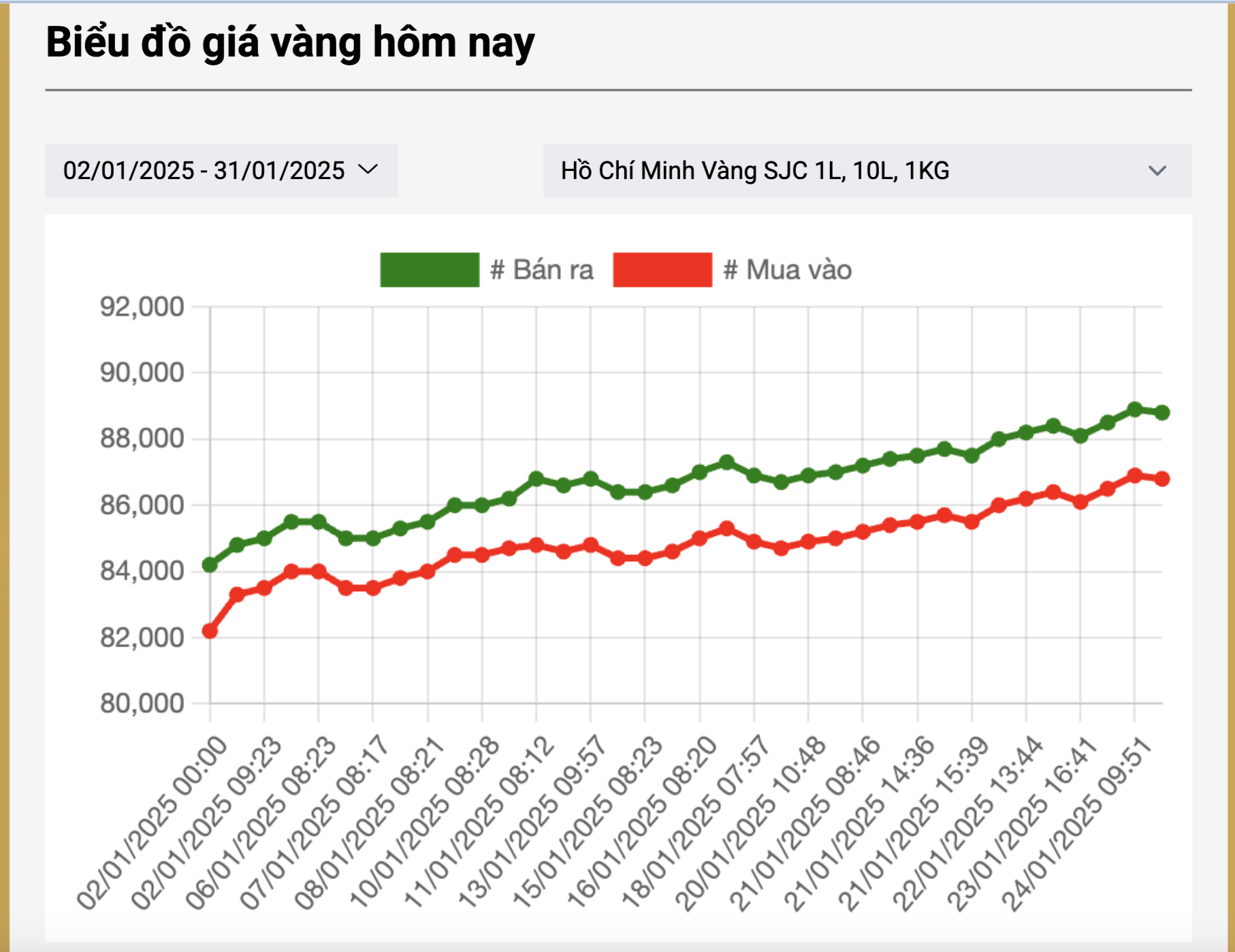

In Vietnam, the price of SJC gold bars jumped to 88.3 million VND/tael, an increase of about 1.1 million VND/tael compared to yesterday. The price of gold rings and jewelry also reached 87.1 million VND/tael, a sharp increase of about 700,000 VND/tael.

Before the shocking increase in gold prices today, a reporter from Nguoi Lao Dong Newspaper talked with gold expert Tran Duy Phuong about the gold price trend after Tet, before God of Wealth Day and the upcoming period.

- Reporter: Gold price has increased dramatically to nearly 2,800 USD/ounce. Will this trend continue, sir?

* Gold expert Tran Duy Phuong: According to my prediction, in the first 6 months of 2025, the gold price will continue to "shine". And from the third quarter onwards, it will tend to go sideways or decline slightly again. In the next few months, the gold price can reach 2,900 USD/ounce, so if you invest in gold, you need a clear strategy.

- Gold price could reach $3,000/ounce?

With the current positive performance of the precious metal, the next peak in the first half could reach 2,900 USD/ounce. However, the price of gold will fluctuate in a zigzag pattern, increasing and decreasing in waves, and it is difficult to go up in a straight line.

Gold expert Tran Duy Phuong

Although still shining, it is not easy to increase by more than 30% like in 2024. The world gold price mark of 3,000 USD/ounce is also very difficult without sudden factors. If it increases to a new peak of 2,900 USD/ounce, the gold price will be supported by factors such as the trend of major central banks in the world, especially the US Federal Reserve (FED), continuing to cut interest rates.

At the same time, the geopolitical tension in the Middle East has not yet shown any clear positive progress, which will support gold prices in the first half of 2025. US President Donald Trump in his new term with tariff policies or some other policies may cause tension in the financial market... Investors tend to seek gold as a safe haven.

But the above factors may calm down in the second half of the year or have been reflected in prices, so gold prices in the second half of 2025 will find it difficult to break out.

- So will the price of SJC gold bars and gold rings increase along with the world price? Should we buy gold now?

Certainly, when the world gold price increases, domestic gold will also increase. But investing at the present time requires considering whether the rate of return is good or not? For example, the price of SJC gold bars and gold rings is about 88 million VND/tael, if it exceeds 90-92 million VND/tael, the rate of return is about 4-5%, equal to the interest rate of a one-year savings deposit. If calculated by time, the rate of return will be higher.

SJC gold bar prices have increased continuously in recent weeks.

However, the gold price will not increase to 2,900 USD/ounce as expected, but will fluctuate up and down at certain times. Notably, during Tet and before God of Wealth Day, gold buyers need to pay attention because the gold price has increased continuously for many weeks, the world gold price has also increased very hotly, so there may be a period of adjustment before increasing again.

The demand for SJC gold bars and gold rings in the country also remains high, which can push the gold price to a new high, even an unusually high level. Therefore, if you buy gold for long-term holding, you should wait for the gold price to decline before "putting money in".

- What do you think is the smartest gold investment strategy in 2025?

As I said, gold prices are expected to increase sharply in the first half of the year and cool down by the end of 2025. If you buy gold, you should only allocate a ratio of 6/4, or 60% of your investment budget to gold, and the rest to savings. Do not put all your capital into gold at this time.

Source: https://nld.com.vn/gia-vang-lap-dinh-lich-su-moi-chien-luoc-dau-tu-nao-duoc-chuyen-gia-he-lo-196250131102044359.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)