Gold price today October 23, 2024: World gold price has surpassed the threshold of 2,700 USD, increasing nearly 40% in the past 12 months. Domestic gold ring price continuously reached unprecedented peaks - increasing sharply to nearly 88 million VND/tael. Precious metals are challenging the strength of the USD - a major change is taking place in the global financial system?

Update gold price today October 23, 2024

World gold price

Thus, the world gold price has increased by nearly 40% from 1,947 USD/ounce to more than 2,700 USD/ounce, in the past 12 months. The excitement in the gold market has been almost unstoppable in recent weeks, fueled by factors such as geopolitical tensions and economic instability. Meanwhile, the moves in the European and Chinese markets will support the continued increase in gold demand, especially global gold demand will increase further when the Chinese market enters the peak buying season.

According to the World & Vietnam Newspaper , the international gold price traded on the Kitco electronic floor, at 6:40 p.m. on October 22 ( Hanoi time), was at 2,732.30 - 2,733.30 USD/ounce , an increase of 13.2 USD/ounce compared to the previous trading session.

“What’s interesting is that this rally has been relatively linear, with any pullback attracting more buyers,” said Mohamed El-Erian, former CEO of PIMCO and now president of Queens’ College, Cambridge. This has happened despite sharp shifts in interest rate policy, wide swings in the US benchmark yield curve, falling inflation and currency volatility.

CEO El-Erian commented that the current gold price rally “is not only unusual in terms of traditional economic and financial impacts”, beyond serious geopolitical impacts, but also points to a broader phenomenon - creating alternative dynamics in the global financial system”.

Domestic gold prices continue to increase strongly, especially gold rings set an unprecedented record.

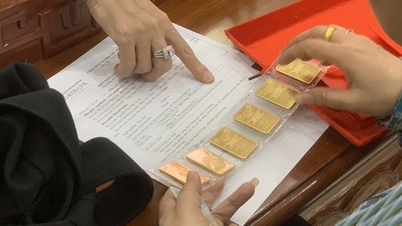

The price of SJC gold bars increased following the world gold price, causing the selling price at Saigon Jewelry Company (SJC) and 4 banks in the Big 4 group to increase by 1 million VND/tael, to 87 - 89 million VND/tael (buy - sell).

The price of 9999 round smooth gold rings increased sharply, in some places it increased to 1.7 million VND/tael, recording the highest level in history, approaching the 88 million VND/tael mark.

DOJI Group has now raised the price of gold rings to 86.6 - 87.6 million VND/tael; Bao Tin Minh Chau has also adjusted it to 86.2 - 87.6 million VND/tael; SJC and PNJ companies listed at lower prices, 85.7 - 87.1 million VND/tael and 86.1 - 87.1 million VND/tael, respectively.

After many days of chasing, the price of 9999 gold rings and the price of SJC gold bars have once again narrowed the gap to 1.62 million VND/tael. Compared to the world gold price converted to the USD exchange rate, the price of SJC gold bars is 5.09 million VND/tael higher, while the price of gold rings is 2.99 - 3.47 million VND/tael higher.

|

| Gold price today October 23, 2024: Gold price increases 'vertically', challenging the strength of the USD; the higher the price, the more people buy, why? (Source: Kitco) |

Summary of SJC gold bar prices at major domestic trading brands at the closing times of trading sessions on October 21:

Saigon Jewelry Company: SJC gold bars 87 - 89 million VND/tael; SJC gold rings 85.7 - 87.1 million VND/tael.

Doji Group: SJC gold bars 87 - 89 million VND/tael; 9999 round rings (Hung Thinh Vuong) 86.6 - 87.6 million VND/tael.

PNJ system: SJC gold bars 87 - 89 million VND/tael; PNJ 999.9 plain gold rings at 86.1 - 87.1 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at 87 - 89 million VND/tael; plain gold rings are traded at 86.2 - 87.6 million VND/tael.

Gold prices rise in all "weather conditions"

Western countries should pay more attention to the soaring price of gold, as the precious metal's continued rise reflects growing interest in alternatives to the US dollar-based financial system, former PIMCO CEO Mohamed El-Erian has warned.

“Something strange has happened to the gold price over the past year,” El-Erian wrote in the Financial Times . “As it has continued to hit record highs, it has seemingly decoupled from traditional historical drivers such as interest rates, inflation and the US dollar. Moreover, the consistency of its price gains contrasts with the volatility of key geopolitical events.”

He said the rise in gold prices “in all weather conditions” indicated the presence of something beyond short-term economic, electoral and geopolitical developments. “It captures an increasingly persistent pattern of behavior between China and other ‘middle power’ countries, as well as other countries,” he said. “And that is a trend that the West should pay more attention to.”

The gold rally suggests that there may be a lot going on in the market. The continued buying of gold by central banks is a key driver of the gold price strength. According to El-Erian, such heavy and continuous gold purchases seem to be related not only to short-term demand, but also to the gradual diversification of their reserves away from the significant dominance of the USD, despite the US's 'economic exceptionalism'.

This phenomenon also seems to be related to the trend of looking for viable alternatives to the US dollar-based payment system - which has been the core of the international economic architecture for the past 80 years. According to CEO Mohamed El-Erian, the phenomenon of gold overtaking the US dollar in the market is not only an erosion of the greenback's dominance but also a step-by-step change in the operation of the global financial system.

“Of course, to date, no other currency or payment system has been able, or is ready, to replace the US dollar at the core of the system, but there are more and more small pipelines being built around this core; and more and more countries are interested and participating in this trend,” said PIMCO CEO Mohamed El-Erian.

Source: https://baoquocte.vn/gia-vang-hom-nay-23102024-gia-vang-tang-dung-dung-thach-thuc-suc-manh-cua-dong-usd-gia-cang-cao-cang-nhieu-nguoi-mua-vi-sao-290948.html

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

Comment (0)