The amendment to the Social Insurance Law needs to set a roadmap for partial withdrawals, and eventually stop one-time withdrawals in the face of the future of tens of millions of elderly people who will not retire, according to experts.

Maintaining or tightening the eligibility conditions becomes a fundamental amendment to this Social Insurance bill in the context of more than 5.62 million people withdrawing at once, from 2016 to the end of June 2023 (accounting for more than 32% of the number of people participating in the system).

In the draft revised Social Insurance Law submitted to the National Assembly recently, the Ministry of Labor, War Invalids and Social Affairs proposed two options for withdrawing social insurance at one time.

Option 1 , one-time withdrawal of social insurance, is resolved with two different groups of workers. Group 1 is those who participated before the amended Social Insurance Law took effect (expected July 1, 2025), after 12 months of unemployment, if in need, they will receive one-time social insurance. Group 2, with those who started working and joined the system after July 1, 2025, will not receive one-time social insurance, except in cases as prescribed.

Option two : Employees who have paid social insurance for less than 20 years and after 12 months of unemployment are not subject to compulsory payment and do not participate in voluntary social insurance, can withdraw their contributions in one lump sum if requested. The maximum benefit is not more than 50% of the total time contributed to the Pension Fund, the remaining amount is reserved to enjoy the regime after meeting the conditions.

Gradually adjust from partial withdrawal to complete withdrawal

Evaluating the proposed options, former Deputy Minister of Labor, War Invalids and Social Affairs Pham Minh Huan asked, "What basis would choose a settlement rate of 50% of the total payment time if it is still possible to withdraw at once?"

According to the review report of the Social Committee, the drafting agency has not explained why this rate was chosen, leading to many different interpretations. The settlement of a part of the payment period is a period in the whole process, not to mention many cases of interrupted payment... If a situation arises where the employee returns to participate in social insurance, how is the time added together calculated?

Mr. Huan believes that both options should be integrated. For those who participated before the law takes effect (expected July 1, 2025), they can withdraw 8% of their contributions, the rest will be accumulated in the system to receive pensions. Those who participated after 2025 will not be able to withdraw anymore. The policy should be gradually adjusted from allowing withdrawals to closing, avoiding causing shocks that make workers react as before.

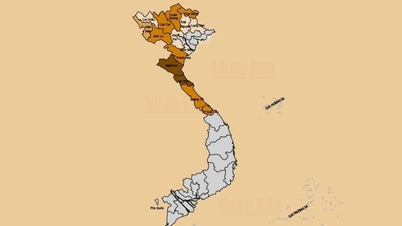

Statistics show that more than 70% of people withdrawing at once are workers in the South. According to Mr. Huan, this region has not suffered the "shock" that happened in the North. He cited the lesson of the pension system under Decision 176/1989, more than one million workers "retired" now have no pension and many of them want to pay it back but cannot. "We agree to work to cover our expenses today, but the state will have to take care of the social security issue later," he said.

Emphasizing the number of more than 9.6 million elderly people who are past working age and currently have no social security, Mr. Huan predicted that this number will increase to tens of millions of people when Vietnam's population ages. The lowest subsidy level proposed for this group is only equal to social assistance, currently 360,000 VND, which does not cover living expenses while the state has to balance a large budget. Adding a pension subsidy level of 500,000 VND will also be difficult to "patch" the already thin safety net.

Sharing the same view, Ms. Tran Thi Dieu Thuy, President of the Ho Chi Minh City Labor Federation, supports the roadmap from allowing partial withdrawal to stopping withdrawal when the law takes effect, expected in July 2025. In addition to first-time workers, those who have withdrawn once and return to the system after this time must also accept the "new rules of the game" and cannot withdraw again.

If the competent authority still allows withdrawal, 8% of the part they pay will be resolved, the rest will be kept in the system. Workers who have accumulated 20-30 years of participating in social insurance will also receive a high level of benefits. Reducing one-time withdrawal in this direction creates more options for workers to withdraw and keep their pension without eliminating all benefits.

"Setting an anti-shock roadmap so that workers can choose and maintain that right in the system will make them feel secure in staying. Otherwise, a policy reaction is understandable," she suggested.

Having questioned Minister of Labor, War Invalids and Social Affairs Dao Ngoc Dung about labor insecurity, saying that benefits are decreasing when policies change constantly, Ms. Thuy cited many workers calculating that if they continuously pay from beginning to end, the opportunity and level of benefits will not be high. They choose to pay for less than 10 years and then withdraw all at once, then re-join with a higher salary and still be eligible to pay for 15 years of participation to receive pension if the law is passed.

The female president of the federation suggested that the amended law should stipulate that the lowest pension level must be equal to the regional minimum wage if this type of salary still exists. Workers living in a region should be entitled to the regional minimum pension so that they can ensure their living expenses and reduce the burden on the budget.

Elderly people in a garment factory at Dong Ba market (Thua Thien Hue ). Photo: Vo Thanh

Opportunity to adjust the social security system that is going wrong

Standing member of the National Assembly's Social Committee Dinh Ngoc Quy said that the Government 's proposed options all have their own advantages and disadvantages and need more time to complete before submitting them to the National Assembly.

He assessed that a developing country with a workforce accounting for more than 50% of the population "cannot continue the path of withdrawing social insurance at one time" while still in retirement age, so that when they retire, they will not have a pension but will receive a subsidy of a few hundred thousand dong.

Looking back at the 30 years of implementing the social insurance policy, according to Mr. Quy, the sad thing is that only 2.7 million people receive monthly pensions from the Social Insurance Fund, while the whole country has over 14.4 million people past working age. The Social Insurance Law, after many amendments, still maintains the policy of one-time withdrawal after 12 months of not continuing to pay social insurance. According to Mr. Quy, this is a "small mistake" but it has caused the social security system to "go astray", and after many years of struggling to resolve it, it has not been resolved.

"Three decades have passed, counting how many generations of workers have retired, but the Pension Fund has only covered less than 20% of the elderly who have reached working age. The success or failure of the social security system is easy to predict," he said, adding that this revised law is an opportunity to gradually adjust the social security system, which is going astray.

The way workers participate is also very "special" when they leave after a certain period of time. A large number of people withdraw their insurance 3-4 times like "playing them", considering the Social Insurance Fund as a type of bank, while the policy has not dared to be tightened for fear of reaction. There are no official statistics on how many people use their one-time withdrawal of social insurance to invest effectively, but a recent survey shows that most of them quickly spend it all.

The draft revised Law on Social Insurance is expected to be discussed by the National Assembly at its session in October 2023, approved at its session in May 2024, and take effect from July 1, 2025.

Statistics show that by the end of 2022, Vietnam will have about 14.4 million people over retirement age, but only 2.7 million will receive pensions; 0.6 million will receive monthly benefits from the Social Insurance Fund. More than 1.8 million will receive social pension benefits from the state budget. About 9.6 million elderly people over working age will not receive any benefits, and this number is expected to increase to 13 million by 2030.

A survey by the United Nations Population Fund Program shows that the majority of income for the elderly in Vietnam comes from support from their children, up to 38%; 29% from continuing to work, only 15% receive pensions and 10% receive social benefits.

Phuong Ha

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)