In the context that the Pilot Decree on centralized crypto-asset trading floors has been basically completed and has just been submitted by the Ministry of Finance to the Government, attracting great attention from the technology and financial community, Nguoi Lao Dong Newspaper had an interview with Mr. Phan Duc Trung - Chairman of 1Matrix Company, Chairman of the Vietnam Blockchain and Digital Asset Association - to clarify issues of particular public interest today.

Centralized cryptocurrency exchange model

* Reporter: Do you think the centralized cryptocurrency exchange (CEX) or decentralized cryptocurrency exchange (DEX) model is more suitable for piloting in Vietnam?

- Mr. PHAN DUC TRUNG: In the current period, if viewed from both perspectives of state management requirements and user habits, the centralized exchange model (CEX) is a more suitable and feasible option for sustainable development, not only in Vietnam but also internationally.

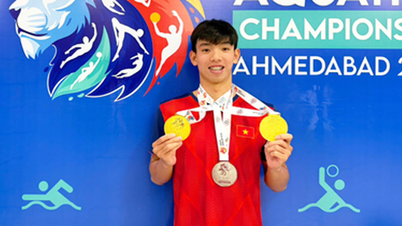

Mr. PHAN DUC TRUNG

CEXs currently account for more than 99.7% of total global trading volume, equivalent to about $261 billion per day. Meanwhile, DEXs, despite bringing a lot of security value, only account for about 0.3%, equivalent to $761 million.

The main reason is still the legal framework issue. While the DEX model does not meet the minimum eKYC (know your customer) standards, CEX exchanges, although having many legal compliance issues, still ensure the basic eKYC standards. The market making (MM) method of CEX also has more transparent rules than DEX exchanges.

According to data from VASPnet, to date, more than 70 countries and territories have issued regulations or granted licenses to CEX, including: the US, UK, EU, Korea, Singapore, Japan, Canada, UAE...

Meanwhile, no country has licensed a DEX to operate completely decentralized. Currently, only the UAE allows DEX to operate if it has a clear legal entity and is operated publicly. Some countries such as Singapore and Japan can collect taxes and fees on trading activities on DEX but have not issued a licensing framework for DEX.

In addition, CEX exchanges are superior in user experience such as friendly interface, easy to use, high liquidity thanks to the large number of users, fast speed and direct, quick customer care support policy. Meanwhile, the activities of the DEX operation team are anonymous so there is almost no support for users. This means that investors on DEX exchanges will have to bear all risks when being scammed or having problems.

Absorb international experiences

* In your opinion, what factors should Vietnam learn from successful cryptocurrency exchange models around the world to build a safe and effective trading ecosystem?

- During the research process, the Vietnam Blockchain and Crypto Asset Association analyzed many crypto asset trading floor models in different countries and regions around the world. However, there is no management model that is considered perfect or absolutely optimal. Each country builds its own strategy, depending on management needs as well as the specific economic and political context.

However, the management models that are considered effective in the world all have four core elements in common: transparent licensing mechanisms, strict regulations on customer identification (KYC), compliance with global standards on anti-money laundering and anti-terrorist financing (AML/CFT), along with clear tax policies and effective user protection mechanisms.

Vietnam is fully capable of absorbing these international experiences, but what is more important is to build a practical solution that is suitable for domestic conditions. Currently, the draft Decree on piloting centralized crypto-asset exchanges has been basically completed.

The Ministry of Finance is expected to submit this document to the Government this August. This is considered a strategic step, laying the foundation for the development of the digital asset market in Vietnam, while opening up opportunities for strong growth in the coming time.

Many Vietnamese people still invest in cryptocurrencies on foreign exchanges every day. Photo: HOANG TRIEU

Many international standards have been carefully studied and selected to be integrated into the new legal framework, from advanced models such as Hong Kong (China), Thailand or Singapore. Therefore, instead of debating which country to learn from, what is more important now is how Vietnam realizes those principles in the most appropriate way for the domestic context.

Looking at the world, the most successful crypto-asset exchanges today are still familiar names such as Coinbase, Kraken or Gemini. In Asia, platforms such as Hashkey or KuCoin also show flexibility and flexible market approach strategies, in line with the fast-moving trends of the global digital asset sector.

* How do you evaluate the financial and technological capacity of large corporations in Vietnam in deploying crypto-asset exchanges?

- Vietnam is facing a great opportunity to develop digital asset trading floors that meet international standards. The advantage comes from the serious participation of large technology and financial corporations such as Techcombank, Vingroup, Viettel or FPT. These enterprises have proven their ability to implement complex technology projects, possess modern digital infrastructure, strong ecosystems and a team of experienced engineers in fields such as fintech, digital banking, e-wallets... This is an important foundation to build a solid digital asset trading floor.

However, unlike traditional financial products, blockchain and digital assets are changing rapidly, requiring in-depth knowledge not only of technology but also of law and risk management in a decentralized environment. Pure banking or fintech experience is not enough. If corporations want to participate systematically, they need to build a specialized team of blockchain engineers, digital finance experts, technology law and cybersecurity.

According to Mr. Phan Duc Trung, 1Matrix is deploying the construction of a multi-chain blockchain infrastructure with Vietnamese technology. From this foundation, the digital asset ecosystem is flexibly developed, allowing international organizations to transfer services through white-label contracts, while domestic enterprises proactively create B2B, B2C or B2B2C service layers customized to market needs.

If Vietnam makes good use of domestic resources and takes a flexible approach, it is entirely possible to build reputable digital asset exchanges in the region. Furthermore, Vietnamese enterprises can export both technology and operating models, affirming their position on the global digital asset map.

Source: https://nld.com.vn/chon-mo-hinh-san-tai-san-so-cho-viet-nam-1962508082153099.htm

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)