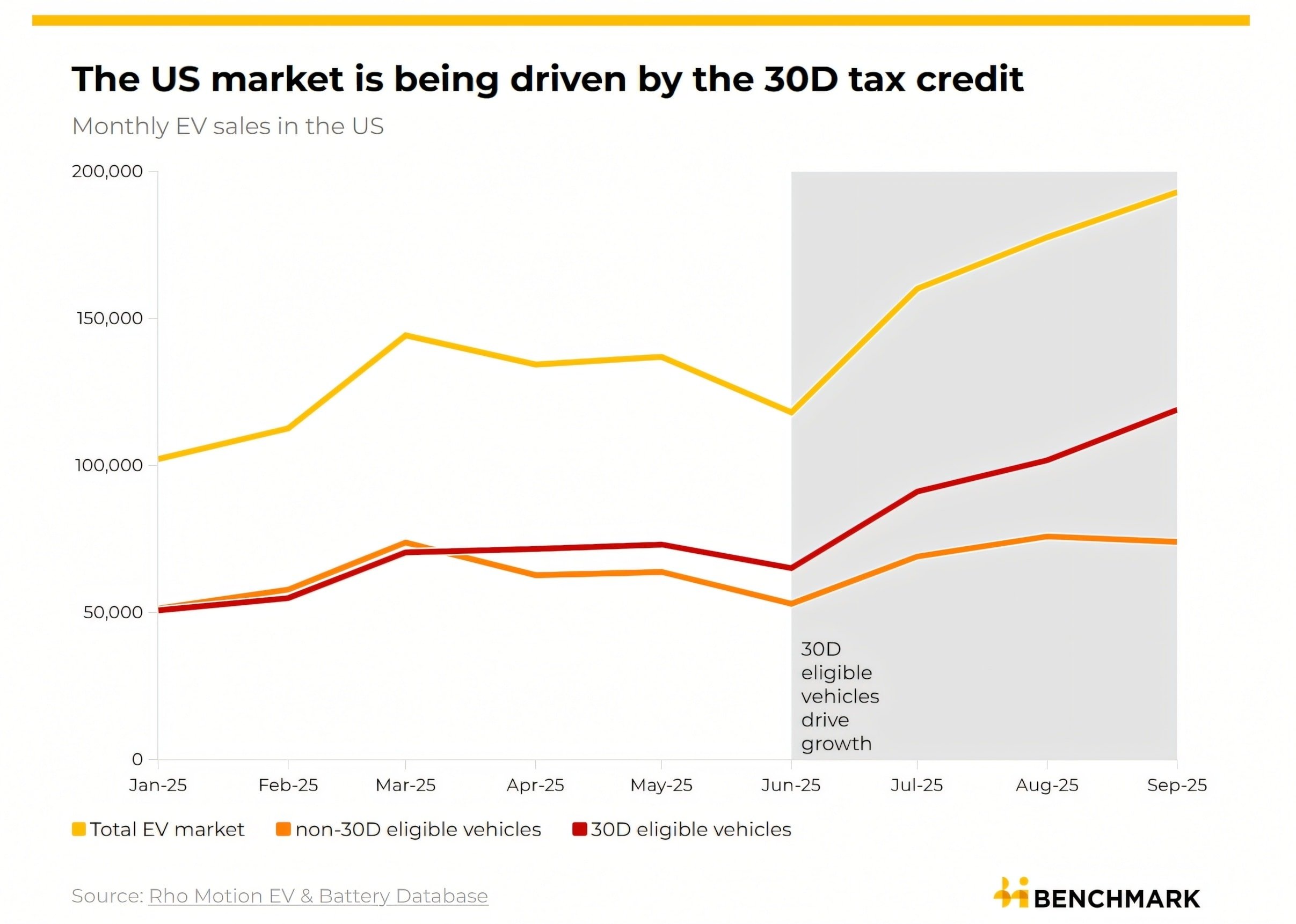

When the maximum $7,500 tax credit for electric vehicles in the US expires on September 30, 2025, the market immediately revealed a greater dependence on policy than the industry had previously acknowledged. Consumers rushed to order and take delivery of vehicles ahead of the deadline, creating a strong third quarter; but also opening up the risk of a sharp decline in the months ahead.

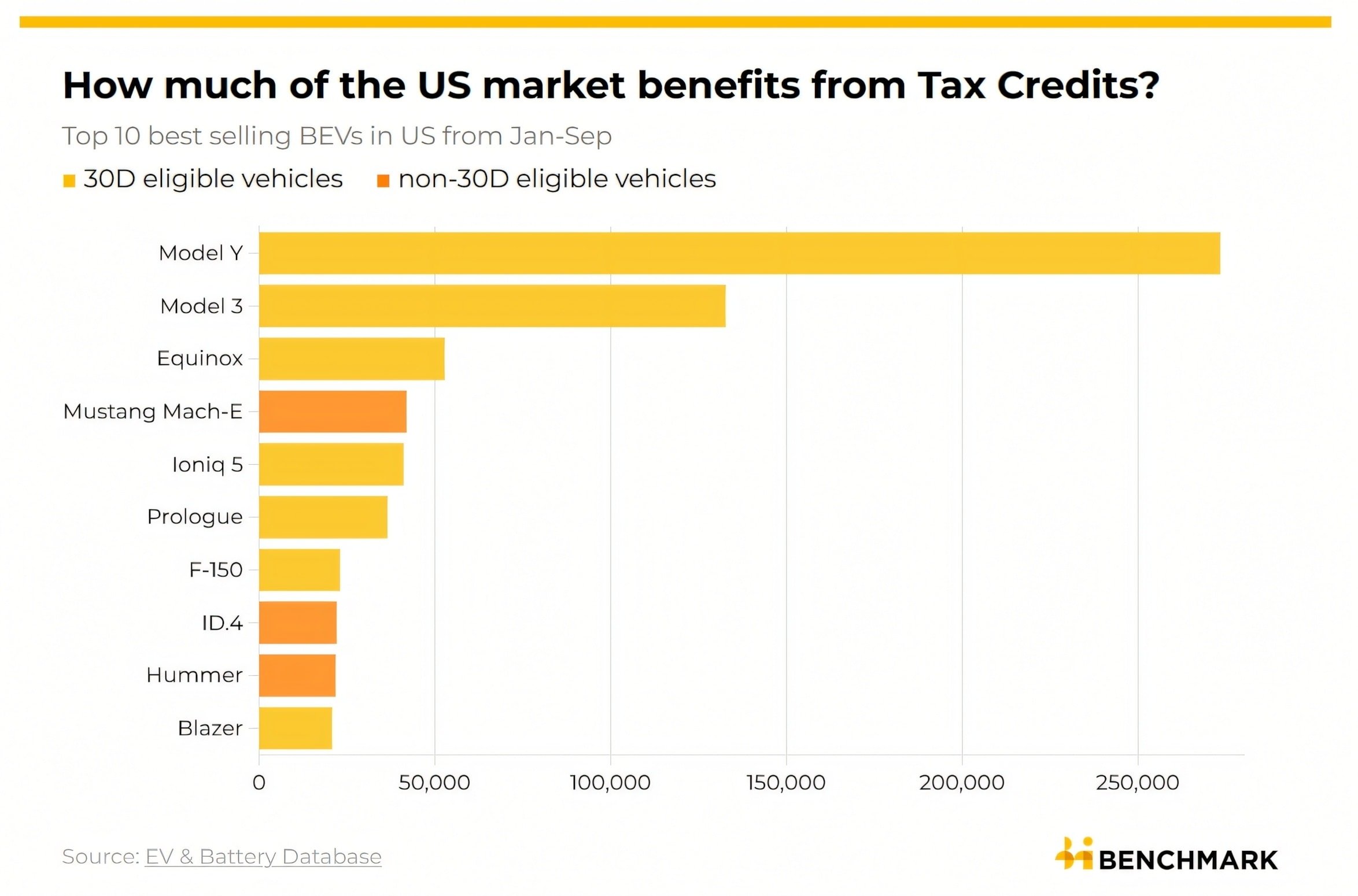

According to EV & Battery Database, the Tesla Model Y is the highest-selling electric vehicle eligible for Section 30D incentives, followed by the Tesla Model 3 and Chevrolet Equinox. The US Environmental Protection Agency (EPA) has identified 20 pure electric vehicles (BEVs) and one plug-in hybrid (PHEV) as eligible for incentives; this group accounts for about 55% of all electric vehicles sold from January to September. Rho Motion estimates that as many as 90% of BEVs and PHEVs sold in the first nine months of the year received some form of tax credit.

Last-minute boost and gap after September 30

The New Clean Vehicle Credit (up to $7,500) is a key driver of demand, which was evident in Q3 2025. Ford recorded 30,612 electric vehicle sales in Q3, up 86% from Q2; General Motors increased 44% to 66,501 vehicles; Tesla increased 27%, while demand for the Hyundai Ioniq 5 more than doubled. At the same time, the Qualified Commercial Clean Vehicle Credit (up to $7,500) program boosted the leasing channel, giving companies the flexibility to reduce leasing prices and expand their corporate customer base.

As September 30 approaches, a wave of closings is spreading across the US. However, according to Rho Motion, this is likely just a short-term buffer: EV and PHEV demand is expected to decline in the fourth quarter as incentives disappear. Factors such as tariffs, high domestic manufacturing costs and looser fuel economy standards could reduce the incentive to invest in US EV production, putting pressure on profit margins and selling prices.

Leasing becomes leverage

Unlike outright purchases, leasing isn’t tied to North American assembly lines the way individual buyers are. That gives automakers more flexibility in adjusting lease prices using trade tax credits, making leasing a powerful stimulus tool for price-sensitive buyers.

The leasing dynamic partly explains the boom in sales near the deadline, when manufacturers and leasing companies optimize their cost packages to help customers access incentives in time. However, when incentives are no longer available, this cost advantage also narrows, posing the problem of maintaining consumption speed in the fourth quarter.

Who benefits most before the deadline?

The short-term picture shows that eligible models like the Tesla Model Y, Model 3, and Chevrolet Equinox have taken advantage of the end of the incentive period to accelerate. Meanwhile, Ford, General Motors, and Tesla all recorded double-digit growth compared to the previous quarter, while Hyundai’s Ioniq 5 stood out for its rapid demand. Focusing resources on credit-eligible configurations is a strategy that is clearly visible in the market.

Key numbers

| Index | Data | Source |

|---|---|---|

| Maximum offer value | 7,500 USD | New Clean Vehicle Credit; Qualified Commercial Clean Vehicle Credit |

| Eligible Sample (1–9/2025) | 20 BEVs, 1 PHEV | EPA |

| Sales Proportion from Qualified Sample | 55% | EPA |

| Percentage of vehicles enjoying a form of credit | Up to 90% | Rho Motion |

| Ford EV on sale in the third quarter of 2025 | 30,612 vehicles; +86% compared to the second quarter | Company data |

| GM EV sales in the third quarter of 2025 | 66,501 vehicles; +44% compared to the second quarter | Company data |

| Tesla growth Q3/2025 | +27% compared to the second quarter | Company data |

| Hyundai Ioniq 5 Demand | More than doubled | Company data |

| Offer end date | September 30, 2025 | US federal policy |

Prospects and problems after incentives

The third-quarter growth momentum shows the sensitivity of purchasing power to incentives. After the policy ends, the market enters a more challenging period: demand may slow down in the fourth quarter, production investment plans face high domestic costs and the impact of trade barriers. For manufacturers, the incentive-eligible product strategy of the past period has proven effective, but to maintain sales, the pressure to shift to cost and supply chain competitiveness is significant.

On the positive side, the customer base has expanded in the first nine months of the year, with a significant portion of buyers accessing EVs through leasing. However, as forecasts warn, without incentives, the market is likely to correct to real demand levels that better reflect affordability and consumer expectations in the short term. Policy remains key to the trajectory of EV growth in the US.

Source: https://baonghean.vn/my-dung-uu-dai-7-500-usd-thi-truong-xe-dien-di-ve-dau-10308218.html

Comment (0)