Mr. Pham Anh Tuan, Director of Payment Department, spoke at the event - Photo: Contributor

Warning for 300,000 transactions to stop transferring to accounts showing signs of fraud

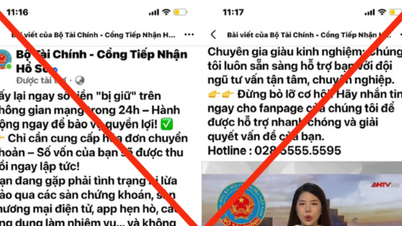

Regarding solutions to prevent cybercrime, Mr. Pham Anh Tuan said that recently, the State Bank has set criteria for transactions that show signs of fraud. For example, an account holder who is only 18 years old and makes transactions many times a day with billions of dong should also be considered suspicious transactions.

"With criteria for transactions showing signs of risk, we require payment service providers to review and make a list of cards and accounts suspected of being involved in fraudulent activities and send them to the State Bank.

The State Bank has collected about 600,000 accounts related to the above issues.

From this list, the State Bank has implemented a pilot program for banks. The results up to early September have helped warn nearly 300,000 customers to stop transactions with a total amount of about 1,500 billion VND.

"With the new tool, we believe that when transferring money, if there is a warning that the transaction has signs of fraud or scam, the customer will decide whether to transfer the money or not," said the Director of the Payment Department.

According to Mr. Tuan, after the accounts related to individuals committing fraud were banned, many subjects have switched to organizational accounts.

Regarding this issue, the State Bank is also amending relevant regulations to ensure security, safety, and prevent fraudulent acts.

Digital payment is a pillar contributing to promoting national digital transformation.

Regarding non-cash payment activities in the past 5 years, Mr. Tuan said that the average growth rate in the number of transactions reached over 62% per year. By the end of 2024, the proportion of adults with bank accounts had reached 87%, showing the rapid popularization of banking and financial services.

In the first 7 months of this year, non-cash payment transactions increased by 44.4% in quantity and 25% in value compared to the same period last year. In particular, transactions via mobile phones increased by 38.34% in quantity and 21.24% in value; transactions via QR codes increased by 66.73% in quantity and 159.58% in value.

In the coming period, the banking industry will continue to take digital payments as one of the important pillars contributing to promoting national digital transformation.

The State Bank will focus on perfecting the legal framework and promoting the development of modern payment services such as domestic cards and e-wallets, to ensure a comprehensive, safe and effective payment ecosystem.

Facing the development potential of mobile payment methods, today, September 26, NAPAS has deployed the NAPAS Tap and Pay service. This is a modern payment solution, allowing users to digitize domestic NAPAS cards on smart devices such as watches and phones when making payments.

Mr. Nguyen Quang Minh - General Director of NAPAS - said that NAPAS Tap and Pay is an important step in the journey of digitalizing payments in Vietnam; it is a fast and convenient payment solution, suitable for modern consumer trends, especially young people and technology-loving users.

Source: https://tuoitre.vn/ngung-300-000-giao-dich-chuyen-tien-co-dau-hieu-lua-dao-20250926124429615.htm

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)