With a series of preferential interest rate policies to support customers, especially young customers and low-income earners, pressure has been put on banks.

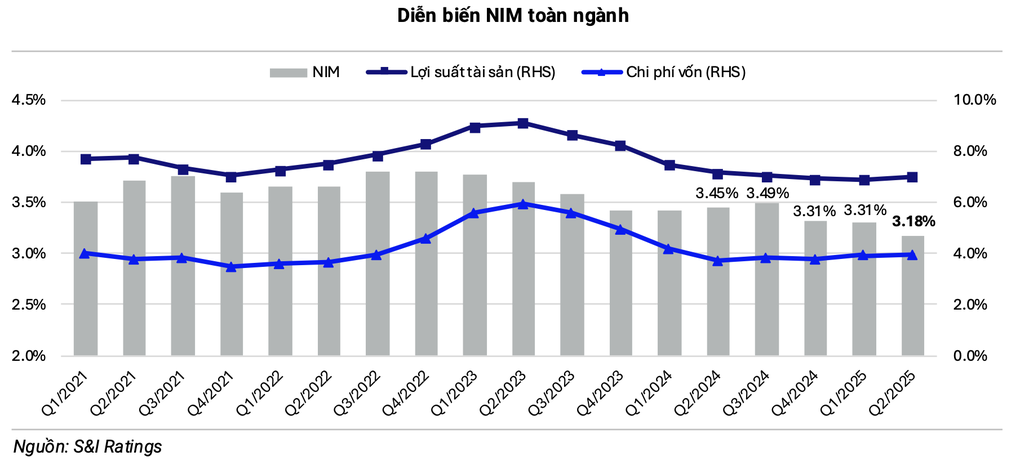

It is noted that the state-owned banking sector has pioneered in implementing many loan packages with preferential interest rates, forcing joint stock commercial banks (JSCs) to also make adjustments to maintain competitiveness. As a result, the industry's NIM decreased to 3.18% in the second quarter of 2025, from 3.31% in the first quarter.

Banks' NIM hits "rock bottom"

Notably, this is the lowest NIM level since 2018, a report from S&I Ratings noted.

NIM (Net Interest Margin) is the net profit margin of a bank or financial institution, representing the difference between interest income from loans and investments and interest expenses paid for deposits and other sources of capital, on total earning assets. This index is usually expressed as a percentage and is one of the important indicators to evaluate the performance and profitability of a bank.

Banks' NIM hits "rock bottom" (Photo: S&I Ratings Report).

S&I Ratings forecasts that NIM pressure will still exist in the coming time, mainly due to the fact that lending interest rates have decreased by 60 points compared to the end of 2024 due to the State Bank's orientation to maintain low interest rates to support economic growth. Along with that, the cost of capital for the whole industry increased by about 25 points compared to the same period as banks increased long-term mobilization to meet credit demand.

However, industry profits are expected to continue to be positively supported by non-interest income, specifically the doubling of bad debt recovery revenues. The bad debt collection of the banking sector in the period recorded an increase of 108% thanks to the recovery of the real estate market, helping to promote the debt collection process.

Notably, Vietinbank (stock code CTG) earned 7,800 billion VND, BIDV (stock code BID) earned 6,300 billion VND, VPBank (stock code VPB) earned 5,200 billion VND.

At the same time, banks also recorded a sharp increase in income from securities trading (growth of 77%), contributing significantly to the industry's overall profit in the second quarter of 2025.

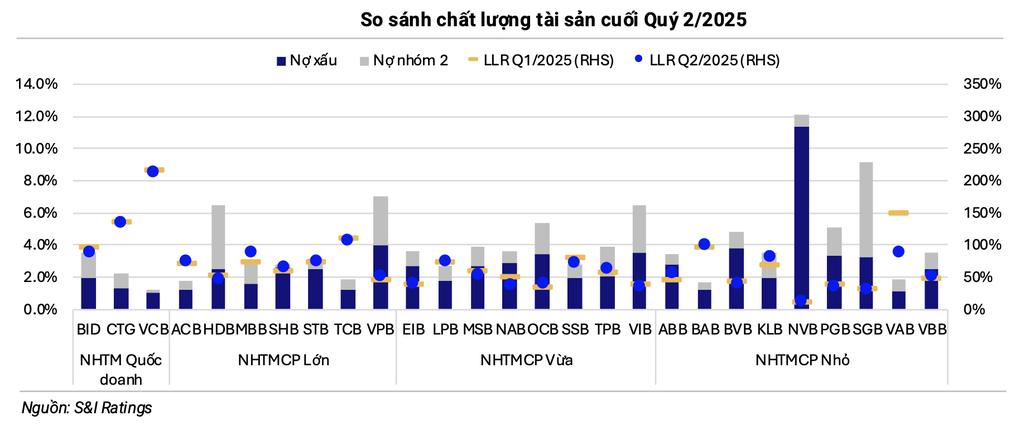

Bright spot from bad debt settlement

Regarding the asset quality of the whole industry, as of June 30, the quality has generally improved significantly, except for some small-scale banks. In particular, the debt ratio of group 2 decreased to 1.24% (compared to 1.61% at the end of the first quarter) - the lowest level in the past 3 years. Bad debt also decreased to 2.03%.

The bank handled VND37,100 billion in bad debt in the second quarter of 2025 (Photo: S&I Ratings).

According to S&I Ratings, this positive development comes from the technical effect when credit increased sharply, helping to reduce the ratio of bad debt to outstanding loans. At the same time, banks also stepped up bad debt handling activities, with 37,100 billion VND of debt handled in the second quarter.

Notably, some large banks MBBank,SHB , VPBank have increased provisions in the context of improved asset quality. On the contrary, PGBank and VietABank (stock code VAB) have reduced provisions despite increasing bad debt.

According to Decree 86/2024/ND-CP, real estate collateral, if more than 2 years have passed since the credit institutions and foreign bank branches have the right to handle it, will no longer be deducted when calculating provisions. This regulation may increase provisioning costs, especially at banks with a high and prolonged Group 5 debt ratio.

In the short term, S&I Ratings assesses that bad debt across the industry is likely to maintain a slight decline. However, in the medium and long term, high credit growth may put pressure on asset quality as bad debt often has a delay in forming.

Banks boost lending for real estate and securities

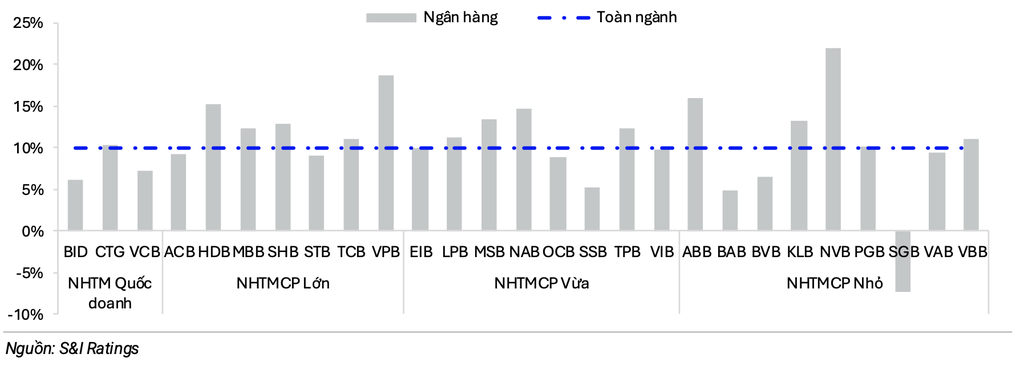

Regarding credit growth, the whole industry achieved an increase of 9.9% in the first half of the year - the highest level in more than a decade.

On July 31, the State Bank adjusted the credit limit for banks that had completed 80% of the limit granted at the beginning of the year, creating more room for growth in the remaining months. S&I Ratings assessed that the Government's credit growth target of 16% is feasible and could reach 17-18% for the whole year if capital demand remains positive along with the economic recovery.

Bank credit growth (Photo: S&I Ratings Report).

In the first half of the year, the group of joint stock commercial banks (especially banks specializing in lending to businesses) continued to be the main driving force. Listed are VPBank with growth of 18.7%, HDBank with growth of 15.3%, NamABank with growth of 14.7%...

In terms of lending sectors, most manufacturing, construction and trade-service sectors contributed well to the credit growth of the entire system.

Meanwhile, the proportion of disbursement for real estate business and financial services is still dominant in some banks. Compared to the end of 2024, outstanding loans to real estate investors at SHB Bank increased by 41,000 billion VND, followed by Techcombank with an increase of 40,000 billion VND, MBBank with an increase of 21,000 billion VND.

Lending to securities companies also increased sharply, for example NamABank increased by 15,000 billion VND, VPBank increased by 13,000 billion VND...

Source: https://dantri.com.vn/kinh-doanh/nim-cham-day-dau-la-vu-khi-bi-mat-giup-cac-ngan-hang-thang-lon-20250919154714636.htm

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)