Under great profit-taking pressure after a long market increase, VN-Index just recorded a sharp decline of more than 42 points on the last trading day of the week (August 22, 2025), bringing the index to 1,645.47 points.

Immediately after the market recorded strong fluctuations, PYN Elite investment fund sent a letter to investors and continued to maintain its positive assessments of the Vietnamese stock market.

This Finnish investment fund said that in the 3 years from 2022 to 2024, VN-Index performed quite sluggishly and recorded a decrease of 15.4%. However, the situation is now different. The stock market has regained positive growth momentum and the speed can be accelerated even more.

Based on current fundamentals, PYN Elite Fund assesses that the market is fully capable of entering a “Big Year” in terms of stock market performance. At that time, the results will be clearly reflected in the market.

In its history, this investment fund has experienced 4 breakthrough years, including: 1999, 2003, 2009 and 2012 when the fund's annual profit grew from 64% to 199%.

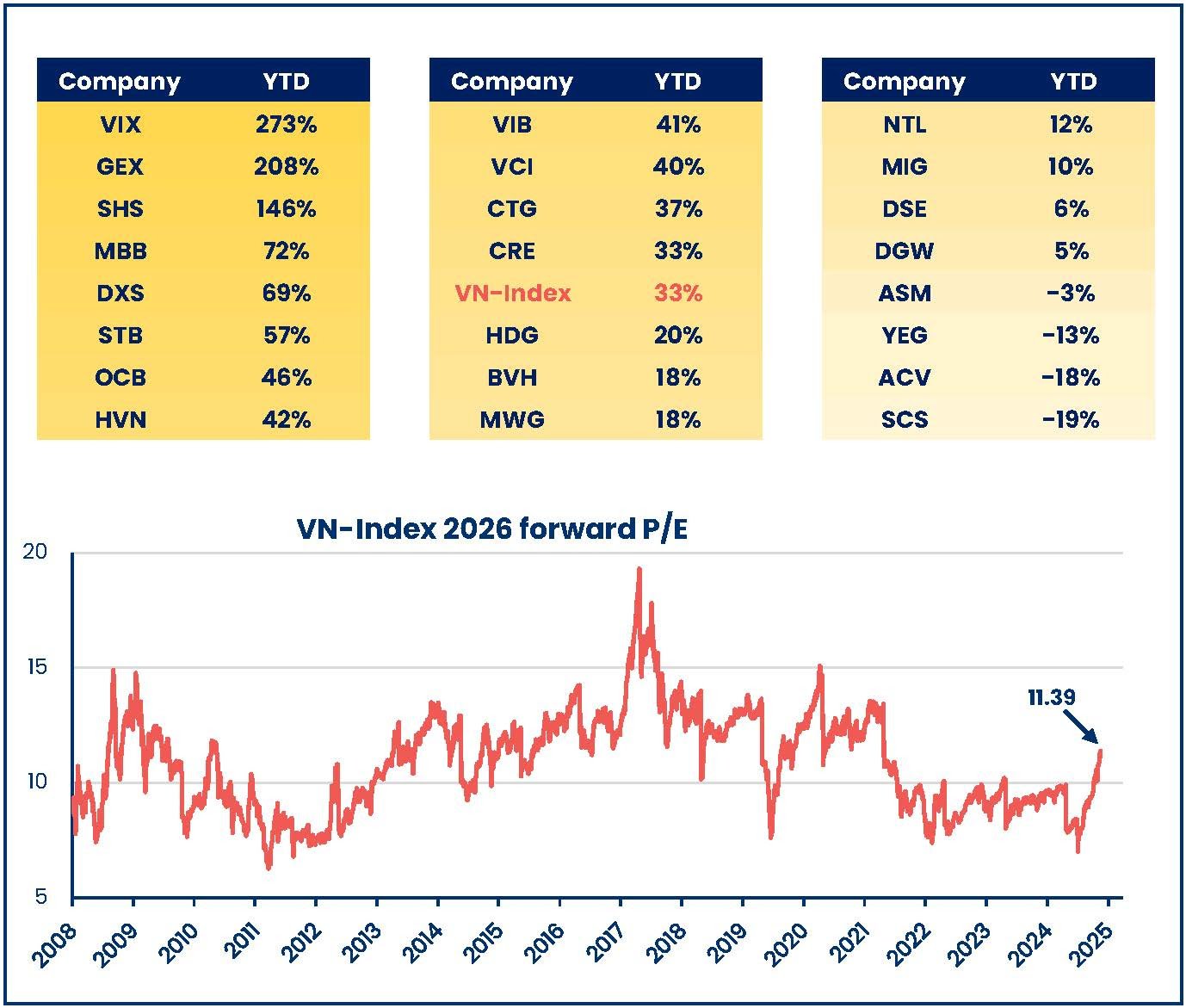

Rarely in its history, PYN Elite Fund has announced the entire investment portfolio of the fund with 23 stocks. Compared to the increase of VN-Index of 33%, the portfolio currently has 12 stocks with an increase that is superior to the market index. Of which, the strongest increase is 3 stocks including VIX (+273%), GEX (+208%) and SHS (+146%).

Other stocks with increases exceeding the index's increase are MBB, DXS, STB,OCB , HVN...

PYN Elite Fund's 23-stock portfolio recorded 10 stocks in the financial group (banking and securities), which is also the industry group with the strongest growth and leading the market in the recent period.

Currently, PYN Elite's portfolio still has 4 stocks with negative performance including ASM, YEG, AVG and SCS, of which ACV and SCS have the biggest decrease, from 18-19%.

|

| PYN Elite Fund's portfolio and market P/E projection |

The fund said that in its current portfolio, it aims to maximize returns. Profits from hot positions. At the same time, the fund is also likely to rotate and change the portfolio because stocks this year recorded uneven increases and decreases. A strong growth period will be accompanied by high volatility, fluctuations and the possibility of adjustments.

Consistent with the positive assessments of the Vietnamese stock market in recent times, PYN Elite Fund has proposed 7 driving forces as a sustainable foundation to promote 2025 to become a "great victory" year.

First, public spending is boosting economic growth.

Second, Vietnam's liquidity is abundant and the government is supportive of credit growth.

Third, concerns about Vietnam's export situation to the US related to tariffs have been resolved.

Fourth is the prospect that FTSE is expected to upgrade Vietnam's stock market to the emerging market (EM) group next October.

Fifth, the outlook for corporate profit growth is positive, with forecasts of 32% in 2025 and 19% in 2026.

Next, with the above profit growth, the projected P/E ratio in 2026 is 11.1 times.

And finally, the recent increase was mainly concentrated in a few stock groups, so the cash flow rotation will trigger new increases in other stocks and industry groups, attracting investors' attention.

Source: https://baodautu.vn/quy-ngoai-diem-7-ly-do-khien-nam-2025-la-nam-dai-thang-cua-chung-khoan-d368953.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)