Liquidity decreased, a series of large securities companies reported decreased profits

The decline in stock market liquidity in the third quarter of 2024 has affected the brokerage segment of many securities companies. Many large securities companies have announced declining business results.

Third quarter profit down, domestic securities company still exceeds yearly plan

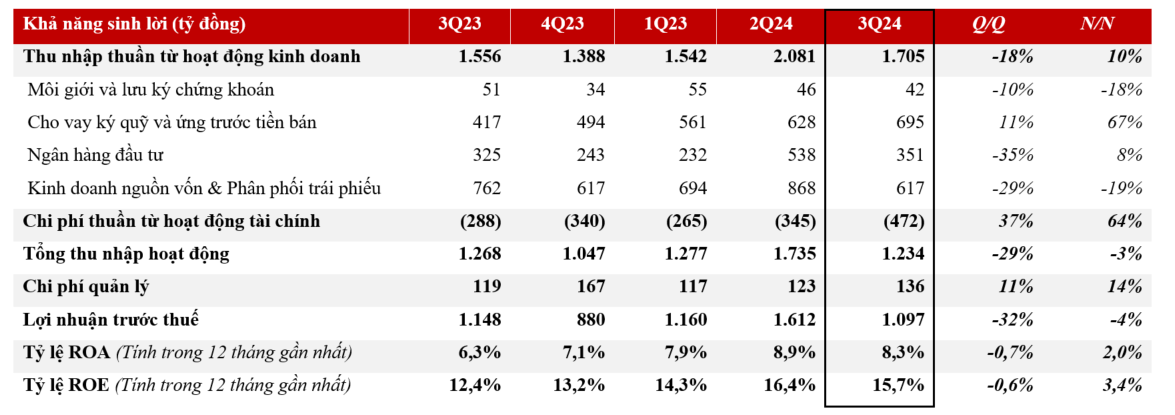

Information from Techcom Securities Corporation (TCBS) said that in the third quarter of 2024, TCBS recorded VND 1,097 billion in pre-tax profit. Thus, TCBS's profit decreased slightly by 4% compared to the same period last year.

TCBS said that market liquidity in the third quarter decreased by 25% compared to the previous quarter, reaching an average of VND16,500 billion due to investors' cautious sentiment due to concerns about the global economic situation. TCBS's securities brokerage and custody segment recorded net income of VND42 billion, down 10% compared to the previous quarter.

In this quarter, TCBS recorded an income from the investment banking segment of VND351 billion, down 35% compared to the previous quarter. The capital sources and bond distribution segment also decreased by 19%, reaching VND617 billion. However, if excluding profits from some irregular securities trading transactions in Q3/2023, net income from this segment increased by 4% compared to the same period last year.

|

| Source: TCBS |

Meanwhile, margin lending and sales advances continued to be a bright spot, reaching VND695 billion, up 11% quarter-on-quarter and 67% year-on-year. The company continued to increase its margin lending balance in the third quarter to VND25,000 billion.

Accumulated 9 months, TCBS pre-tax profit reached 3,869 billion VND, completing 105% of the yearly plan.

Another domestic securities company, Rong Viet Securities Corporation (VDSC), also reported an unfavorable business period with a sharp decline in securities brokerage revenue, reaching VND41 billion, down 58% compared to the third quarter of 2023. Due to the sharp decline in brokerage revenue, although income from self-trading and interest from receivable loans both grew, it was still only able to slow down the decline in total revenue.

As a result, operating revenue in the third quarter of this year reached VND219 billion, down 10.6% over the same period last year. Profit after tax accordingly reached VND74.7 billion, down 18%.

VDSC said that although most of the company's business segments have been maintained and developed, the sharp decline in liquidity value and unfavorable market conditions have significantly affected the company's securities brokerage revenue and investment banking activities.

However, in the first 9 months, VDSC still achieved VND 798 billion in operating revenue and VND 306 billion in after-tax profit, growth rates of 39% and 21% respectively, exceeding the yearly profit plan (VND 288 billion).

Increasing margin lending has not yet brought profits to foreign-invested securities companies.

Also affected by the market, foreign-invested securities companies also reported negative business results.

With investment capital from Taiwan, Yuanta Securities Vietnam Co., Ltd. does not operate on its own, most of its revenue comes from lending and receivables activities.

In the third quarter, interest from loans and receivables still contributed the most, accounting for 70% of Yuanta's total revenue, reaching 104 billion VND, a sharp increase compared to last year, up to 44%. However, revenue from brokerage decreased by 40% and interest from held-to-maturity (HTM) investments decreased by 70%.

This caused Yuanta's after-tax profit in the third quarter of 2024 to reach only VND27.5 billion, down 30% compared to the same period last year. This is Yuanta's first reported profit decline in 2024 after significant growth in the first two quarters of the year.

As of September 30, 2024, Yuanta's total assets reached VND5,400 billion, an increase of 16% compared to the beginning of the year. Most of Yuanta's assets are in loans with a value of VND4,325 billion, equivalent to 80% of total assets. The value of margin loans has been continuously increasing and has increased by 41% compared to the beginning of the year, an increase of more than VND1,270 billion.

Another foreign-invested securities company, KIS Vietnam Securities JSC (KIS), also reported a decline in profits due to the impact of its proprietary trading and brokerage segments.

Specifically, KIS's profit from financial assets recognized through profit/loss (FVTPL) in the third quarter of 2024 only reached VND 292.8 billion, down 38%. In the same period last year, this segment contributed nearly 60% of the company's operating revenue. At the same time, revenue from securities brokerage also decreased by 33%, bringing in VND 91 billion.

Meanwhile, although interest from loans and receivables increased by 10%, bringing in 164.7 billion, it was still not enough to increase profit for KIS because the revenue structure still mainly came from self-trading.

As a result, KIS's third quarter after-tax profit was VND105 billion, down 26% compared to the same period last year. This is also the second consecutive quarter that KIS recorded negative growth. However, thanks to the positive first quarter, after 9 months, KIS's pre-tax profit reached VND451 billion, the company's after-tax profit still increased by 10%, reaching VND361.6 billion.

As of September 30, 2024, KIS has lent VND8,002 billion for margin activities, an increase of more than VND1,442 billion compared to the beginning of the year and an increase of VND406 billion compared to the end of the second quarter. Currently, loans account for more than 60% of KIS's total assets.

Also a securities company with Korean investment capital like KIS, KB Securities Vietnam has just reported a sharp decline in its proprietary trading and brokerage segments.

The third quarter's self-trading activities only brought in 7.3 billion VND, only 11% of the same period last year's profit. Brokerage revenue also decreased by 40%, bringing in 53 billion VND. While other securities companies still recorded increased profits from lending and receivables, KB Vietnam in the last quarter only achieved the same level as the same period last year.

With no growth momentum, KB Vietnam's total operating revenue in the third quarter of 2024 only reached VND223.5 billion, down 37% year-on-year. Profit after tax decreased by 25% to VND48.6 billion, this is the quarter with the lowest profit in the past 2 years of KB Vietnam.

The company explained that, in addition to the impact of the stock market, which caused brokerage activities, HTM profits, and securities trading profits to decrease, investment in information technology and advertising for new trading applications also increased the company's costs.

As of the end of the third quarter, KB Vietnam was using VND6,186 billion for margin lending, an increase of 30%, equivalent to an increase of more than VND1,420 billion compared to the beginning of the year. This category accounts for 72% of the total assets of this securities company.

Source: https://baodautu.vn/thanh-khoan-giam-loat-cong-ty-chung-khoan-lon-bao-loi-nhuan-giam-d227678.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs the Conference to deploy the National Target Program on Drug Prevention and Control until 2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759990393779_dsc-0495-jpg.webp)

Comment (0)