However, compared to the second quarter, the market showed signs of a slight correction, with volume decreasing by 14.5% and the average daily trading value reaching about VND6,777 billion. This figure shows the stability of commodity investment activities in Vietnam.

Soybean oil "dethrones" platinum

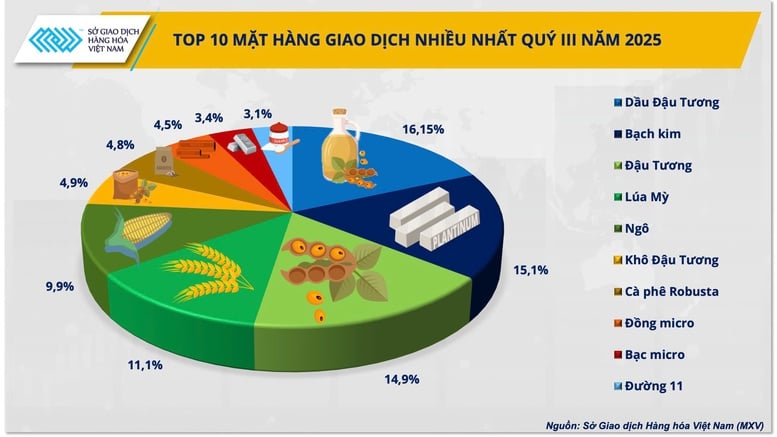

The Q3 trading landscape saw a notable reshuffling of positions between the two most-watched commodities. Soybean oil surpassed platinum for the first time, taking the top spot with 16.15% of total market trading volume.

Analysts said the growth momentum of soybean oil comes from a combination of supply-demand factors and energy price movements. In the third quarter, major exporting countries such as the US, Brazil and Argentina continued to expand their biofuel blending programs, boosting demand for soybean oil. At the same time, crude oil prices rose sharply to the region of 70 USD/barrel in late July, the highest level in the quarter, pushing soybean oil prices up to 1,260 USD/ton in the session on July 29 - the highest peak in many months.

Although the price has since dropped to around $1,100/ton, the large fluctuation range still makes soybean oil a “focus” that attracts investors who love short-term opportunities. This development also reflects the characteristics of the trading market - where volatility is an opportunity and investors can flexibly seek profits even during the adjustment period.

On the other hand, platinum fell to second place with 15.09% of total trading volume. Adjustment pressure appeared when global market sentiment became cautious about the progress of trade negotiations between the US and its partners, along with a series of reciprocal tariff measures applied in the third quarter. However, the supply and demand foundation of platinum is still assessed to be solid.

According to the World Platinum Investment Council (WPIC), the platinum market will continue to have a deficit of about 850,000 ounces in 2025, marking the third consecutive year of deficit due to declining mine supply, especially in South Africa. Although temporarily losing the top position, platinum is expected to regain growth momentum soon as the supply chain stabilizes and industrial demand, especially from the fuel cell industry, continues to recover.

Soybeans and wheat ranked third and fourth, accounting for 14.9% and 11.08% of total trading volume, respectively. Meanwhile, corn fell to fifth place with 9.86%, due to abundant supplies and months of falling prices.

Soybean meal, Robusta coffee, micro copper, micro silver and 11-carat sugar are at the bottom of the rankings, with weights ranging from 3% to 5%.

According to MXV, the differentiation between commodity groups shows that investment capital is becoming more selective, instead of spreading evenly as before. The context of energy prices, extreme weather and trade policies between major economies is making volatility the “new normal ” of global commodity markets.

Notably, information about the possibility of the US reducing import tax to 0% for some agricultural products that are not produced domestically could create a new boost for export businesses. If this policy is issued, Vietnamese coffee is expected to increase its presence in the US market, opening up opportunities to improve its trading ranking in the near future.

Brokerage market share: Stable leading group, exciting mid-range race

The picture of commodity brokerage market share in the third quarter continued to record stability in the leading group, but was full of excitement in the mid-range group, reflecting the natural expansion trend of the Vietnamese commodity trading market.

According to MXV, Gia Cat Loi Commodity Trading Joint Stock Company is still leading the entire market with 26.29% market share, maintaining stable performance for three consecutive quarters. Its extensive branch network and professional consulting capacity help the company consolidate its pioneering position in the field of commodity brokerage.

Saigon Futures Joint Stock Company maintained its second position with 20.3%, recording steady growth thanks to its focus on investor training and building a transparent and modern trading system. Meanwhile, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) maintained its third position with 13.26%, continuing to be a familiar name in the top group.

The highlight of the third quarter belonged to Friendship International Investment Company Limited (Finvest) - the company whose market share nearly doubled, from 5.22% to 10.43%, thereby rising to the fourth position. This result comes from a strategy of investing heavily in trading technology, market data and customer care services. Hitech Finance Joint Stock Company completed the top 5 with 7.53% market share, continuing to expand its coverage in the northern region.

According to Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV, the leading group of enterprises in the third quarter are generally still familiar names.

According to Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV, the leading group of enterprises in the third quarter are generally still familiar names, reflecting the necessary stability in the period when the market enters a sustainable development cycle. Although there is not much change in position, the market share picture shows that the competition is becoming more and more fierce, both in terms of service quality and analysis capacity and transaction technology.

“With a flexible adaptation strategy and thorough investment in the consulting team as well as data infrastructure, I believe that by the end of 2025, there will be new faces on the rankings. That will create a new momentum for the entire Vietnamese commodity brokerage market,” Mr. Quynh emphasized.

Source: https://baochinhphu.vn/thi-phan-moi-gioi-hang-hoa-on-dinh-o-top-dinh-soi-dong-o-duong-dua-phia-sau-102251008101827527.htm

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)