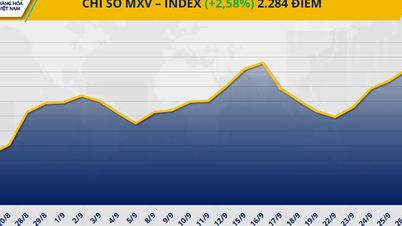

Energy commodity market "bright red". Source: MXV

According to the Vietnam Commodity Exchange (MXV), the energy group fell across the board yesterday, with all five commodities in the red. Notably, crude oil prices continued to extend their streak of four consecutive declines.

Of which, Brent crude oil price lost nearly 1.9%, down to 64.11 USD/barrel - the lowest level since the end of May; WTI crude oil decreased more sharply, up to 2.1%, closing at 60.48 USD/barrel, the lowest level in 5 months.

The downward pressure on prices is mainly due to the prospect of excess supply. The market is focusing on the October 5 meeting of OPEC+, with many predicting that the alliance will continue to raise production in November.

According to analysis by the largest investment bank in the US - JPMorgan Chase, the combination of increased supply, global refining slowdown due to maintenance, and consumption entering a low period, will increase inventories and continue to weigh on prices.

The metal commodity market is divided. Source: MXV

Amid a mixed metal market, COMEX copper rose nearly 1.4% to $10,911 a tonne yesterday, driven by concerns over a global supply glut.

In Chile, the world's largest copper producer, August output fell nearly 10% year-on-year to just over 423,600 tonnes, according to the National Statistics Agency (INE). This was the sharpest decline since May 2023.

Global copper supplies have also been affected by the incident at the Grasberg mine in Indonesia - the world's second largest. The Freeport-McMoRan mine had to declare force majeure after a mudslide in early September caused difficulties in mining operations.

According to research organization BMI, the 20 largest mines alone account for about 36% of global production this year, so any incident at these mines could have a ripple effect on the supply chain.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-gia-dong-tang-dau-thap-nhat-ke-tu-thang-5-718242.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

![G-DRAGON 2025 WORLD TOUR [Übermensch]](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/0dec353013874c2ead28385a8c4ccf55)

Comment (0)