Silver price “free-falls” more than 7% after a series of hot increases

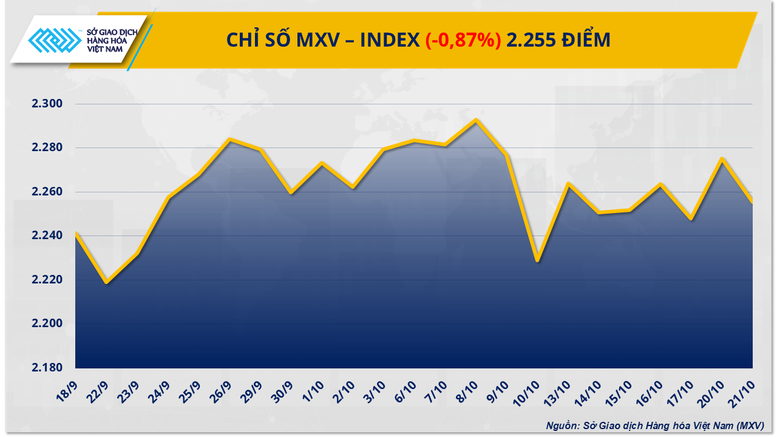

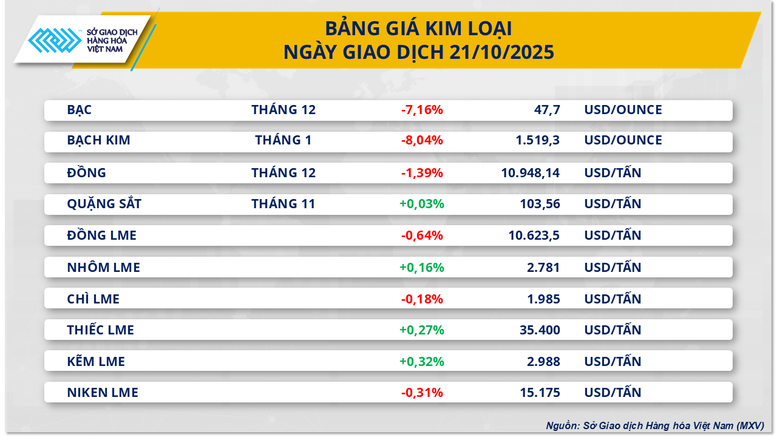

According to the Vietnam Commodity Exchange (MXV), the metal group is the focus of domestic and international investors as it leads the weakening trend of the entire market. Silver prices fell more than 7% - the sharpest decline since early October, falling below the psychological threshold of 50 USD/ounce due to massive profit-taking activities, in the context of a stronger USD and a weakening outlook for industrial consumption. At the end of the session, the December silver futures contract stopped at 47.7 USD/ounce.

Analysts say this correction is inevitable after a long streak of gains, especially when new data shows that industrial demand is slowing. In China - a country that accounts for about 40% of global industrial silver demand, GDP growth in the third quarter was only 4.8%, down from 5.2% in the previous quarter. Although industrial output in September increased by 6.5% compared to the same period last year, the economy is assessed to be increasingly dependent on exports, threatening silver demand in the electronics, solar panels and green energy sectors. At the same time, the USD index (DXY) increased by 0.35% to 98.93 points - the third consecutive increase, making the precious metal less attractive to investors holding other currencies.

Despite the sharp short-term correction, silver’s long-term outlook remains positive thanks to a solid supply-demand foundation. The market is forecast to continue to record a deficit for the fifth consecutive year as demand from the renewable energy and electric vehicle sectors remains strong.

In addition, geopolitical risks and the possibility of the US Federal Reserve (Fed) easing monetary policy are expected to reactivate safe-haven buying. Investors are currently watching the US Consumer Price Index (CPI) data, scheduled to be released on the evening of October 24 (Vietnam time), which is considered a key factor in orienting interest rate expectations in the context of the US Government being temporarily shut down.

Coffee goes “upstream” in the context of scarce supply

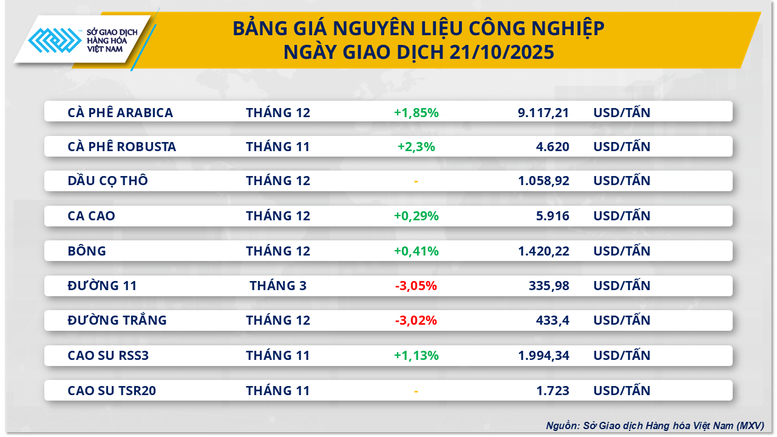

In contrast to the gloomy performance of the precious metals group, world coffee prices continued to improve as supply from Brazil - the world's largest producer and exporter - decreased sharply. At the end of the session on October 21, the Arabica contract for December delivery increased by 1.85% to 9,117 USD/ton, while Robusta futures for November delivery increased by 2.3% to 4,620 USD/ton.

According to the Brazilian Coffee Exporters Association (Cecafé), as of October 21, the amount of coffee cleared through customs reached more than 2.1 million bags and is expected to reach only 3.8-4 million bags for the whole month, down 20% compared to the same period last year. In addition, tariff barriers continue to block the flow of trade between Brazil and the US, forcing roasters to find temporary supplies on the ICE exchange, causing Arabica coffee inventories to fall to a 19-month low (467,110 bags), while Robusta inventories hit a three-month low of only 6,152 lots.

In the domestic market, weather factors are also creating pressure as tropical storm Fengshen moves into the Central region, forecast to cause prolonged heavy rains in the Central Highlands - the country's key coffee growing region. Continuous rains in the next 7-10 days may increase the risk of flooding and landslides, affecting the harvest progress.

Domestic trading activities are currently taking place at a standstill, with purchasing agents mainly waiting for the main crop. Recorded this morning (October 22), the purchase price of green coffee beans in the Central Highlands and Southeast increased by VND2,000/kg compared to yesterday, to VND115,000-116,000/kg.

MXV believes that the coffee price increase is likely to continue in the short term as supply factors have not yet improved significantly. Brazil's exports are forecast to continue to slow down in November due to adverse weather and tariff barriers. In addition, the risk of prolonged heavy rains in the Central Highlands region could affect the harvest progress and quality of coffee beans, thereby increasing pressure on global supply. However, MXV believes that the price increase margin may gradually narrow when entering the peak harvest period, especially if new sources from Vietnam and Indonesia are soon introduced to the market.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-gia-bac-lao-doc-ca-phe-nguoc-dong-102251022100032044.htm

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

Comment (0)