Notable among them were two coffee products which continued to record significant increases. In addition, copper prices also recorded their third consecutive increase due to signs of improved supply and demand.

Drought in Brazil supports coffee prices

At the end of yesterday's trading session, green continued to cover the industrial raw material group, in which coffee was the focus when attracting strong investment capital. Arabica coffee prices increased by 1.3% to 8,529 USD/ton, while Robusta jumped by 2.4% to 4,477 USD/ton.

According to MXV, the lack of rain in Brazil just before flowering is putting a lot of pressure on the prospects for the 2026 crop. Flowering has already begun, but weather forecasts from Vaisala show that the dry spell will last for at least the next 10 days, with low soil moisture and scarce rainfall likely to severely hamper plant development. This has raised concerns about medium-term supply, supporting prices.

In addition to weather factors, the trade situation also contributes to the impact on the market. A report from the Brazilian Coffee and Cocoa Association (Cecafé) said that the country exported only 3.1 million bags of coffee in August, down 17.5% compared to the same period in 2024; the cumulative first 8 months of the year also decreased by more than 20% compared to last year. Notably, exports to the US decreased by 46%, while Mexico and Colombia increased sharply, reflecting a shift in the structure of the consumption market. On the other hand, Colombia recorded a 10% increase in coffee exports in August compared to the same period last year, reaching 1.13 million bags, thereby contributing to partially offset the shortage from Brazil.

Domestically, buying and selling activities are also bustling. Some export enterprises have started to offer to buy new crop coffee at 107,000-108,000 VND/kg, delivery from mid-December, with a deposit of about 2.7 million VND/ton. In the domestic market, the purchase price of green coffee beans increased by 1,000 VND/kg this morning, fluctuating around 114,500-115,600 VND/kg.

Copper prices mark third consecutive gain

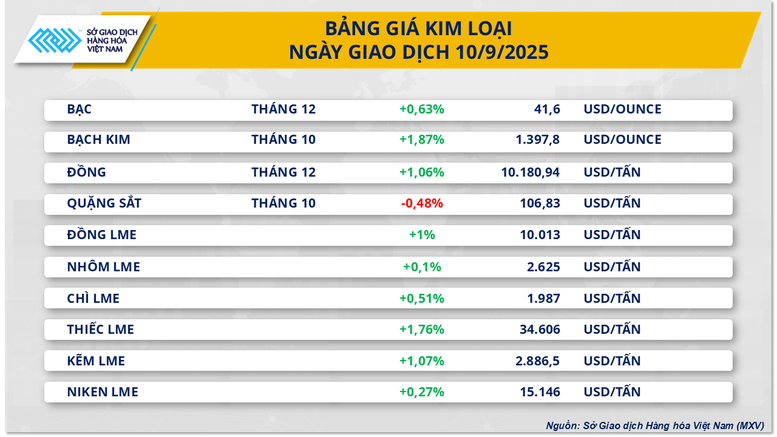

The metal market also maintained its green color in yesterday's session, with 9/10 items increasing in price. Notably, the COMEX copper contract for December delivery closed up 1.06% to $10,180.94/ton, marking the third consecutive recovery session after a series of declines at the beginning of the month.

The rise in copper prices is underpinned by both supply and demand factors. On the supply side, an incident at the Grasberg mine in Indonesia - one of the world's largest mining complexes - has forced Freeport-McMoRan to temporarily halt operations, raising concerns about disruptions to global supplies. Grasberg currently supplies an average of more than 770,000 tonnes of copper and 1.4 million ounces of gold per year, so any disruption there would have a major impact on the market.

On the other hand, the demand side also showed positive signs. According to customs data, China imported nearly 2.8 million tonnes of copper concentrate in August, up 7.8% from July and reaching the second highest level on record. Copper consumption continued to be boosted by the transition to green energy - a sector where copper plays an essential role.

Meanwhile, China's producer price index (PPI) in August also showed that deflation was narrowing, helping to reduce pressure on businesses and is expected to support industrial demand in the coming time.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-noi-dai-chuoi-tang-102250911102144448.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)