Supply pressure causes oil prices to plummet

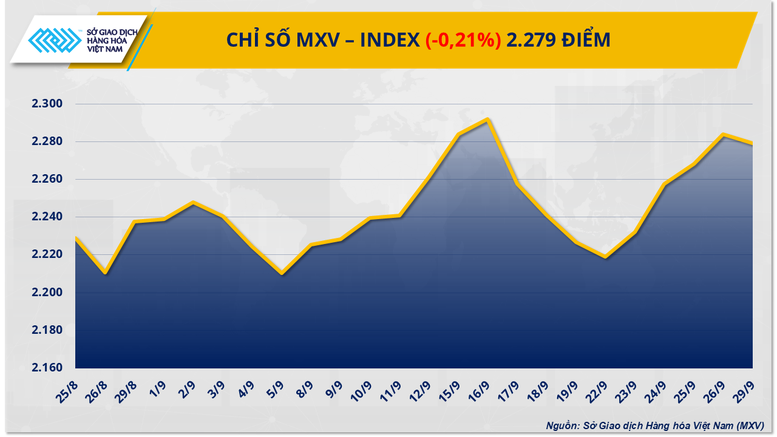

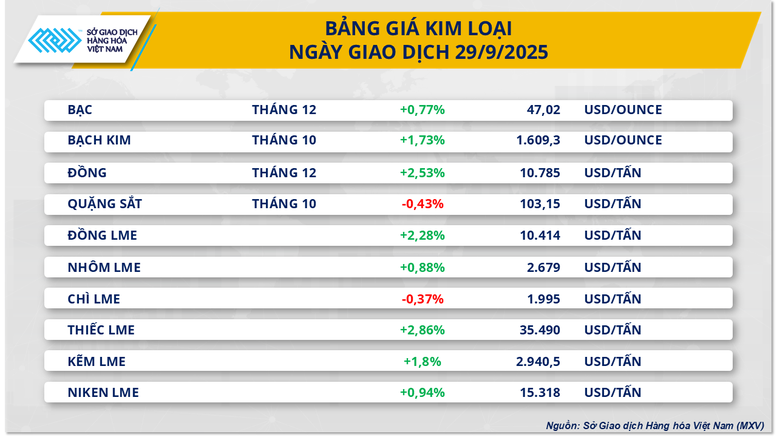

According to the Vietnam Commodity Exchange (MXV), the energy market was in the red in yesterday's trading session, when most key commodities fell sharply. WTI oil prices lost nearly 3.5%, falling to 63.4 USD/barrel, while Brent oil also fell more than 3% to 67.9 USD/barrel. Positive signals about supply appeared over the weekend, stopping the previous 4 consecutive sessions of increase.

OPEC+ is likely to stick to its plan to increase production by 137,000 barrels per day in November, after a meeting of eight key member countries scheduled for October 5, OPEC+ said. The move is aimed at expanding market share and responding to pressure from the US to increase supply and cool oil prices. Since April, OPEC+ has raised its total production quota by more than 2.5 million barrels per day, equivalent to about 2.4% of global demand, completing the reversal of the 2.2 million barrel/day cut and starting to reverse the second cut of 1.65 million barrels per day in October.

The downward pressure on prices also comes from Iraq - the world's second largest crude oil producer. On September 27, the Iraqi Oil Ministry announced that it had resumed oil exports from the autonomous Kurdish region in the north to Turkey, after more than two and a half years of interruption. The new agreement between the Baghdad government, the autonomous Kurdish region and foreign companies is expected to increase the transport capacity to 150,000-160,000 barrels/day via Ceyhan port and possibly reach a maximum of 230,000 barrels/day in the near future.

In contrast to crude oil, natural gas in the US continued to buck the trend. At the close of the session, natural gas prices on the NYMEX increased by nearly 1.9% to $3.27/MMBtu. The main driver came from forecasts of hot weather returning, increasing demand for electricity and fuel for power plants. In addition, BloombergNEF data showed that US natural gas exports have increased sharply recently, contributing to the price increase during the session.

COMEX copper rises for second straight session

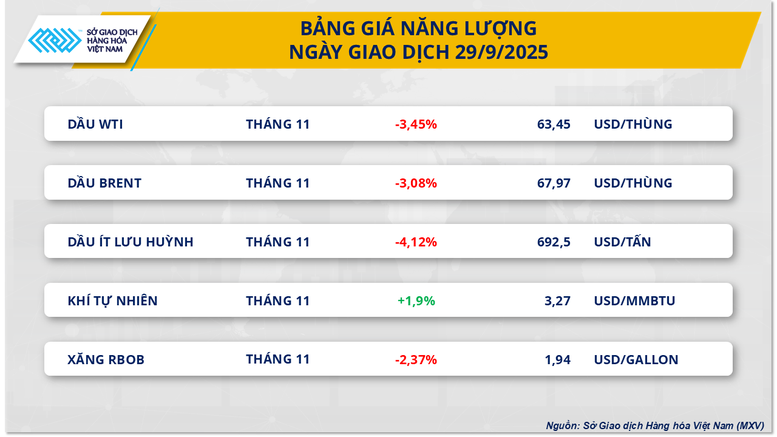

Contrary to the general trend in the commodity market, buying power continued to dominate the metal group when 8/10 items increased in price in the first session of the week. Notably, the price of COMEX copper contract jumped 2.53% to 10,785 USD/ton - the highest level in the past two months.

According to MXV, the increase in copper prices was significantly supported by two main factors. First, the USD index continued to weaken by 0.25% to 97.91 points, making USD-denominated commodities, including copper, more attractive to investors holding other currencies. Second, the supply disruption at the Grasberg mine (Indonesia) - the world's second largest copper mine - has not been resolved. After the incident earlier this month, Freeport Indonesia and the government of this country decided to temporarily suspend mining to focus on rescue, putting global output under great pressure.

According to Goldman Sachs, the incident could reduce copper production by 160,000 tonnes in the second half of 2025 and by another 200,000 tonnes in 2026, shifting the 2025 supply-demand balance from a surplus of 105,000 tonnes to a deficit of 55,500 tonnes. BMI also raised its forecast for a global supply deficit in 2026 to 400,000 tonnes, while Citi warned of a further shortfall of around 350,000 tonnes in 2027. These figures suggest the market balance is gradually tilting towards a deficit in the medium term.

On the other hand, China – the world’s largest copper consumer – is showing signs of limiting the expansion of refining capacity. The main reason is that the ore processing fee (TC/RC) has dropped to a record low, forcing many factories to sign contracts with fees close to 0 USD/ton to maintain supply. This move may weaken demand for raw copper ore in the short term, somewhat restraining the price increase. However, the industry’s failure to expand capacity also poses a risk of a shortage of refined copper in the next few years, especially when the demand for this metal in the production of electric vehicles and the power grid system in China is still growing rapidly.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-chung-lai-sau-chuoi-5-phien-khoi-sac-102250930094658958.htm

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)