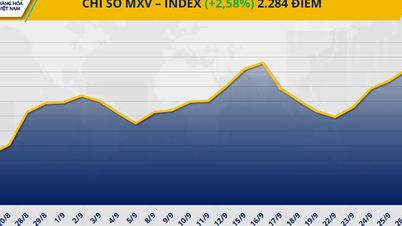

Closing on September 30, the MXV-Index decreased another 0.86% to 2,259 points.

The market for industrial raw materials fluctuates. Source: MXV

According to the Vietnam Commodity Exchange (MXV), the industrial raw materials market recorded relatively mixed developments.

Notable among them was cocoa, which recorded a decrease of 3.65% to 6,749 USD/ton - the lowest level in the past 11 months.

According to MXV, the pressure is mainly coming from the expectation of improved supply in Ivory Coast - the world's largest cocoa exporter. Above-average rainfall in the past week is raising hopes of a longer harvest season, with abundant and higher-quality output early next year. This prospect is enough to pull the market away from the severe shortage scenario that haunted the market throughout 2024.

After seven consecutive weeks of pressure, high prices and heavy tariffs are causing a sharp decline in global purchasing power, pushing the chocolate industry into a difficult period.

Crude oil prices fell to a three-week low. Source: MXV

The energy group also saw overwhelming selling pressure across most of the key commodities in the group.

Notably, the prices of both crude oil products have fallen to their lowest levels in about 3 weeks. Specifically, Brent oil price stopped at 67.02 USD/barrel, corresponding to a decrease of about 1.4%; meanwhile, WTI oil price also recorded a decrease of about 1.7%, falling to 62.37 USD/barrel.

Behind this weakness is a combination of many resistances, including expectations of OPEC+ production expansion, the return of Iraqi supply, new record US oil production and more signs of persistent oversupply.

The market’s focus is now on OPEC+’s November production decision. Although the group has dismissed rumors of a 500,000 bpd increase, the possibility of an increase in the 137,000-400,000 bpd range is still present.

Source: https://hanoimoi.vn/gia-ca-cao-cham-day-dau-tho-doi-dien-ap-luc-du-cung-717967.html

Comment (0)