USD exchange rate today 7/12/2025

At the time of survey at 4:30 a.m. on July 12, the central exchange rate at the State Bank was currently 25,128 VND/USD, down 3 VND compared to yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,900 - 26,290 VND/USD, unchanged in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,740 VND

VRB Bank is buying USD transfers at the lowest price: 1 USD = 25,880 VND

PGBank is buying USD cash at the highest price: 1 USD = 26,000 VND

OCB Bank is buying USD transfers at the highest price: 1 USD = 26,010 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,234 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,234 VND

SCB Bank is selling USD cash at the highest price: 1 USD = 26,370 VND

SCB Bank is selling USD transfers at the highest price: 1 USD = 26,370 VND

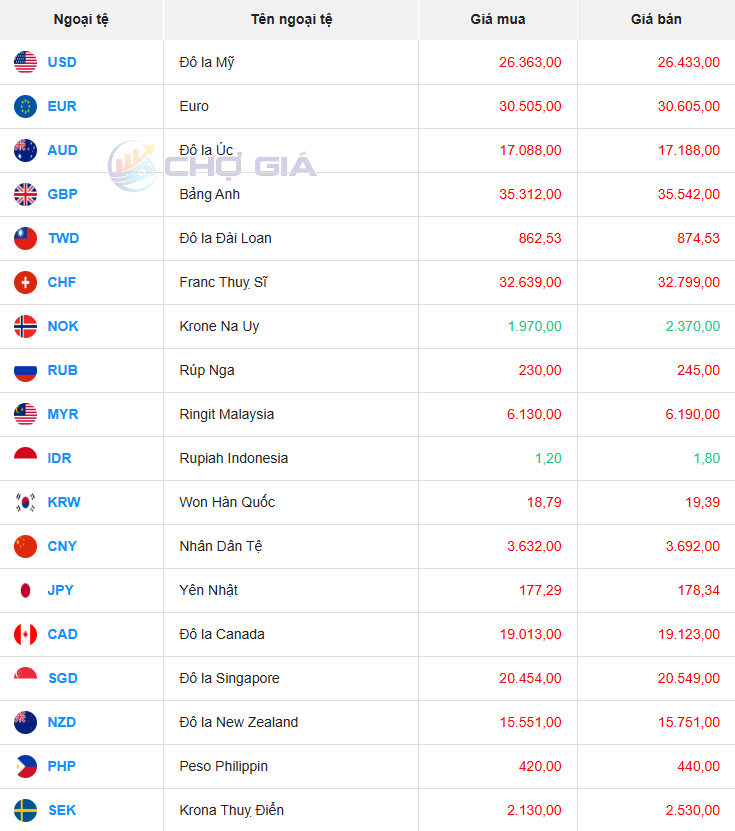

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 11, 2025 increased by 2 VND in buying and decreased by 28 VND in selling, compared to yesterday's trading session, trading around 26,363 - 26,433 VND/USD.

USD exchange rate today July 12, 2025 on the world market

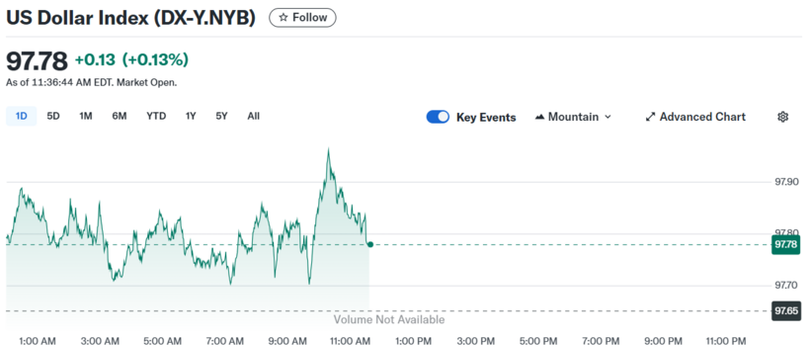

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.78 - down 0.01 points compared to July 11, 2025.

By the end of the first quarter of 2025, the USD recorded a nearly 4% depreciation due to many major policy changes from the Donald Trump administration, especially on trade, security and economy, which have shaken market confidence in the world's leading reserve currency.

The decline accelerated significantly in the second quarter, when the dollar fell more than 7% after Mr. Trump introduced sweeping tariffs in early April. That helped the safe-haven Swiss franc become one of the best-performing currencies this year, rising 14% against the dollar.

According to IMF data, the share of global currency reserves in the USD reported to the IMF fell to 57.7% in the first quarter of 2025 while the share of reserves in the euro increased from 19.8% to 20.1%, the highest level since the end of 2022.

Mr Trump singled out several countries over trade, a day after he told 14 countries they would face higher tariffs from a new deadline of 1 August.

The pound has been one of the main beneficiaries of the dollar sell-off on expectations that a global trade war could also hurt the US economy. Britain was also the first economy to sign a trade deal with the US, making it less likely to face new tariffs, analysts say.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-1272025-dong-usd-giu-vung-vi-the-post291569.html

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)