USD exchange rate today (June 26): Early morning of June 26, the State Bank announced the central exchange rate of Vietnamese Dong to USD is currently at: 23,732 VND.

The USD Index (DXY), which measures the greenback's performance against a basket of six major currencies, currently stands at 102.87.

Forecast of USD trend this week

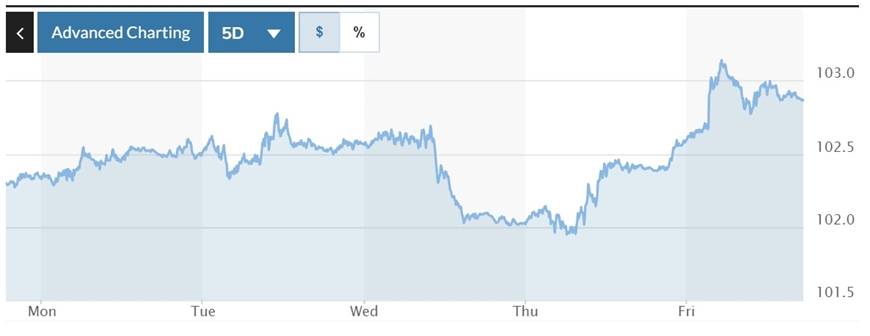

The DXY index may remain within a certain range, before data on the US Personal Consumption Expenditures (PCE) Index - the US Federal Reserve's inflation measure - is released on June 30.

|

| DXY Index volatility chart over the past week. Photo: Marketwatch. |

During his testimony before the US Congress earlier this week, Fed Chairman Jerome Powell reiterated the central bank’s “hawkish” stance on interest rate policy in the coming period. He also emphasized that, although inflation is still far from the Fed’s target, the Fed may still need to raise interest rates further but at a “more cautious pace”.

The core PCE price index in May is forecast to remain unchanged at 4.7% year-on-year, while the PCE price index is expected to decline from 4.4% in April to 3.8% in May.

Over the past week, the DXY Index has held well above the key support level of 102, trading in a range of 102-103. Any break above the resistance level at 102.50-103.25 could establish an uptrend for the greenback. Conversely, if the index falls below 102, it could fall straight to the 101-100.50 region in the coming days, establishing a short-term bearish trend.

Elsewhere, the Euro saw a slight decline last week, falling below the key 1.09 level, but still holding firm in the 1.0870-1.0850 support zone. If the currency can hold well in this support zone, the short-term outlook will be bullish, even aiming for the 1.11-1.1135 target in the coming weeks.

|

| USD exchange rate today June 26: USD needs more momentum to maintain its upward momentum. Illustration photo: Reuters. |

Domestic USD exchange rate today

In the domestic market, at the end of the trading session on June 23, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD unchanged, currently at: 23,732 VND.

* The reference exchange rate at the State Bank's buying and selling exchange center remains unchanged, currently at: 23,400 VND - 24,868 VND.

USD exchange rates at commercial banks for buying and selling are as follows:

USD exchange rate | Buy | Sell out |

23.30 VND | 23,690 VND | |

23,315 VND | 23,735 VND | |

BIDV | 23,371 VND | 23,671 VND |

* The Euro exchange rate at the State Bank's buying and selling exchange center decreased slightly to: 24,698 VND - 27,298 VND.

Euro exchange rates at commercial banks for buying and selling are as follows:

Euro exchange rate | Buy | Sell out |

Vietcombank | 25,154 VND | 26,297 VND |

Vietinbank | 24,762 VND | 26,052 VND |

BIDV | 25,279 VND | 26,419 VND |

MINH ANH

Source

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)