From BlackRock's decision to close its fund: "Vietnam cannot remain a frontier market forever"

iShares MSCI Frontier and Select EM ETF - a large fund investing in frontier and emerging markets - is expected to close on May 31, 2025. Experts from SSI assess that the above move will not have much impact, but shows that the story of upgrading is becoming more urgent.

Recently, BlackRock Asset Management Group announced the dissolution of the iShares MSCI Frontier and Select EM ETF - an ETF specializing in investing in frontier and emerging markets established in 2012. The fund is expected to hold the majority of its assets in cash and cash equivalents during the extended liquidation period. The closing date is no earlier than August 12, 2024. Currently, the above ETF is expected to stop trading, and at the same time, no longer accept creation and redemption orders after the market closes on March 31, 2025.

“During the liquidation period, the iShares MSCI Frontier and Select EM ETF will no longer be managed in accordance with its investment objective and policies as the fund will sell off its assets. The proceeds from the liquidation are expected to be distributed to shareholders approximately three days after the last trading day,” said a statement from BlackRock Asset Management Group.

According to the update to June 11, the total net asset value (NAV) of the fund reached 400.6 million USD. The leading asset portfolio of iShares MSCI Frontier and Select EM ETF at the present time is cash in VND (more than 62 million USD), equivalent to 15.94% NAV. Recently, the fund has actively sold Vietnamese stocks to collect money. Not only in the Vietnamese market, the proportion of cash and derivatives in this ETF portfolio has increased to 47.11%.

The value of the Vietnamese stock portfolio as of June 11 decreased to 14.59%, equivalent to about VND1,460 billion. The proportion of Vietnamese stocks continued to decrease rapidly compared to the previous session's level of 18%. Previously, Vietnam was often the market with the highest proportion in the portfolio of iShares MSCI Frontier and Select EM ETF. By the end of the first quarter of 2024, the proportion of Vietnamese stocks still accounted for 28.5% of the fund's NAV.

Commenting on the above movement, Mr. Pham Luu Hung - Chief Economist of SSI Securities said that in fact, the list of ETF funds closed by BlackRock is quite long. In the case of iShares MSCI Frontier and Select EM, according to Mr. Hung, the impact on the Vietnamese stock market is not much.

“With the fund’s portfolio size of 400 million USD, the proportion of Vietnamese stocks used to reach 28%, equivalent to about 120 million USD. The fund has sold a net of approximately 45 million USD. For the rest, I think this does not affect much. However, this shows us a longer story. That is, Vietnam cannot stay in a frontier market forever,” SSI’s chief economist emphasized.

|

| Mr. Pham Luu Hung - Chief Economist of SSI Securities |

iShares MSCI Frontier and Select EM ETF was originally named iShare MSCI Frontier Markets 100 ETF and referenced the MSCI Frontier Markets 100 Index. However, in March 2021, the fund changed its name and used the MSCI Frontier & Emerging Markets Select Index as a reference. According to Mr. Hung, the decision to add some stocks from emerging markets three years ago was also a solution that BlackRock implemented to increase attractiveness and attract more investors to buy fund certificates.

“One of the big funds in the frontier market has closed down, and if Vietnamese securities stay, they will not receive any benefits. Therefore, all parties need to be more proactive in the goal of upgrading the market,” Mr. Hung said.

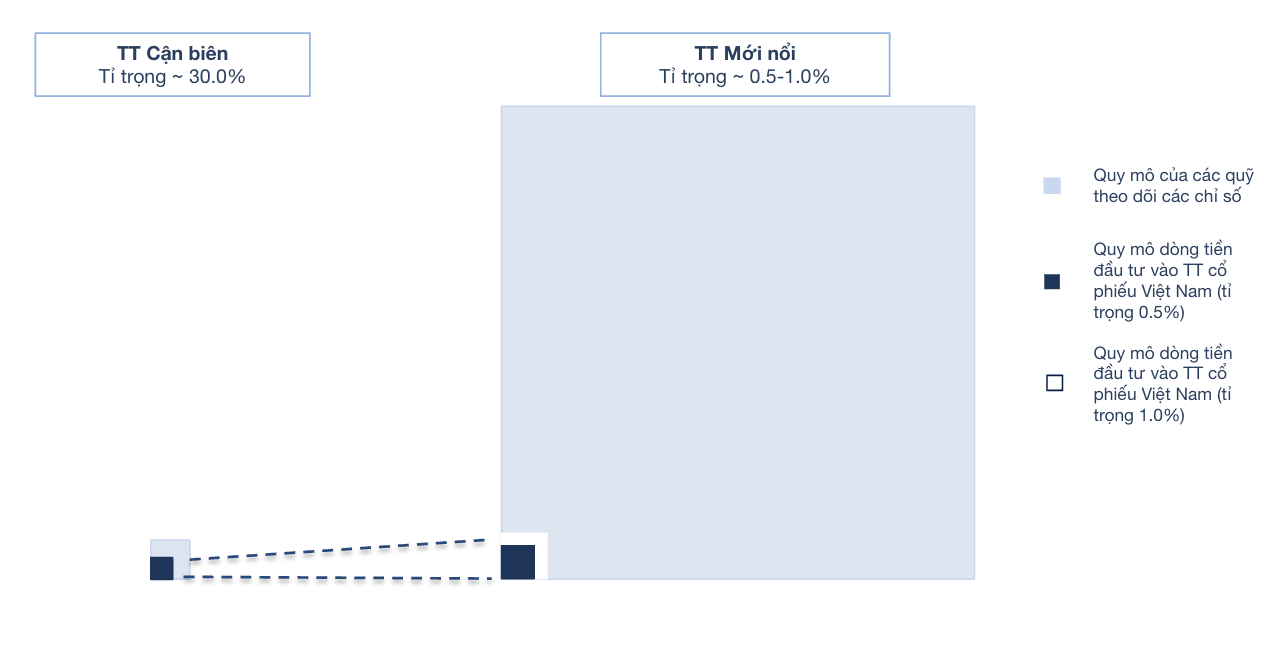

According to the World Bank's estimates, if MSCI and FTSE Russell upgrade Vietnam's stock market to emerging market status, it could attract about 25 billion USD in new investment capital from international investors to the Vietnamese market by 2030. If it moves to the frontier market group, the proportion of Vietnamese stocks may only account for 0.5% -1% of the entire index basket. However, in terms of absolute value, the scale of investment cash flow will be much larger.

|

| Comparison of Vietnam's proportion in the frontier market index and emerging market index - Source: WB |

The story of market upgrading is expected to be the highlight attracting capital flows from investors. Foreign capital has recorded a strong wave of net selling in the first months of the year. By the end of the session on June 12, the net selling value of foreign investors was approximately VND41,450 billion, nearly double the figure for the whole year of 2023 (more than VND22,000 billion).

Analyzing the reasons for foreign investors' net selling, Mr. Nguyen Ba Huy, CFA - Investment Director - SSI Fund Management Company Limited (SSIAM), assessed that one of the important selling forces came from the decision to take profits, especially with the group of foreign investors who made a profit in 2021. At the same time, the trend of net withdrawal of Thai capital in technical terms due to this country imposing personal income tax on foreign investments or concerns related to exchange rate issues... also affected the above capital flow.

According to Mr. Huy, foreign investors may continue to sell net. However, the current story of net selling from foreign investors mostly has a psychological impact. What the market needs to pay more attention to is domestic cash flow when the low interest rate environment is expected to stabilize in the next 6 months - 1 year. At the same time, foreign cash flow through domestic funds is also strong enough for the above sources to balance the cash flow.

Specifically, Vietnam has improved its transferability thanks to the increase in off-exchange transactions and in-kind transfers from regulatory changes. Thus, the Vietnamese stock market has only 8 criteria that have not been met, including foreign ownership limits, foreign room, equal rights for foreign investors, freedom of the foreign exchange market, investor registration & account establishment, market regulations, information flow and clearing.

Source: https://baodautu.vn/tu-quyet-dinh-dong-quy-cua-blackrock-viet-nam-khong-the-cu-mai-o-thi-truong-can-bien-d217540.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the inauguration ceremony of the Memorial Site of National Assembly Standing Committee Chairman Bui Bang Doan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/6feba23492d14b03b05445dd9f1dba88)

Comment (0)