Overcoming profit-taking pressure from foreign investors, the VN-Index increased by more than 26 points in the first session of the week (July 28), becoming the stock market with the strongest increase in Asia, right on the occasion of the 25th anniversary of the Vietnamese stock market officially coming into operation (July 28, 2000).

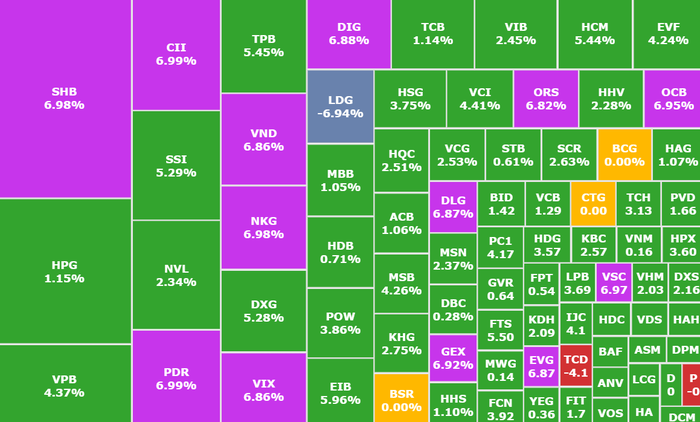

The market extended its "upward" streak with the 7th consecutive session of increase, VN-Index closed at 1,557.42 points, setting a new record here. HOSE had 258 stocks increasing in price (of which, 33 stocks "hit the ceiling"), 38 stocks moving sideways and 81 stocks decreasing in price (of which, 2 stocks "hit the floor").

In today's session, the VN30 index also had a positive performance when it increased by +26.3 points to 1,695.63 points. In the VN30 basket, the number of stocks increasing dominated with 26 stocks increasing while 1 stock kept the reference price and 3 stocks decreased.

Besides the index record, liquidity also reached a record level compared to the beginning of April, 41.7% higher than the average of 20 sessions, with more than VND 46,715 billion.

"Green" covers the entire market

Abundant cash flow helped "green" cover all industry groups with 18/21 industry groups increasing points. Leading the way was Securities (+6.19%), followed by Sugar (+3.15%) and Construction (+2.77%). On the other hand, plastics (-0.99%), consumer food (-0.06%) and retail (-0.04%) were the only three industry groups under pressure to adjust.

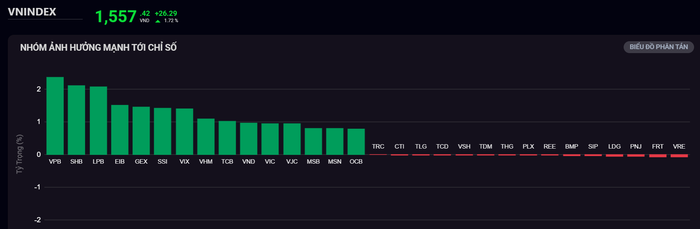

The stocks that strongly supported the index today were VPB (VPBank, HOSE) up 4.37%,SHB (SHB, HOSE) up 6.98%, LPB (LPBank, HOSE) up 3.69%, EIB (Eximbank, HOSE) up 5.96%, GEX (Gelex, HOSE) up 6.92%,...

Group of stocks strongly affecting VN-Index on July 28 (Screenshot: SSI iBoard)

On the contrary, stocks that decreased in today's session include: VRE (Vincom Retail, HOSE) down -0.51%, FRT (FPT Retail, HOSE) down 0.89%, PNJ (PNJ, HOSE) down 0.46%,...

In addition, at the Hanoi Stock Exchange, the two indices HNX-Index and UPCoM-Index also performed positively, reaching 263.79 points (+9.23) and 106.94 points (+1.17) respectively.

For foreign investors , this group of investors still maintained the "profit-taking" status when net selling 984 billion VND in the entire market today. Of which, on the HOSE floor, foreign investors net sold approximately 1,049 billion VND.

The focus was on HPG (Hoa Phat Steel, HOSE) when it was suddenly sold for 419 billion VND. Next was FPT (FPT, HOSE) with selling pressure of 150 billion VND.

In the opposite direction, SHB (SHB, HOSE) was bought the most with 335 billion VND. In addition, other codes such as VNM (Vinamilk, HOSE) and a series of bank stocks LPB (LPBank, HOSE), OCB (OCB, HOSE) and EIB (Eximbank, HOSE) were net bought from 44 billion to 75 billion VND.

According to experts, the developments in the Vietnamese stock market today show that a large amount of money is flowing into the market, the price increase and liquidity are in sync and support each other, this is a signal that the upward trend is likely to continue in the next session.

However, with the current strong and rapid increase in stock prices, chasing the stock will face the risk of correction when the stock has not yet reached the investor's account in the next sessions. Therefore, investors are advised to be cautious, limit chasing the stock, continue to maintain a higher cash ratio than stocks, and at the same time, carefully consider the strategy and stock selection between the strong price increase and the internal capacity of the enterprise.

Stocks enter an important week

Some information that investors should pay attention to this week in the Vietnamese and international stock markets: The US Federal Reserve's (Fed) monetary policy meeting, with the interest rate decision expected to be announced early Thursday morning (July 31); The US President's reciprocal tax (August 1), from 15% - 50% on imported goods from many countries; The overall picture of business results in the second quarter of 2025.

Source: https://phunuvietnam.vn/vn-index-bung-no-dip-sinh-nhat-25-tuoi-2025072818082432.htm

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)