The stock market continues to face pressure to adjust - Photo: QUANG DINH

At the end of the trading session on September 26, VN-Index decreased by more than 5 points, falling back to 1,660 points. Similarly, HNX-Index also decreased by 0.57%, while UPCom-Index remained green.

With total market liquidity of less than 30,000 billion VND, in general, active trading today was quite quiet, in which selling pressure dominated near the end of the session.

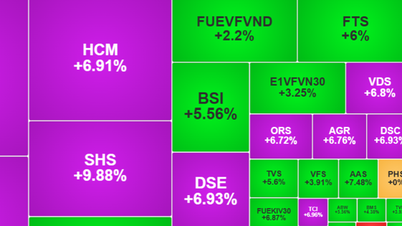

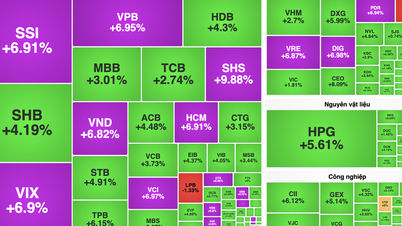

Red covered most of the market when 16/19 industry groups decreased points. Of which, the securities group was sold quite heavily, losing nearly 2.4% of the entire industry.

Many leading stocks have a decrease of over 2% such as SSI (-2.56%), SHS (-3.14%), VCI (-2.16%), VND (-2.41%), MBS (-2.99%), VIX (-3.36%)...

The banking group was also under pressure to adjust when it lost nearly 0.9%. Accordingly, HDB decreased nearly 2.8% in market value, while VPB (-1.78%), MBB (-1.13%), TPB (-3.09%), MSB (-1.5%)...

Although there was a time when the banking group recovered, helping the index increase slightly, increased selling pressure caused most stocks in this industry to sink into the red, except for a few that went against the trend such as CTG (+0.8%) or LPB (+0.21%).

The highlight of today's session came from mineral stocks, when a series of codes increased strongly, even "green and purple" with sudden liquidity, becoming the market leading group.

Along with that, the construction group continued to attract cash flow, with many codes increasing strongly in the morning session, then "cooling down" such as CII (+2.87%), HHV (+0.91%), CTI (+0.52%)...

Meanwhile, some stocks in the same industry such as VCG (-0.89%), LCG (-2.26%), FCN (-2.08%), DPG (-2.75%) turned around and made slight adjustments, accompanied by decreased liquidity.

In the real estate group, the differentiation is more obvious with relatively good growth momentum of VIC (+3.8%), KDH (+2.37%), HDG (+5.1%)..., the rest are under pressure to decrease points according to the general trend.

Other industry groups such as aviation, retail, and electrical equipment all decreased, but the decrease was not too strong.

In the whole market, there were more than 430 stocks decreasing in price, counterbalancing more than 300 stocks increasing. Foreign investors had a strong net selling session with a value of nearly 2,200 billion VND.

A series of securities stocks are in the "focus" of net selling by foreign investors such as SSI, VIX, SHS. In addition, this group increased sellingSHB , MSN, HPG...

Vingroup shares "save" stock index

Vingroup's VIC shares experienced two strong increases of +6.04% and +3.8% respectively. Thanks to that, the VN-Index's score slowed down its decline. At the same time, the market capitalization of this private corporation reached VND636,400 billion - a record number in the stock market.

At the same time, the assets of Mr. Pham Nhat Vuong - Chairman of Vingroup - also increased "dizzily". According to real-time data updates on Forbes , Mr. Vuong's assets have reached 15.7 billion USD.

Meanwhile, Ms. Pham Thu Huong - Mr. Vuong's wife - with 170.61 million VIC shares, is holding assets of nearly 28,000 billion VND - an increase of nearly 1,000 billion VND compared to yesterday.

Source: https://tuoitre.vn/vn-index-giam-diem-tai-san-vo-chong-ti-phu-giau-nhat-viet-nam-van-khong-ngung-tang-2025092615345212.htm

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)