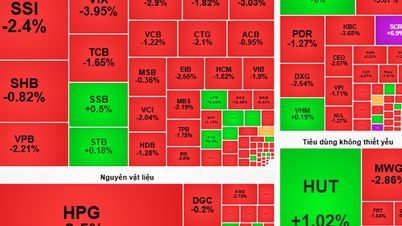

VN-Index fell 9.42 points to 1,240.41 points due to widespread selling pressure across many stock groups, while cash flow still chose to stay out and observe the market, and foreign investors net sold more than 650 billion VND.

VN-Index fell 9.42 points to 1,240.41 points due to widespread selling pressure across many stock groups, while cash flow still chose to stay out and observe the market, and foreign investors net sold more than 650 billion VND.

After yesterday's slight decline (December 3), some experts maintain the view that the market will continue its upward trend with slow movements in the process of accumulating demand and gradually shaking off selling pressure. Investors can consider increasing disbursement when the market shows clear signs of recovery accompanied by positive trading volume, focusing on long-term stocks with good fundamentals and business prospects.

However, the actual developments proved the opposite when VN-Index fell below the reference point right at the opening of the trading session on December 4 due to selling pressure from stock holders. The index representing the Ho Chi Minh City Stock Exchange plummeted in the middle of the afternoon session and at one point lost 11 points, down to nearly 1,239 points.

The decrease gradually narrowed before closing thanks to the appearance of cash flow disbursement at low prices. VN-Index closed the session at 1,240.41 points, losing 9.42 points compared to the reference and extending the decline for the second consecutive session.

Foreign investors contributed significantly to today's sharp decline with a net selling value of approximately VND651 billion. Specifically, this group sold more than 46 million shares, equivalent to VND1,684 billion, while only disbursing more than VND1,033 billion to buy about 29 million shares.

Foreign investors massively sold MWG shares with a net selling value of VND260 billion, followed byFPT with more than VND134 billion, VRE with nearly VND83 billion. On the other hand, foreign investors strongly bought HAH shares with a net value of VND72 billion. MSN ranked next with a net absorption of nearly VND66 billion, followed by ACV with more than VND60 billion.

Domestic investors' cash flow still chose to stay out and observe the market. Specifically, today's liquidity reached VND13,933 billion, down VND1,706 billion compared to yesterday's session. This value came from 575 million shares traded, down 98 million units recorded in the previous session. Large-cap stocks contributed more than VND6,175 billion to liquidity, equivalent to more than 171 million shares successfully traded.

FPT leads in terms of order matching value with nearly VND814 billion (equivalent to 5.6 million shares). This figure far exceeds the following stocks, MWG with approximately VND519 billion (equivalent to 8.9 million shares) and HPG with more than VND334 billion (equivalent to 12.5 million shares).

VN-Index was covered in red when 281 stocks decreased, while the number of stocks increased by only 109. The VN30 basket was strongly differentiated when the selling side dominated, leading to 25 stocks closing below the reference, 5 times the number of stocks closing in green.

Most banking stocks traded in negative territory. According to Mirae Asset, BID was the stock that weighed down the general index the most, falling 1.95% to VND45,150 and taking more than 1.2 points off the VN-Index. Next, CTG fell 1.67% to VND35,300, VPB fell 1.04% to VND19,000 and TCB fell 0.85% to VND23,450.

Red dominated Vingroup stocks as VHM, VIC and VRE all closed below reference. Of which, VHM decreased 1.96% to 40,100 VND, VIC decreased 0.99% to 40,000 VND and were both on the list of stocks with the most negative impact on VN-Index.

Similarly, the steel group also recorded a series of price reductions. Specifically, NKG decreased by 2.6% to 18,700 VND, HSG decreased by 2.1% to 18,250 VND, HPG decreased by 1.1% to 26,700 VND and TLH decreased by 0.7% to 4,300 VND.

On the other hand, VCB is a rare code in the banking group that closed above reference and topped the list of codes that positively impacted the market when it increased 0.54% to 93,500 VND.

Some positive market signals were recorded in the seaport group with two pillar stocks, HAH and GMD, also appearing in the above list. Specifically, HAH increased by 4.49% to VND50,000 and GMD increased by 1.09% to VND64,700.

Source: https://baodautu.vn/vn-index-mat-hon-9-diem-xuong-sat-1240-diem-d231690.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)