In the morning session of September 11, right from the opening minutes, selling pressure quickly pulled the VN-Index down below the reference. The VN-Index fell sharply, at one point down 36 points compared to the reference, red covered all industry groups.

By the end of the morning session, the VN-Index had somewhat reduced its losses. However, the market still closed the morning session in a negative state when the VN-Index fell 13.79 points to 1,629.47 points; the HNX-Index fell 4.47 points to 270.13 points.

In the afternoon session, the market reversed positively when pillar stocks pulled the VN-Index above the reference level and increased strongly.

At the end of the session, VN-Index increased by 14.49 points, equivalent to 0.88%, to 1,657.75 points. VN30-Index increased strongly by 26.45 points; HNX-Index decreased by 0.42 points; UPCoM-Index decreased by 5.99 points.

VN-Index fluctuated strongly in the trading session on September 11 (Screenshot).

In the whole market, the total value of matched transactions reached more than 36,600 billion VND. The board was strongly differentiated with 163 codes increasing, of which 12 codes increased to the ceiling price; 63 codes maintained the reference price and 152 codes decreased.

In particular, Vingroup family stocks VIC and VHM became the main pillars, helping VN-Index narrow the decline. On the contrary, the securities and banking groups put great pressure on the market with a series of stocks such asACB , VIX, TCB, MBB, VPB, MSB, VND...

Foreign investors net sold more than 1,000 billion VND today. Of which, SSI was the stock sold the most by foreign investors with a value of more than 245 billion VND, followed by MWG, MSB,SHB , VIX, MBB... On the contrary, foreign investors net bought stocks such as VHM, TCB, GEX, STB, HDG, TPB...

Source: https://dantri.com.vn/kinh-doanh/vn-index-quay-xe-ngoan-muc-ket-phien-xanh-ngat-20250911155816738.htm

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

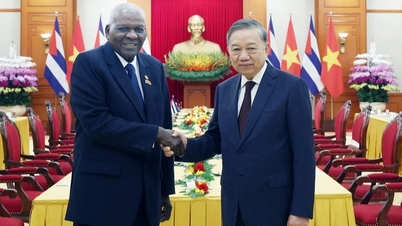

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)