At the end of the session on October 1, the VN-Index closed at 1,665 points, up slightly by 3 points (+0.20%).

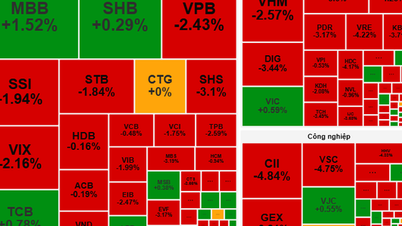

The VN-Index opened the morning of October 1 with a narrow increase. Banking and consumer stocks led the increase, attracting strong cash flow. Meanwhile, Vingroup (VIC, VHM) and some large-cap stocks such as BCM and GMD put downward pressure on the market. Notably, stocks in the securities (VIX, VND, HCM) and real estate (TCH, HHS, NVL) groups recorded a return of cash flow after strong selling pressure from previous sessions.

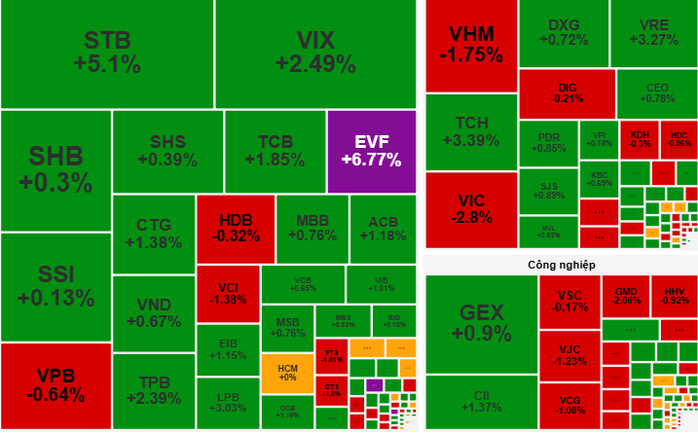

Entering the afternoon session, VN-Index continued to consolidate its upward momentum thanks to the green color from the banking group, with prominent codes such as STB (+5.1%), TCB (+1.85%) and LPB (+3.03%). However, the downward pressure from VIC and VHM somewhat restrained the market's upward momentum. The bright spot in the afternoon session was the cash flow into agricultural stocks, with HAG increasing by 3.68%, in addition to the persistence of securities and real estate codes.

At the end of the session, VN-Index closed at 1,665 points, up slightly by 3 points (+0.20%). Liquidity decreased sharply by 35% compared to the previous session, reaching over VND 21,000 billion. Foreign investors continued to sell strongly, focusing on codes such asFPT , VHM and MWG, with a total net selling value of over VND 1,651 billion.

According to VCBS Securities Company, the market is re-examining supply and demand in the 1,650-1,670 point range, with liquidity slightly decreasing compared to the same period last year, showing investor caution. Cash flow is currently clearly differentiated, focusing on groups of stocks with their own stories or expectations of positive third-quarter business results, such as banks, securities and retail.

"Investors can take advantage of corrections or fluctuations during the session to disburse, prioritizing stocks with prices significantly lower than their intrinsic value" - VCBS Securities Company recommends.

Some other securities companies forecast that the market on October 2 will continue to fluctuate in the range of 1,650-1,670 points. The fluctuations in the session will create opportunities for investors to restructure their stock portfolios. Cash flow may continue to diversify, pouring into industry groups with good fundamentals and positive business prospects. Investors need to closely monitor liquidity developments and foreign investors' movements to make appropriate decisions on buying and selling stocks.

Source: https://nld.com.vn/chung-khoan-ngay-2-10-tan-dung-nhip-rung-lac-de-giai-ngan-196251001165908362.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)