Tug of war around the resistance level of 1,700 points

The VN-Index is very close to the peak of 1,700 points. At the end of yesterday's session (September 4), the index reached 1,696.29 points with liquidity on the HoSE floor of nearly VND40,000 billion.

Many securities companies have commented that the index may fluctuate around the resistance level of 1,700 points today (September 5). Yuanta Vietnam Securities Company believes that the market will maintain its upward momentum and the VN-Index may retest the resistance level of 1,700 points.

At the same time, liquidity has shown signs of improvement, but the market is still likely to experience divergence as most of the cash flow is still concentrated in the mid- and small-cap groups.

In addition, the sentiment indicator continues to rise, indicating that investors are more optimistic about the current market performance. The short-term trend of the general market has been upgraded from bearish to neutral. Investors can gradually increase the proportion of the portfolio to 20-40% and buy new with a low proportion because the short-term risk remains high.

Sharing the same view,ACB Securities Company believes that VN-Index is expected to move towards the short-term peak around 1,700 points. However, the risk of a downward correction is still latent, especially when the market is already at a high price range. Investors should maintain caution and consider restructuring their portfolios to both seize opportunities and limit risks when the trend suddenly reverses.

Meanwhile, Saigon - Hanoi Securities Company (SHS) commented that the short-term trend of VN-Index is still growing above the nearest support around 1,680 points, maintaining the outstanding growth trend when surpassing the old peak of August.

However, short-term cash flow still shows quite good rotation. VN30 will similarly rotate well and surpass the old peak, heading towards the next psychological price zone of 1,900 points. Investors should maintain a reasonable proportion. Investment targets are aimed at codes with good fundamentals, leading in strategic industries, and outstanding growth of the economy .

The stock market is approaching the maturity date (Illustration: Huu Khoa).

The market faces a great opportunity, possibly attracting more than 10 billion USD in foreign capital when upgraded.

In a recently published report, HSBC said that Vietnamese securities will be considered by FTSE for upgrading from a frontier market to an emerging market in the annual index review on October 7.

Vietnam has met 7/9 necessary criteria, the remaining two criteria on settlement cycle and failed transaction costs have also made significant progress. The Securities Law, amended at the end of 2024, removed the margin requirement before buying stocks and added regulations on information disclosure in English. The KRX trading system, which has been operational since May, also helped to resolve order congestion and increase the ability to handle large transactions.

HSBC estimates that in an optimistic scenario, FTSE’s upgrade could help Vietnam’s stock market attract a maximum of $10.4 billion in foreign capital. However, the actual capital flow will be modest and distributed in stages. Because FTSE usually announces at least 6 months in advance when changing the classification of a market.

Overall, HSBC said that compared to previous cases, the Vietnamese stock market has recorded significant gains ahead of the review. The VN-Index has increased by 37% in the past 6 months and 40% since the beginning of the year, becoming one of the best performing markets in the world. The report said that the room for further gains after the upgrade will be limited.

Source: https://dantri.com.vn/kinh-doanh/vn-index-tien-sat-1700-diem-thi-truong-chung-khoan-dung-truoc-co-hoi-lon-20250905071505806.htm

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

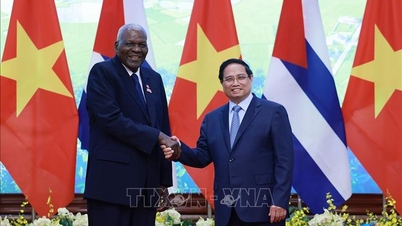

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)