World Bank experts forecast Vietnam's economic growth to reach 4.7% in 2023. Growth momentum will then recover to 5.5% in 2024 and 6% in 2025.

Economic growth Vietnam's economic growth, after reaching 8% in 2022, has slowed sharply in the first half of 2023, due to low external demand and weak domestic demand. However, the economy will accelerate again in the last months of the year and maintain it in the following years.

This is the assessment given by a World Bank representative at the press conference announcing the August Economic Report on August 10.

Demand is the main driver of growth

According to the report, Vietnam's GDP growth in the first half of the year reached only 3.7% (year-on-year) and was much lower than the 6.4% increase in the first 6 months of 2022.

Ms. Dorsati Madani, senior economist of the World Bank, said that the reason for this decline is the sharp decline in external demand. This is reflected in the export turnover falling by 12% compared to the same period. On that front, domestic demand has slowed down as the “low starting point” effect of the post-COVID-19 recovery phase has faded. Moreover, consumer confidence has also gradually weakened, reflected in the growth rate of spending down to 2.7% compared to the same period.

Stressing that the decline in aggregate demand was reflected in the manufacturing sector (aggregate supply), Ms. Dorsati cited the industrial sector, which recorded a 0.4 percentage point decline in its contribution to growth in the first half of the year. The impact of the “shock” in export demand was further exacerbated by the persistent power shortages that affected the North in May and June, disrupting economic activities with an estimated loss of 0.3% of GDP.

In addition, a survey of 10,000 businesses in the first four months of the year by the Private Economic Development Research Board (WB) also showed that 60% of businesses said that their revenue had decreased by at least 20%; 59% of businesses shared that orders had decreased, 71% had to cut at least 5% of their workforce. Evidence in the Southeast region - one of the key export areas, witnessed a surge of nearly 62% in the number of people approved to receive unemployment benefits in the second quarter.

“Despite slowing demand, this will remain the main driver of growth in 2023. Private consumption is expected to hold steady at 6% (y/y) and contribute 3.4 percentage points to GDP growth,” said Ms. Dorsati.

On that basis, World Bank experts forecast that Vietnam's economic growth will reach 4.7% in 2023. After that, the growth momentum will recover to 5.5% in 2024 and 6% in 2025.

In addition, the CPI is expected to increase slightly from an average of 3.1% in 2022 to an average of 3.5% in 2023. This is due to the slowdown in growth and the policy of reducing the value added tax rate from 10% to 8% implemented in the second half of the year. Accordingly, CPI inflation will continue to stabilize at 3% in 2024 and 2025 (based on expectations of stable energy and commodity prices).

Increased domestic and foreign risks

Looking ahead, the World Bank report said Vietnam will face risks both domestically and internationally. In general, developed economies and China will grow at a lower rate than expected and continue to reduce demand for Vietnam's export sector.

Furthermore, the prolonged uncertainties in financial markets are likely to exacerbate tensions in the global banking sector. Given these perceptions, investors are likely to adopt a risk-averse mindset and discourage investment (including FDI in Vietnam). On the other hand, escalating geopolitical tensions and natural disasters could increase risks for Vietnam (including through escalating food and fuel prices).

Domestically, the financial sector is facing growing risks and vulnerabilities, requiring close monitoring and innovation.

According to Ms. Carolyn Turk, Country Director of the World Bank in Vietnam, the domestic economy is facing challenges from both inside and outside. Therefore, to promote economic growth, the Government can support aggregate demand through effective public investment, thereby creating jobs and stimulating economic activity.

“In addition to short-term support measures, the Government should not neglect structural institutional reforms, including in the energy and banking sectors, as these are imperative for long-term growth,” said Carolyn Turk.

Regarding policy recommendations, World Bank experts believe that there is still ample fiscal space, so it is necessary to play a leading role and ensure that the investment budget for 2023 is significantly better implemented. In addition, the planned public investment budget, if fully implemented, will raise public investment to 7% of GDP in 2023, creating a fiscal impulse to support aggregate demand at 0.4% of GDP.

In addition to public investment, support policies need to focus on workers and households affected by economic slowdowns, through improving the efficiency of the social security system, which is also a way to support aggregate demand.

To do that, Ms. Carolyn said that the authorities need to improve the approach to selecting subjects and the mechanism for providing support in the social security system, becoming a flexible tool to support vulnerable people when facing economic shocks.

In addition, experts recommend that fiscal policy support should be implemented in parallel with monetary policy easing, but it should be noted that there is not much room for further easing. Currently, credit demand is low despite the reduction in interest rates. Therefore, further interest rate cuts may not bring about the desired effect of promoting credit growth. In addition, interest rate cuts will increase the interest rate differential with global markets, potentially putting pressure on exchange rates.

To help improve productivity and sustainability for economic growth, World Bank experts believe that Vietnam needs to continue reforming, reducing the burden of administrative regulations for businesses. And, re-implementing state-owned enterprise reform to create a catalyst to attract the participation of the private sector.

“Promoting financial inclusion is a way to empower individuals and businesses to participate more fully in economic activities, thereby increasing their contributions to sustainable growth. In addition, improving the resilience of export commodities in the medium term will help mitigate risks related to external shocks. Diversifying export commodities and destinations is a way to reduce dependence on specific markets and products, improving the economy's resilience to global economic fluctuations,” the World Bank representative emphasized./.

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

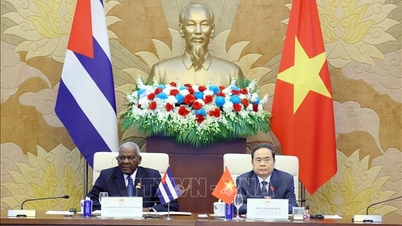

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)