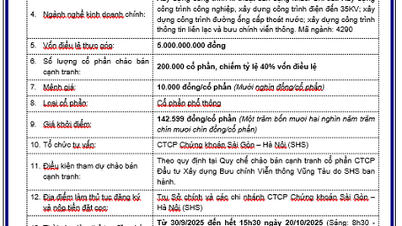

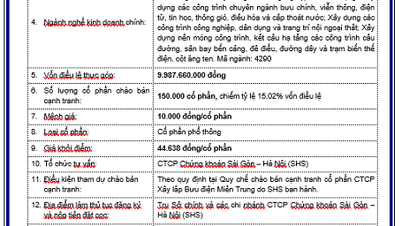

Increase revenue from concessional capital

Implementing the direction of the Vietnam Bank for Social Policies, in recent times, the Bac Ninh Branch of the Vietnam Bank for Social Policies has promoted the disbursement of loan capital to the right subjects and in accordance with regulations. This capital comes from the National Fund for Employment and the local budget, which is allocated annually. The maximum loan amount is 100 million VND for individual workers and 2 billion VND/project for production and business establishments; the loan term is up to 120 months with a preferential interest rate of 7.92%/year (equivalent to the loan amount for near-poor households).

|

Ms. Vi Thi Manh (right) , Nung ethnic group, Bien Dong commune, received support in borrowing capital to build an economic model and escape poverty. |

According to Mr. Do Van Hien, Acting Director of the Provincial Social Policy Bank Branch, as of July 2025, the total outstanding loan balance for job creation in the whole province reached 3,850 billion VND for more than 55,500 customers. From preferential loans, many cooperatives, small businesses and households have effectively developed production, increased income, and created stable jobs for workers.

| As of July 2025, the total outstanding loan balance for job creation in the whole province reached 3,850 billion VND for more than 55,500 customers. |

A typical example is Mr. Dam Gia, Director of Dam Gia Garment Joint Stock Company (Son Dong Commune), who used to work for many places but encountered difficulties due to lack of capital. At the end of 2020, he decided to start a business in his hometown and borrowed 100 million VND from the Transaction Office of Son Dong Social Policy Bank. Thanks to timely capital, his company has expanded production, built 3 facilities with more than 100 workers, mainly poor, near-poor, ethnic minorities, with a stable income of 6-10 million VND/person/month.

Last year, Mr. Nguyen Van Nam, a member of the Chu Nam The Noodle Production and Consumption Cooperative (Nam Duong Commune), received a loan of VND80 million to expand its scale. Currently, his family operates a rice noodle production line, creating jobs for 7 workers, selling about 6 tons of noodles to the market each month, with a net profit of nearly VND40 million.

In reality, capital is mainly used for start-up models, high-tech agricultural production and craft village products. Many customers have risen to build product brands and have a foothold in the market, such as: Minh Phuong Production and Service Cooperative, Canh Thuy Ward with the product "Yen Dung fragrant rice" certified with 3-star OCOP, is cooperating with people to produce over 8,000 hectares of quality rice. Or Thao Moc Linh Cooperative (Tay Yen Tu Commune) produces lim mushrooms, leaf yeast wine, dried bamboo shoots, etc. These cooperatives all bring in billions of VND in revenue each year, creating stable jobs for 8-10 workers with salaries from 6-10 million VND/person/month.

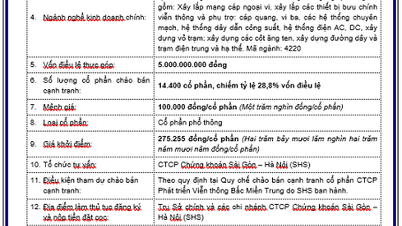

Fast disbursement, right target

Identifying the loan program to support job creation as one of the key tasks, the Provincial Social Policy Bank Branch and transaction offices have proactively coordinated with local authorities to ensure quick and correct disbursement. Currently, the whole province has 18 units at the transaction office level, 5,116 savings and loan groups operating effectively. Of which, the old Bac Ninh has 8 transaction offices with 2,012 groups, and the old Bac Giang has 10 offices with 3,104 savings and loan groups.

|

Staff of Son Dong Policy Bank Transaction Office disburse loans to people. |

During the implementation process, many localities have had effective ways through associations and organizations such as the Women's Union, Youth Union, Farmers' Association with a team of responsible village and residential group cadres who have been entrusted to act as a "bridge" to bring capital to those in need. According to comrade Do Van Hien, Acting Director of the Provincial Social Policy Bank Branch, the whole province currently has 18 transaction offices and 5,116 savings and loan groups operating effectively. Specifically, Bac Ninh Branch (before the merger) has 8 transaction offices with 2,012 savings and loan groups; Bac Giang Branch has 10 transaction offices, managing 3,104 savings and loan groups.

At the Transaction Office of the Son Dong Social Policy Bank, after receiving the registration of needs from the commune, bank staff will go to the place to carefully evaluate each project. Only workers with feasible business plans that can create more jobs for others will be disbursed. In addition, the Social Policy Bank also combines capital disbursement with training, coaching on entrepreneurship, agricultural production techniques, crop and livestock care... to help people improve their capacity and efficiency in using loans.

As one of the units operating effectively, up to now, Tien Du Social Policy Bank Transaction Office is managing outstanding debt of 258 billion VND with 3,703 customers with outstanding debt. Lending activities are implemented synchronously with consulting and guiding people on management skills, using capital for the right purpose and effectively. Savings and loan groups in villages and residential groups regularly monitor and remind borrowers to fulfill their obligations to pay interest and principal on time, and coordinate to collect loans at regular maturity. Through actual inspection, most customers use capital for the right purpose, promoting clear efficiency in production and business. Thanks to that, many localities do not have overdue debt, contributing to improving the quality of policy credit and creating solid trust in the community.

Although the program has achieved many positive results, the current capital source is still limited compared to actual needs. Many households, especially those affected by the pandemic, wish to borrow more to invest in machinery, expand production, and create long-term jobs. The leader of the Provincial Social Policy Bank Branch said that in the coming time, the unit will continue to promote propaganda about loan policies, while strictly controlling outstanding debt and recovering capital on time to effectively rotate capital. Along with that, the bank will coordinate with relevant departments and branches to advise on developing a project to allocate local budget capital entrusted through the social policy bank system to implement the Project "Lending to support job creation, maintaining and expanding employment in the province in the period 2026-2030".

According to current guidelines, the time for loan application appraisal and processing is 10 working days. In the coming time, the Branch and transaction offices will promote technology application, digital transformation, and make efforts to shorten the appraisal process, check disbursement documents, help people access capital early, create more opportunities for economic development and improve the quality of life.

Source: https://baobacninhtv.vn/bac-ninh-tao-viec-lam-tang-thu-nhap-tu-von-uu-dai-postid421215.bbg

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] General Secretary To Lam receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/3814a68959e848f586178624b6bd66e5)

Comment (0)