Dr. Nguyen Ngoc Tuan - lecturer of orthopedic trauma department, Pham Ngoc Thach University of Medicine

The discussion "Stories behind insurance contracts" took place today, August 7, at the Tuoi Tre newspaper office, co-organized by the Vietnam Insurance Association.

Insurance contracts must be easier to understand, so that customers do not lose their benefits.

At the program, Dr. Nguyen Ngoc Tuan - lecturer of the Department of Orthopedics, Pham Ngoc Thach University of Medicine, said a worrying fact is that many customers are denied compensation payments due to "dishonest declaration".

However, this error often does not come from intentional fraud, but from people not understanding the medical terminology in life insurance contracts.

"I once met a patient who had taken mild allergy medication, but when declaring the illness, he could not remember the name of the illness, or did not think it was a serious illness. This led to a dispute when he did not declare it when buying insurance," said Dr. Tuan.

Therefore, medical experts recommend that life insurance contracts should be interpreted in more common language, and consultants must have thorough knowledge to guide customers to make accurate declarations.

Most importantly, it is necessary to have a full health check before signing the contract to reduce the risk of future disputes.

In addition, Dr. Tuan also recommends that patients and their relatives should learn and arrange to resolve insurance claim procedures as soon as they begin treatment, to avoid the situation of missing documents because the hospital cannot reissue them after a long time.

Mr. Ngo Trung Dung - Deputy General Secretary of the Vietnam Insurance Association - also acknowledged that life insurance contracts are highly complex because they are related to finance, health and investment.

Therefore, in recent times, many businesses have also sought to simplify and publicize information on digital platforms for customers to easily access. Clearly stating terms also helps limit risks for parties when unexpected disputes arise.

At the same time, many businesses are also applying artificial intelligence (AI) and big data to shorten the payment process, even processing records within just one day. Some products also integrate health consulting functions, acting as a "virtual doctor" in addition to the main insurance benefits.

When buying insurance, you need to understand your obligations from the beginning.

Life insurance promotes humanistic values when it is consulted transparently, purchased according to needs and paid compensation quickly - Photo: HUU HANH

Mr. Ngo Trung Dung recommends that people need to carefully understand both their rights and obligations before signing a life insurance contract. "Like any other civil agreement, insurance is a contract. The buyer has rights but also obligations, and needs to understand this clearly from the beginning," Mr. Dung said.

At the seminar, the Vietnam Insurance Association also emphasized some basic rights for customers to pay attention to.

Accordingly, customers have the right to consider within 21 days from the date of signing the life insurance contract, if they do not want to continue, they can cancel and receive a full refund of the premium paid. Along with that is the right to clearly explain the terms, especially the exclusions, the cases where the insurance company will not pay.

Regarding obligations, participants need to read the contract carefully, not "buy it and put it in the closet". At the same time, be honest in declaring health status.

Regarding concerns about the lack of transparency in consulting by some life insurance agents, Mr. Dung said that legal regulations are now more stringent and complete than before. "The problem is no longer a lack of regulations but how to comply properly, standardize the profession and take advantage of technology to make the entire market transparent," Mr. Dung said.

Accordingly, the Vietnam Insurance Association is closely coordinating with businesses to improve consulting ethics and strictly control sales activities to better protect consumers.

Accompanying patients , not letting consultants "disappear"

Dr. Nguyen Ngoc Tuan believes that insurance is not just a signed contract but a long-term companionship process. Therefore, the role of a consultant cannot end immediately after selling the product.

"There are cases where after a few years, the consultant quits the job and the customer doesn't know who to contact for support. This breaks trust and leaves the customer abandoned halfway," Mr. Tuan stated the reality.

Therefore, businesses need to have a thoughtful care system after customers have signed a life insurance contract. If a consultant leaves, there must be a replacement quickly to continue supporting customers and resolve compensation rights quickly. Do not leave customers alone when they need support.

Source: https://tuoitre.vn/ban-bao-hiem-khi-khach-hang-can-phai-co-mat-chu-khong-mat-hut-20250807140625928.htm

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

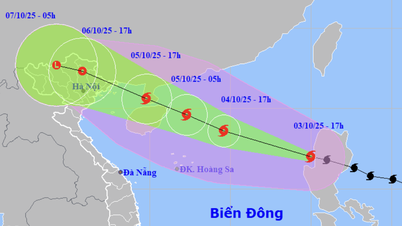

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)