Wages increased by more than 20%

According to Decree 204/2004/ND-CP, salaries of cadres, civil servants, public employees and armed forces are calculated by multiplying the basic salary by the salary coefficient.

In which, the salary coefficient is calculated according to the principle that the cadres, civil servants and public employees appointed to a civil servant or public employee rank or to a professional or technical title will have their salary ranked according to that rank or title.

The basic salary applied before July 1 was 1.49 million VND/month. From July 1 onwards, the basic salary increased to 1.8 million VND/month, 20.8% higher than the old basic salary.

With this increase in basic salary, the salaries of cadres, civil servants, public employees and armed forces will also change by an additional 20.8%.

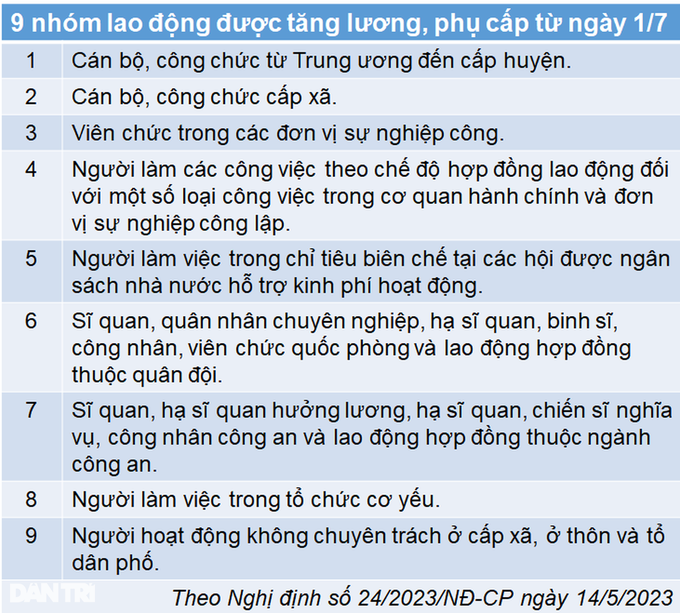

9 groups of workers will have their salaries increased from July 1 (Photo: Tung Nguyen).

A series of allowances increased accordingly.

In addition to salaries, public sector workers also have their real income increased when a series of allowances in addition to basic salaries are increased according to the new basic salary level.

The first is the seniority allowance beyond the framework. Depending on the position and seniority, this allowance is calculated as a percentage of the salary of the last salary level in the scale. When the monthly salary increases according to the basic salary, this allowance will also increase.

The second is the allowance for holding a concurrent leadership position. The allowance is equal to 10% of the current salary plus the leadership position allowance and seniority allowance (if any). When salaries, seniority allowances, etc. increase, the allowance for holding a concurrent leadership position also increases.

Third is the regional allowance applied to people working in remote, isolated areas and in bad climates. The allowance consists of 7 levels (0.1; 0.2; 0.3; 0.4; 0.5; 0.7 and 1.0) compared to the basic salary. When the basic salary increases, the actual amount of this allowance will also increase.

Fourth, there is a special allowance applied to people working on islands far from the mainland and in border areas with particularly difficult living conditions. The allowance includes 3 levels as follows: 30%; 50% and 100% of the current salary plus leadership position allowance and seniority allowance (if any)... When salary and position and seniority allowances increase, the special allowance will also increase.

The fifth is the attraction allowance applied to cadres, civil servants and public employees working in new economic zones, economic establishments and islands far from the mainland with particularly difficult living conditions. The allowance includes 4 levels as follows: 20%; 30%; 50% and 70% of the current salary plus the leadership position allowance and seniority allowance (if any). When the salary and position and seniority allowances increase, the special allowance will also increase.

The sixth is the mobility allowance applied to cadres, civil servants and public employees working in certain occupations or jobs that frequently change their workplace and residence. The allowance includes 3 levels (0.2; 0.4 and 0.6 compared to the basic salary). When the basic salary increases, the actual amount of this allowance will also increase.

The 7th is the toxic and dangerous allowance applied to cadres, civil servants and public employees working in occupations or jobs with toxic and dangerous working conditions and especially toxic and dangerous working conditions not yet specified in the salary level. The allowance consists of 4 levels (0.1; 0.2; 0.3 and 0.4 compared to the basic salary level).

The 8th is the specific allowance regime according to the profession or job, including: seniority allowance, preferential allowance according to the profession, responsibility allowance according to the profession, job responsibility allowance... Depending on the prescribed position, different allowance levels are enjoyed based on the basic salary.

Income of state-owned workers improved from July 1 (Photo: QA).

Many subsidies increased

In addition to increased monthly income thanks to increased wages and allowances, workers also benefit from a series of social insurance subsidies that also increase according to the new basic salary applied from July 1.

The first is the level of health care and recovery benefits after illness. This benefit is calculated daily, one day is equal to 30% of the basic salary. When the basic salary increases, the level of health care and recovery benefits after illness will increase from 447,000 VND/day to 540,000 VND/day.

The second is a one-time allowance for giving birth or adopting a child. When the basic salary increases, this allowance will increase from 2.98 million VND per child to 3.6 million VND per child.

Third is the level of health care and recovery after maternity leave. From July 1, this benefit level will increase from 447,000 VND/day to 540,000 VND/day.

Fourth is a one-time subsidy for work-related accidents and occupational diseases. When the basic salary increases, employees will receive the lowest one-time subsidy (when their working capacity is reduced by 5%) of 9 million VND, then for every additional 1% reduction in working capacity, they will receive an additional 900,000 VND.

The fifth is the monthly allowance for occupational accidents (TNLĐ) and occupational diseases (BNN). From July 1, employees will receive the lowest monthly allowance (when their working capacity is reduced by 31%) of 540,000 VND/month, then for each additional 1% reduction in working capacity, they will receive an additional 36,000 VND/month.

The fifth is the allowance for people with occupational accidents and diseases. When the basic salary increases, this allowance will increase from 1.49 million VND/month to 1.8 million VND/month.

In addition, there are a series of other social insurance benefits that also increase according to the basic salary, such as one-time benefits for death due to work-related accidents or occupational diseases; benefits for convalescence and health recovery after treatment of injuries or illnesses; funeral benefits; monthly death benefits, etc.

Many allowances and subsidies increase according to the basic salary (Illustration: QA).

Early retirement without deduction of pension rate

According to Decree 115/2015/ND-CP regulating monthly pension levels, male workers with 20 years of social insurance contributions when retiring will receive a pension equal to 45% of the social insurance contribution salary, female workers with 15 years of social insurance contributions when retiring will receive a pension equal to 45% of the average monthly social insurance contribution salary, then for each additional year of social insurance contributions, an additional 2% will be calculated.

The monthly pension of employees eligible for early retirement is also calculated at the above rate, then for each year of early retirement, the pension is reduced by 2%.

On June 3, the Government issued Decree 29/2023/ND-CP regulating the streamlining of staff for cadres, civil servants and public employees. This Decree takes effect from July 20.

According to Decree 29/2023/ND-CP, there are 3 groups of cadres, civil servants and public employees who retire before the retirement age and will not have their pension rate deducted as prescribed above.

The person who is downsized must be at least 5 years younger than the prescribed retirement age and have at least 20 years of compulsory social insurance contributions, of which at least 15 years must be working in a arduous, toxic, dangerous or especially arduous, toxic, dangerous occupation or job, or at least 15 years must be working in an area with particularly difficult socio-economic conditions.

The people subject to staff reduction are commune-level cadres and civil servants who are redundant due to the rearrangement of commune-level administrative units and whose age is at least 10 years lower than the maximum and 5 years lower than the minimum retirement age and have at least 20 years of compulsory social insurance contributions.

The people subject to staff reduction are female commune-level cadres and civil servants whose age is at least 10 years lower than the maximum and at least 2 years lower than the prescribed retirement age, and who have paid compulsory social insurance for 15 years to under 20 years.

Source link

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)