SGGPO

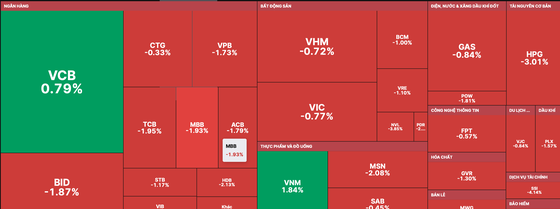

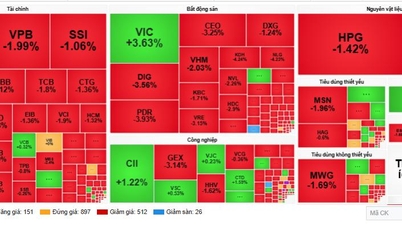

Although the two "pillar" stocks VCB and VNM increased points, the downward pressure on most stock groups was so great that the VN-Index turned around and fell sharply, "breaking" the 1,130 point mark, ending the previous 7 consecutive increasing sessions.

|

| Two "pillar" stocks VCB and VNM increased but could not "support" the index in the session of June 29. |

Faced with strong profit-taking pressure from investors, along with not-so-bright macro information in June, the Vietnamese stock market on June 29 witnessed a session of sharp declines across the board. The number of stocks falling in price was more than 4 times higher than the number of stocks increasing. Although VCB and VNM increased, they could not "support" the index, causing the VN-Index to "break" 1,130 points.

In the group of large-cap banking stocks, only VCB remained green, the rest BID, CTG,ACB , HDB, TCB, VPB, VIB, STB, MBB... all decreased from nearly 1 to nearly 3%. The group of securities stocks also decreased sharply such as: VCI decreased by 4.47%, SSI decreased by 4.14%, HCM decreased by 3.61%, VND decreased by 3.84%, SHS decreased by 3.7%... The group of real estate and public investment stocks also "plummeted" with IDC decreased by 2.3%, NLG decreased by 2.36%, PDR decreased by 2.94%, DIG decreased by 5.8%, VCG decreased by 2.11%, NVL decreased by 3.85%, VGC decreased by 3.31%, DRH decreased by 3.08%, DXS decreased by 3%, DXG decreased by 4.2%...

At the end of the trading session, VN-Index decreased by 12.96 points (1.14%) to 1,125.39 points with 361 stocks decreasing, 84 stocks increasing and 63 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also decreased by 2.77% to 227.48 points (1.2%) with 148 stocks decreasing, 50 stocks increasing and 134 stocks remaining unchanged. Market liquidity remained high with a total trading value in the entire market of nearly VND19,600 billion. Foreign investors continued to net buy VND114.74 billion on the HOSE.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)