|

| Russia's 'campaign' to break the siege was stopped, de-dollarization seems easy but is incredibly difficult, does Moscow have a new plan? (Source: Reuters) |

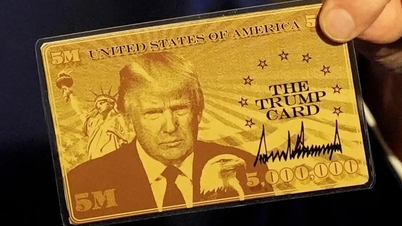

For a long time, commodities from oil, gold... to wheat, as usual, have been mostly traded globally in USD - the world 's number 1 reserve currency.

"Struck" by Western sanctions

However, the Russian financial system has been essentially isolated after being hit by Western sanctions - imposed after Russia's military campaign in Ukraine (February 2022).

Russia has been left almost unable to conduct transactions in greenbacks, thus restricting most international trade.

President Putin has tried to solve this problem by selling oil to “friendly countries” like China and India in exchange for their own currencies, including the yuan and rupee.

This Russian solution has at times raised the possibility that the US dollar will weaken in the international market due to the dominance of local currencies from large economies such as China and India.

In the context, China has long sought to weaken the influence of the US dollar in world trade, by increasing international transactions in yuan. Most recently, Beijing has convinced leaders in the Middle East and the Gulf to allow oil and gas purchases in yuan. Some reports have even indicated that some bilateral deals in yuan may be in the works.

However, Russia’s efforts to circumvent sanctions by de-dollarizing bilateral trade with its giant buyer, India, appear to have been “blocked” by preemptive Western moves, and are only now taking effect – linked to the dominant role of the dollar, as Russian banks have been cut off from the SWIFT international payment system by Western sanctions.

“The initial trade campaign seemed to be going well – and now Russia has become one of India’s top oil suppliers and is generating billions in sales. But the success of the scheme has only resulted in Russian rupee assets being “filled up” in Indian banks – up to $1 billion a month.

But the trouble is, Moscow still cannot take it out for use due to restrictions by the Reserve Bank of India (BRI), which prevents Russian companies from transferring Indian currency back to Russia and converting it into Rubles.

Economist Timothy Ash and colleagues at the Russia and Eurasia Programme in the UK commented that the sanctions imposed by the West on Russia have just reaffirmed that the US dollar is still “king”.

“There is simply no quick international payment solution for Russia, China or any other country, when globally the US dollar still maintains a certain level of reliability,” commented expert Timothy Ash.

So why is the USD still trusted by the market to be freely convertible, while the Rupee is not?

India operates a partially convertible account, where the rupee can be exchanged for foreign currency and vice versa, but within certain limits. “Concerns about exchange rate stability are the main hurdle behind the Indian government’s reluctance to make the rupee fully convertible.

“In addition, price stability is the most important prerequisite for internationalizing a currency. Another concern is that internationalizing the Indian Rupee could limit the RBI’s ability to manage the domestic money supply and influence interest rates in the prevailing macroeconomic environment,” said Aditya Bhan, an expert at the Observer Research Foundation.

Have money, but hard to spend

As a result of these restrictions, as much as $39 billion in assets may be trapped in Indian bank accounts. “This is a problem,” Russian Foreign Minister Sergei Lavrov told reporters in the Indian state of Goa.

"We need to use this money. But to do that, the Rupees need to be converted into other currencies and this issue is currently being discussed." Recently, Foreign Minister Lavrov seemed to admit that he was "helpless" in his efforts to rescue this huge amount of assets.

"We spoke with Indian External Affairs Minister Subrahmanyam Jaishankar in Jakarta and discussed bilateral issues, including issues such as the payment mechanism between Russia and India.

In the current situation, billions of rupees of Russian goods have accumulated in India, but have not yet found a way to use them, our Indian friends have assured us that they will introduce us to promising areas for investment,” said Minister Lavrov.

Indeed, to use the aforementioned billions of rupees, Russia’s only option at the moment is to spend or invest in India. But the problem is that, given the unbalanced trade relationship between New Delhi and Moscow, India does not have many of the relevant things that Russia needs, leaving the Kremlin unable to spend this money by buying goods.

In fact, apart from oil, Russia is one of the leading suppliers of weapons and military hardware to India. According to Factly data, from April 2022 to February 2023, India's imports from Russia reached $41.56 billion, including crude oil imports, which increased by more than 900% year-on-year. Meanwhile, its exports to Russia were only $3 billion.

This means that the amount of Russian assets in the fund frozen in India could be worth tens of billions of dollars, said Alexander Knobel, director of the Institute of International Economics and Finance at the Russian Ministry of Economic Development. The situation is aggravated by India’s “traditional” large trade deficit, which makes it more difficult to reach a settlement agreement with a third country.

Last month, former Russian Finance Minister Mikhail Zadornov, who also headed one of the country's largest banks, said that the temporary lack of refunds of export earnings to India was "the direct cause of the ruble's devaluation this summer."

Another unclear reason for the ruble’s weakness is its stuckness. Russia has supplied $30 billion worth of oil and petroleum products to India in the first half of 2023, but imports from India are estimated at only $6-7 billion a year. “We have nothing to buy in India, but we cannot return these rupees because the Indian currency is difficult to convert,” Zadornov said.

Russia has also expressed interest in developing an alternative payment mechanism with the BRICS (Brazil, Russia, India, China and South Africa) countries, in an effort to find a common currency to replace the dollar. But the road for emerging economies to realize this ambitious plan will be long, despite many developing economies, many of which may be “fed up” with the greenback’s dominance of the global financial system – especially in the context of the dollar’s rapid appreciation.

Experts say that, in reality, there is no alternative that can achieve the same level of global dominance as the US dollar. Abandoning the US dollar in trade transactions is not easy, and it cannot be done “overnight”.

As former US Treasury Secretary Paul O'Neill commented, the idea of replacing the USD is unthinkable. Because about 90% of international transactions are conducted in USD, and USD accounts for about 60% of global foreign exchange reserves.

Source

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)