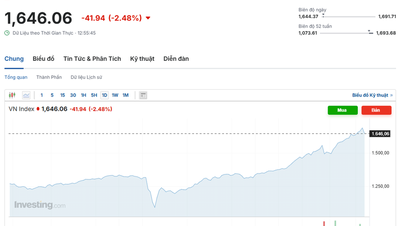

The VN-Index closed this afternoon with a lower decline than the morning, but the stock price level was significantly lower. Some large-cap stocks in the banking group turned up to support the index, but selling pressure showed signs of strengthening in many other stocks. This could be a situation where the pillar is pulled down…

The VN-Index closed the morning session down 2.82 points and closed this afternoon down 4.36 points. Although the difference in points was very small, the stocks fell more. Specifically, the HoSE floor had only 75 stocks that fell more than 1% in the morning session, but by the end of the session, there were 128 stocks. The liquidity of this group with the deepest decline in the morning only accounted for 19.5% of the total matched value of the floor, but this afternoon it accounted for 44.3%.

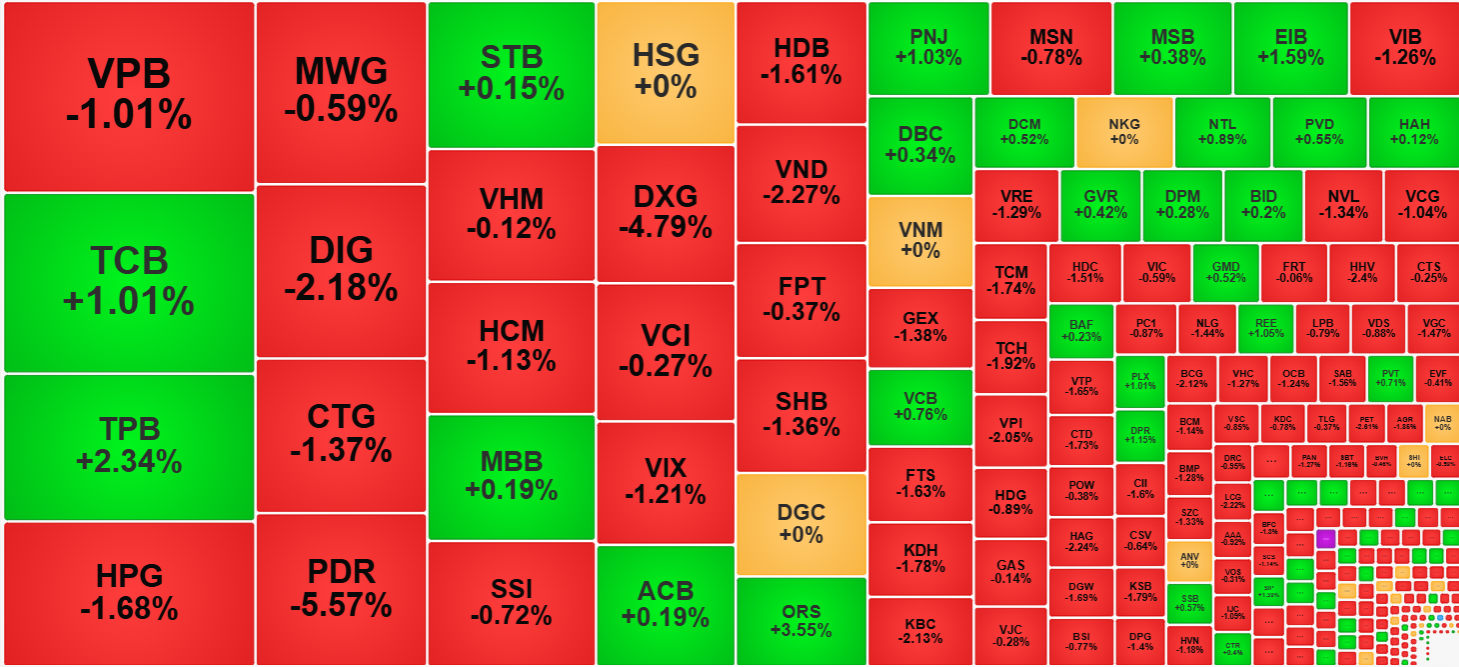

Many stocks showed clear selling pressure and prices fell sharply. In addition to the stocks that have been weak since morning such as DIG, CTG, PDR, HDB, DXG, this afternoon VPB, HPG, HCM, VIX, VND... appeared with high liquidity. The breadth at the end of the day was still very negative with 96 stocks increasing/299 stocks decreasing. This breadth was already bad since morning (84 stocks increasing/281 stocks decreasing) and this afternoon the price level of the group decreasing was lowered even lower.

Fortunately, the VN-Index did not lose too many points thanks to the large-cap stocks holding their prices. VCB increased by 0.76%, the amplitude was not much but the capitalization advantage is very valuable at this time. VCB alone pulled the index back nearly 1 point. VHM also had a pretty good recovery when it regained about 0.81% compared to the morning closing level and narrowed the end-of-day decrease amplitude to -0.12%. TPB had a sudden breakthrough after 2:00 p.m., closing up 2.34% compared to the reference, meaning that this afternoon alone it increased by about 1.75%.

Among the 10 stocks with the largest market capitalization today, only 3 codes decreased significantly, including CTG down 1.37%, VPB down 1.01% and HPG down 1.68%. On the contrary, there were also 3 codes that were slightly balanced, including VCB up 0.76%, BID up 0.2% and TCB up 1.01%. The number of codes that decreased was outstanding in the VN30 group (10 codes increased/19 codes decreased) but the overall amplitude of the group's decrease was not much. VN30-Index therefore only decreased slightly by 0.32% compared to the reference.

The group that went against the trend today does not represent the industry group but only specific stocks with well-maintained supply and demand. For example, the securities group appeared with ORS increasing strongly by 3.55% with impressive liquidity of 183 billion VND. This is the second consecutive session that this stock has broken through with very large transactions. BVS increased by 2.53%, VFS increased by 2.22%, MBS increased by 1.58%, which are also other very strong codes in this group. However, the whole group of red stocks still dominated many times over, even with blue-chips such as SSI, HCM, VCI, VND, FTS... Banking stocks are similar, TPB, EIB, TCB are good enough, but the number of price decreases in the whole group is still greater, even 11/27 codes decreased by more than 1%. In other words, the stocks that were able to go against the trend this session are due to their individual strength, even due to the advantage of small capitalization and low liquidity.

The market weakness today may be partly due to the increase in tensions in the Middle East affecting the international stock market, but the bigger factor is still the decline in confidence in the market's ability to break through. Today is the 5th session that the market has been struggling near the 1300-point peak without any clear signal of a breakthrough. This can easily lead to the decision to reduce the portfolio to prevent risks in case the market turns down.

A faint positive signal is that foreign investors are still buying, although it has decreased significantly compared to yesterday. This afternoon alone, foreign investors disbursed another VND137.2 billion, still focusing on a few codes: TCB +258.8 billion, PNJ +161 billion,FPT +66.8 billion, VHM +46.7 billion, VCB +48.8 billion, TPB +43.3 billion, VCI +26.6 billion. On the net selling side, there were VPB -74.3 billion, HDB -61.5 billion, CTG -47.8 billion, HPG -36.6 billion, DPM -34 billion, VND -27.4 billion. For the whole day, foreign investors net bought VND254 billion after yesterday's net buying of nearly VND670 billion.

TH (according to VnEconomy)Source: https://baohaiduong.vn/chung-khoan-tiep-tuc-di-lui-394653.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)