Stocks continue to move sideways, many accounts suffer heavy losses

The Vietnamese stock market has just experienced a volatile trading week as the VN-Index was under constant pressure from both domestic and international factors. After increasing well in the first two sessions of the week, the index approached the historical peak of 1,700 points but could not maintain the excitement, quickly turning down for four consecutive sessions.

At the end of the week, VN-Index stopped at 1,658 points, down 0.52% compared to the previous week. HNX-Index fell to 276 points (down 0.9%) while UPCoM-Index stood at 111 points, almost unchanged.

From the peak of 1,700 points, the index lost about 35 points, but many stocks fell deeply, causing investors to suffer heavier losses than the general decrease.

Market liquidity last week averaged just over VND28,000 billion per session, 15% lower than the previous week. Cash flow was mainly concentrated in a few pillar stocks in the real estate group, notably VIC. If this support were removed, the decline of the VN-Index could have been even stronger.

Meanwhile, the securities group – which was expected to benefit from the market upgrade – disappointed with a simultaneous decrease of 5-10%. Banking and real estate, two groups with large proportions, also lost an average of 3-7%. Some individual stocks plunged as much as 15% in just two weeks, causing many accounts to evaporate sharply.

Mr. Le Quoc (an investor in Ho Chi Minh City) said that his portfolio of stocks, real estate and banking codes has decreased by 10-15% continuously in the past two weeks. "The VN-Index only decreased by a few dozen points at first glance, but my account lost hundreds of millions because the stocks fell too strongly" - he shared.

Stocks have been moving sideways in recent days.

Foreign investors continue to net sell, experts recommend keeping cash

Another factor causing pressure is the net selling of foreign investors. Last week, foreign investors continued to sell off more than VND2,000 billion, focusing on large-cap stocks in the banking and steel groups. This was the third consecutive week of net selling, contributing to the more cautious market sentiment.

In addition, international factors also have a significant impact. The US Federal Reserve (FED) has just lowered interest rates by 0.25 percentage points, a move that is expected to support the global market. However, concerns about recession and cautious sentiment in the face of newly released US economic data have prevented capital flows from returning strongly. At the same time, information related to the process of upgrading Vietnam's market to the emerging group according to FTSE standards is not enough to change the situation.

According to Mr. Dinh Viet Bach, analyst at Pinetree Securities Company, the phenomenon of "putting people to sleep, sawing the table leg", meaning the market slightly decreasing alternately with sideways, is making investors lose patience. In addition, the derivatives maturity date and the portfolio restructuring activities of ETF funds at the weekend further disrupt the index's fluctuations.

SHS Securities Company believes that in the context of low liquidity and foreign investors continuing to net sell, the scenario of VN-Index breaking through the support zone of 1,603 points is entirely possible if selling pressure increases sharply. On the contrary, for the market to establish a clear trend, it needs a session with explosive liquidity with a transaction value exceeding 35,000 - 37,000 billion VND.

Vietnam Construction Securities Company (CSI) also believes that the probability of VN-Index breaking through the peak of 1,700 points next week is not high, it is likely to be a correction and accumulation phase. Therefore, investors should maintain a higher cash ratio, limit the use of margin and patiently wait for opportunities at more attractive price levels.

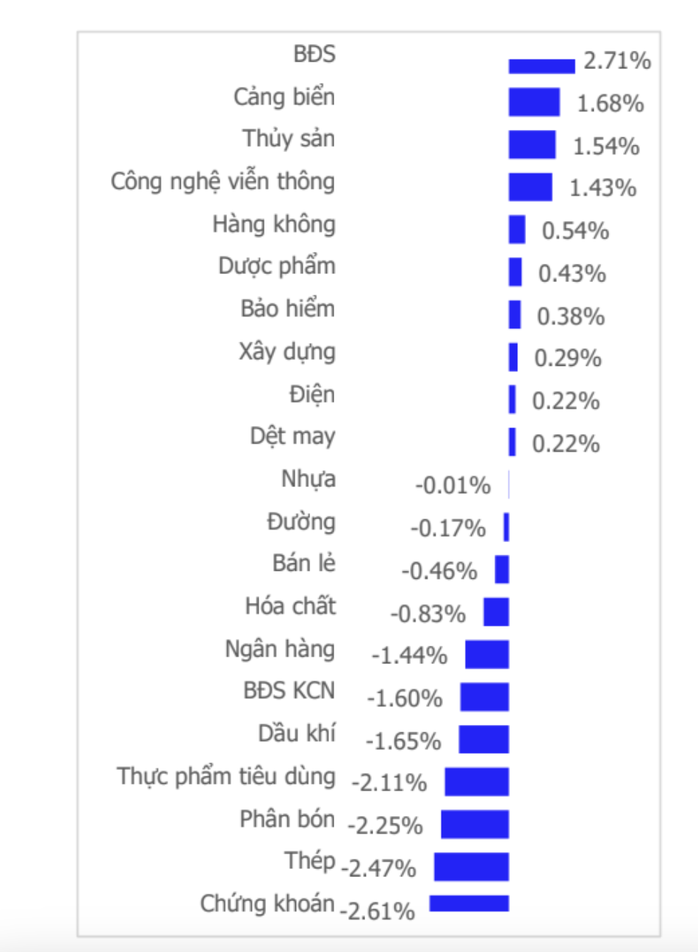

Fluctuations of industry groups last week

Source: https://nld.com.vn/chuyen-gia-neu-dieu-kien-de-chung-khoan-tro-lai-vung-dinh-1700-diem-196250921100129927.htm

![[Photo] Prime Minister Pham Minh Chinh receives Secretary of Shandong Provincial Party Committee (China) Lin Yu](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/26/821396f0570549d39f33cb93b2e1eaee)

Comment (0)