Ho Chi Minh City Stock Exchange (HoSE) recently announced the rules for building two new investment indexes: VN50 Growth and VNMITECH.

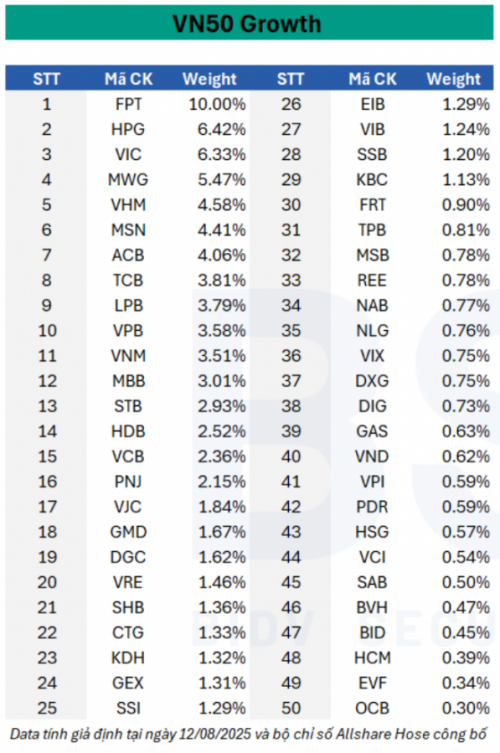

Based on hypothetical calculation data ending on August 12, 2025, BSC Research provides a list of potential stocks that could be included in the above two index baskets.

In which, the VN50 Growth Stock Index (Vietnam Growth 50 Index), abbreviated as VN50 Growth Index, includes 50 component stocks selected from the list of component stocks of the VNAllshare index.

The screening condition for this index is that stocks in VN50 Growth must be in VNAllshare and meet the minimum adjusted free-float capitalization value (GTVH_f) of VND 2,000 billion and the minimum matched transaction value (GTGD_KL) of VND 20 billion/day.

From the list of stocks that satisfy the above conditions, the 50 stocks with the largest GTVH_f (higher GTGD_Volume is preferred when GTVH_f is equal) will be included in the official index basket. The next 10 stocks will be included in the reserve index basket.

Based on the above criteria, BSC has screened out 50 codes that satisfy the conditions as of August 12, 2025, of which the highest proportion isFPT code with a proportion of 10%. A series of Bluechips codes are also named such as HPG, VIC, MWG, VHM, MSN, TCB...

|

| BSC's forecast on stocks of VN50 Growth index. |

In addition, BSC also forecasts 10 reserve stocks for the VN50 Growth basket including POW, VHC, SIP, VCG, SBT, TCH, KDC, DBC, PVD and CII.

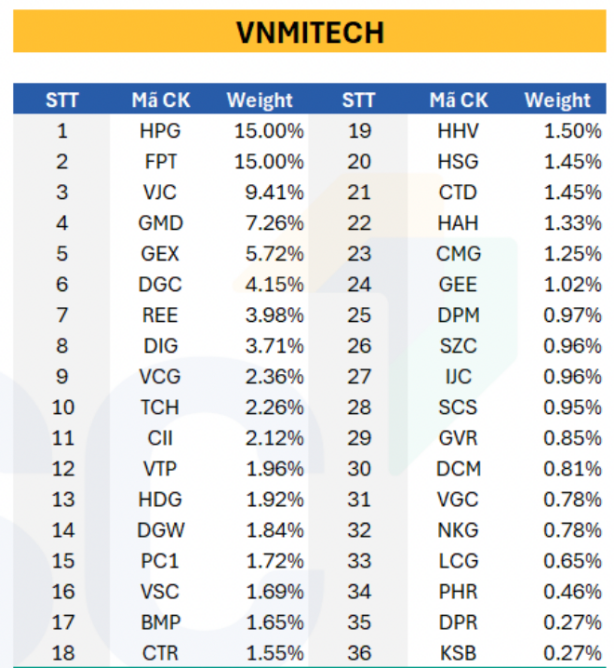

For the Vietnam Modern Industrials & Technology Index, abbreviated as VNMITECH, it will include a minimum of 30 and a maximum of 50 stocks. The stocks are selected from the component list of the VNAllshare Materials (VNMAT), VNAllshare Industrials (VNIND), VNAllshare Information Technology (VNIT) sector indexes and meet the index screening criteria.

|

| BSC's forecast on VNMITECH index component stocks. |

According to BSC’s screening, two codes HPG and FPT will be added to the basket with the largest proportion of 15% for each stock. Next are VJC, GMD, GEX, DGC…

BSC assesses that after HoSE officially announces the two index sets VN50 Growth and VNMITECH, in the coming time, new ETFs will be established. Thus, the scale of the domestic ETF market will be more diverse, with more choices for investors. Deploying ETFs by theme is a necessary direction for Vietnam when the opportunity to upgrade to an emerging market is growing.

Source: https://baodautu.vn/co-phieu-nao-du-dieu-kien-vao-ro-chi-so-moi-vn50-growth-va-vnmitech-d362534.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)