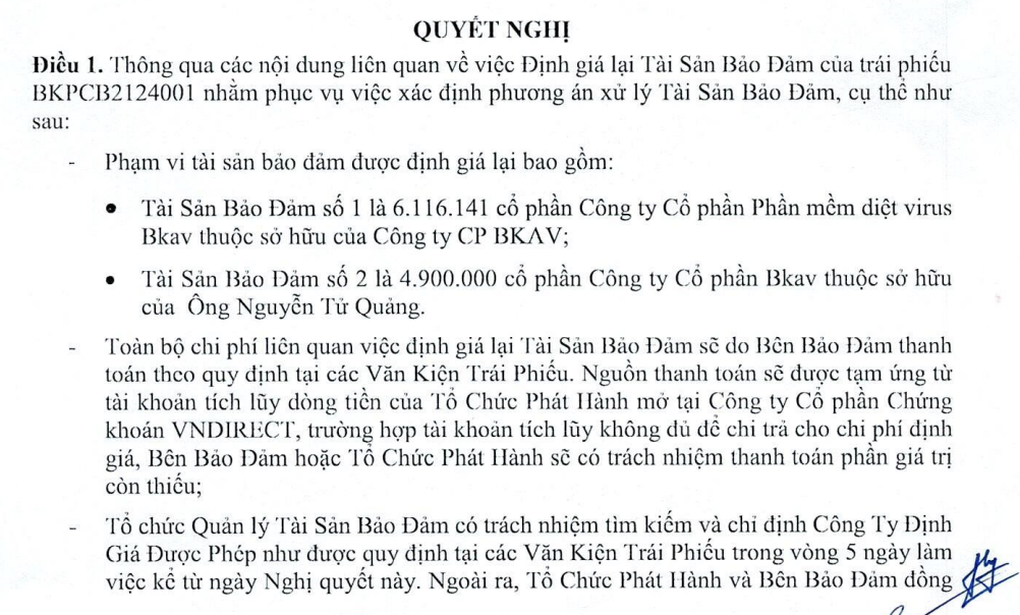

Bkav Antivirus Software Joint Stock Company (Bkav Pro) recently announced the resolution of the bondholders' conference. The bondholders of this enterprise approved the contents related to revaluation of collateral assets.

The scope of revalued collateral assets includes more than 6.1 million Bkav Pro shares owned by Bkav Joint Stock Company and 4.9 million Bkav Joint Stock Company shares owned by Mr. Nguyen Tu Quang.

Specifically, Bkav Pro has 30 days from the effective date of the resolution (July 24) to find a partner to sell the secured assets, provided that the total amount of money collected from the sale of the secured assets and the amount Bkav can arrange to repay the debt to the bondholders is at least equal to the unpaid secured obligations.

In case after 30 days, the enterprise is unable to sell the secured assets to fully pay the bond debt obligation, the secured asset management organization will convene a meeting of other bondholders to get votes for the next options.

Information on the handling of collateral assets of bond lot BKPCB2124001 (Screenshot).

May 26 is the due date for payment of nearly 163.3 billion VND in principal and more than 8.9 billion VND in interest of the bond lot coded BKPCB2124001. However, this enterprise has been slow in payment and negotiation with bondholders.

By the end of July, Bkav Pro had received approval from bondholders to re-evaluate the collateral assets of bond BKPCB2124001 to determine the collateral handling plan.

Bond BKPCB2124001 was issued in May 2021 with a value of VND 170 billion, term of 3 years. Initial interest rate 10.5%/year. In May 2024, the company was approved by bondholders to extend the bond for another year, the new maturity date is May 26, 2025. Interest rate from the 37th month is 11%/year.

At the same time, the issuing company also amended and supplemented the terms on collateral of the bond lot including more than 6.1 million Bkav Pro shares owned by Bkav Joint Stock Company and the entire capital contribution of Nguyen Tu Quang at Vietnam Digital Transformation Platform Company Limited (DXP Company).

Bondholders have the right to request Bkav Pro, Bkav and DXP to provide revenue and expenditure reports and cash flow accumulation plans, ensuring at least VND 1.5 billion/month into Bkav Pro's securities account at VNDirect Securities Company.

In July 2024, the company repurchased a portion of the bonds worth VND6.73 billion. The remaining outstanding value of the bonds to date is VND163.3 billion.

In early 2025, VNDirect reported Bkav Pro for violating the law by not accumulating enough VND 1.5 billion in January. On February 14, VNDirect sent a document requesting the enterprise to pay the full amount of the shortfall within 15 days.

The 2024 financial report shows that Bkav Pro's business performance has improved significantly compared to the previous year. Specifically, the company recorded a profit after tax of nearly 40.9 billion VND, 2.4 times higher than in 2023.

Bkav Pro's business results in 2024 (Photo: Cbond).

Bkav Pro is a software publishing company of Bkav Group, established in March 2018, with an initial charter capital of 50 billion VND. Of which, 3 founding shareholders include Bkav Joint Stock Company holding 96%, Mr. Vu Ngoc Son holding 2%, Ms. Lai Thu Hang holding 2%.

In August 2018, the company increased its charter capital to 100 billion VND, the founding shareholder structure remained unchanged. By October 2018, Bkav Joint Stock Company reduced its ownership ratio to 83.963%, the remaining 2 individuals kept 2% each.

From July 2022 to present, the company has Mr. Nguyen Tu Quang as General Director and Legal Representative.

Source: https://dantri.com.vn/kinh-doanh/cong-ty-cua-ong-nguyen-tu-quang-ban-tai-san-bao-dam-de-xu-ly-no-trai-phieu-20250812141354128.htm

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)