Century Real Estate Joint Stock Company (Cen Land - stock code: CRE) has just announced its consolidated financial report for the fourth quarter of 2023 with a sharp decline in results.

In the last quarter, the company achieved 330.6 billion VND in net revenue, 2.1 times higher than the same period in 2022. The revenue in the fourth quarter of 2023 increased sharply, but the accumulated net revenue in 2023 only reached 932.6 billion VND, down 73.2% compared to 2022.

Revenue from financial activities in the fourth quarter of 2023 reached VND13.8 billion, down 62%. Other income also decreased sharply from VND8.2 billion to VND656 million while other expenses in the last quarter amounted to VND3.7 billion, double the same period in 2022.

After deducting expenses, profit after corporate income tax in the last quarter was VND1.2 billion, an improvement compared to last year's loss of VND62.6 billion.

Due to difficult business operations, Cen Land's profit for the whole year of 2023 is only 2.5 billion VND, down 98.7% compared to 2022.

At the end of 2023, the total assets of the enterprise were VND 7,108.5 billion, down 6.7% compared to the beginning of the year. Of which, short-term receivables were VND 4,101.9 billion, accounting for 57.7% of total assets, down 3.9% compared to the beginning of the year. Long-term receivables were also VND 1,763.7 billion, accounting for 24.8%.

Thus, the total value of receivables accounted for 82.5% of Cen Land's total assets at the end of the year. This ratio was 83.7% at the beginning of the year.

The financial statement notes show that most of these receivables mainly include contract performance deposits that the company has paid to investors, to perform the role of general agent distributing real estate products formed from projects.

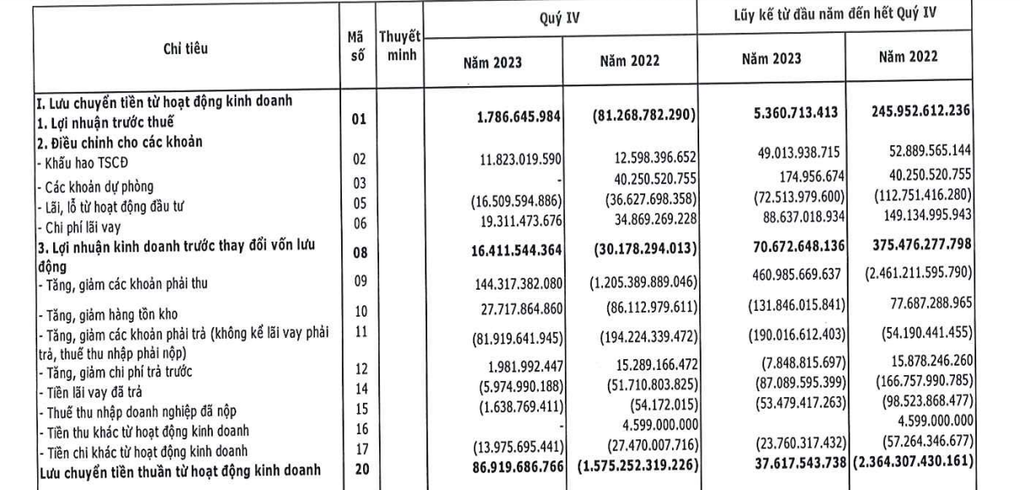

Although 2023 profit decreased sharply compared to 2022, the company's financial report showed that net cash flow from operating activities improved from negative VND 2,364.3 billion to VND 37.6 billion. The reason is that Cen Land increased receivables in 2023.

Thanks to the increase in receivables, Cen Land's net cash flow from operating activities in 2023 recorded a positive value (Photo: Financial Statements).

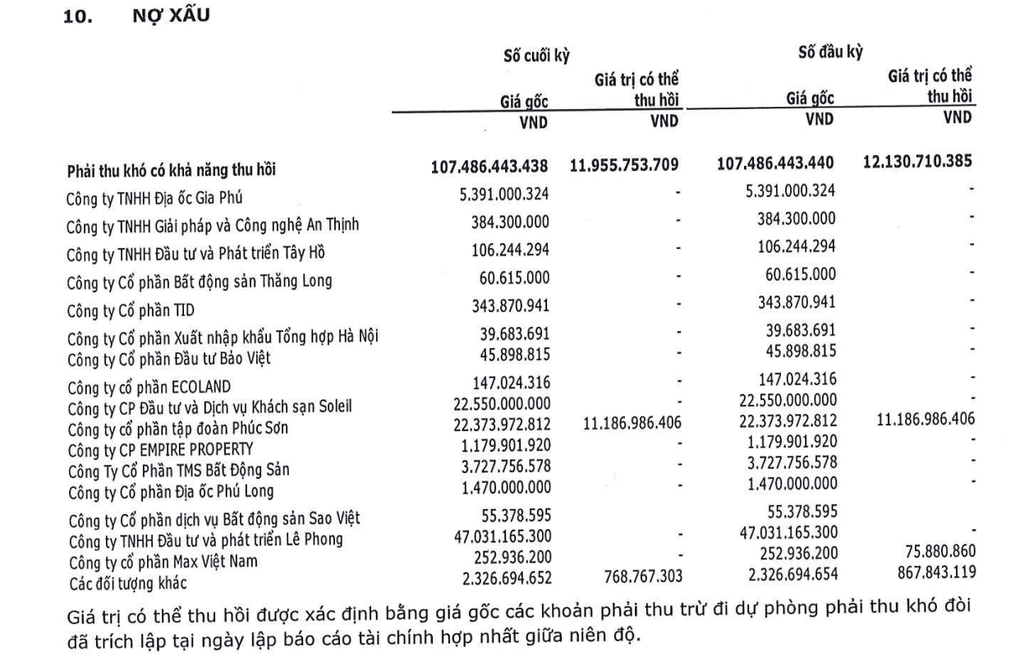

However, the increase in receivables due to deposits for partners also poses risks to the business. The report shows that the company's bad debt at the end of 2023 had an original value of 107.5 billion VND from receivables that are difficult to collect. But the recoverable value is only 11.9 billion VND.

These difficult-to-collect receivables come from partners such as Le Phong Investment and Development Company Limited, Soleil Hotel Investment and Services Joint Stock Company (a business related to the Van Thinh Phat case), and Phuc Son Group Joint Stock Company.

Bad debt from receivables that are unlikely to be collected at the end of the year of the enterprise amounted to 107.5 billion VND (Photo: Financial Statement).

The company maintains a low leverage ratio. As of December 31, 2023, liabilities stood at VND1,489 billion, down 25.6% from the beginning of the year. Equity stood at VND5,619.5 billion, unchanged from the beginning of the year.

Source

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)