Many securities companies increase capital - Photo: QUANG DINH

The stock market in general and this group of stocks are under strong correction pressure due to a wave of widespread profit-taking. However , in the medium and long term, the market is still positively evaluated by domestic and foreign organizations.

Mirae Asset Vietnam also forecasts that VN-Index still has room to increase to set a new record of 1,800-2,000 points in the last months of this year.

To seize new opportunities, capital resources are very important for securities companies. Not to mention that in addition to the traditional field, the digital currency sector... is being promoted by many securities companies, Vietnam has also officially issued a resolution to pilot this market from September 9.

The trillion-dollar race in the securities industry

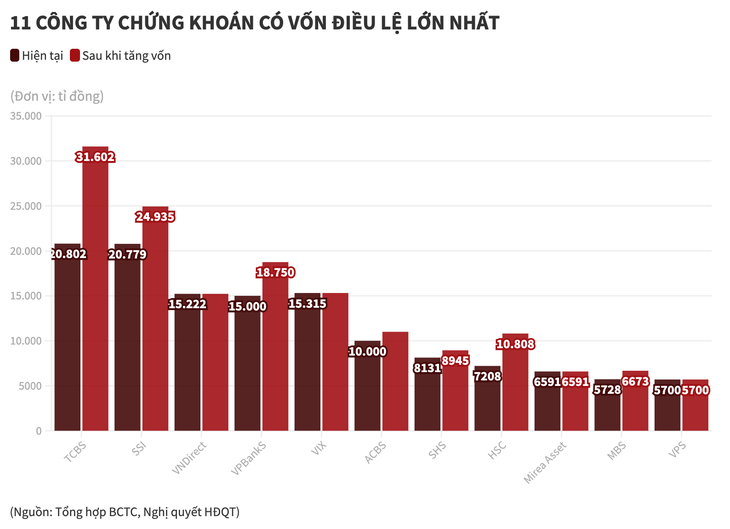

Techcom Securities (TCBS) is becoming the center of attention when implementing the IPO of more than 231 million shares at the price of 46,800 VND/share, expected to mobilize over 10,800 billion VND. TCBS's charter capital is expected to increase from 20,801.6 billion to 31,601.6 billion VND after the IPO.

Meanwhile, VPBankS - The bank with the most impressive growth rate in recent years suddenly faced competitive pressure in terms of charter capital scale when it was surpassed by VIX. After the stock dividend payment in the first half of 2025, VIX increased its charter capital to more than VND 15,314 billion, thereby temporarily surpassing VPBankS (VND 15,000 billion).

VPBank is also accelerating preparations for a new issuance plan to maintain its advantage . If successful, the company in the VPBank ecosystem will increase its charter capital from VND 15,000 billion to VND 18,750 billion.

In the recent announcement, Kafi Securities also said that it has officially completed increasing its charter capital to VND7,500 billion, through issuing stock purchase rights to existing shareholders. Currently, Kafi is in the top 10 securities companies with the largest asset scale in the market.

SSI also plans to hold an extraordinary general meeting of shareholders in 2025, scheduled to take place on September 25, mainly related to the offering of shares to existing shareholders.

SSI plans to offer up to 415.6 million additional shares to existing shareholders at VND15,000/share. Charter capital is expected to increase to VND24,934.9 billion.

Another company, Tien Phong Securities (ORS), also plans to offer 287.9 million shares to TPBank at VND12,500/share. The purpose of the offering is to increase the charter capital, supplementing capital for the company's operations and business operations. If the issuance is successful, the securities company's charter capital will increase from nearly VND3,360 billion to more than VND6,239.3 billion.

Charter capital size of large securities companies in the market (Chart: Nguyen Nguyen)

Entering the digital asset playground

Talking to Tuoi Tre , an expert from DSC Securities Company said that the strong market growth since April has brought many surprises to the units in the industry. For example, VPS or VPBankS, although they have not yet had an IPO plan, are currently rushing to implement IPO in the near future.

According to this person, increasing capital in the securities industry is an inevitable trend when people's income increases and the financial market develops. In addition to meeting traditional business activities, companies are increasing their internal resources to develop asset management, investment trust, and corporate bond issuance.

In addition, a few businesses with technological advantages and support from commercial banks are increasing capital partly to prepare for the upcoming digital asset playground.

In the latest development, the Vietnamese Government has officially issued a resolution to pilot the crypto market for 5 years, then continue to operate until new regulations are issued.

Regarding the conditions for granting a floor license, the enterprise must have a minimum charter capital of VND 10,000 billion. At least 65% of the charter capital must be contributed by organizations, of which over 35% must come from at least two units: commercial banks, securities companies, fund management companies, insurance companies or technology enterprises.

Although not officially announced, in fact many securities companies and banks have prepared the digital currency ecosystem for the new race.

Source: https://tuoitre.vn/cuoc-dua-nghin-ti-cac-cong-ty-chung-khoan-binh-dien-ra-sao-sau-tang-von-20250911135756904.htm

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)