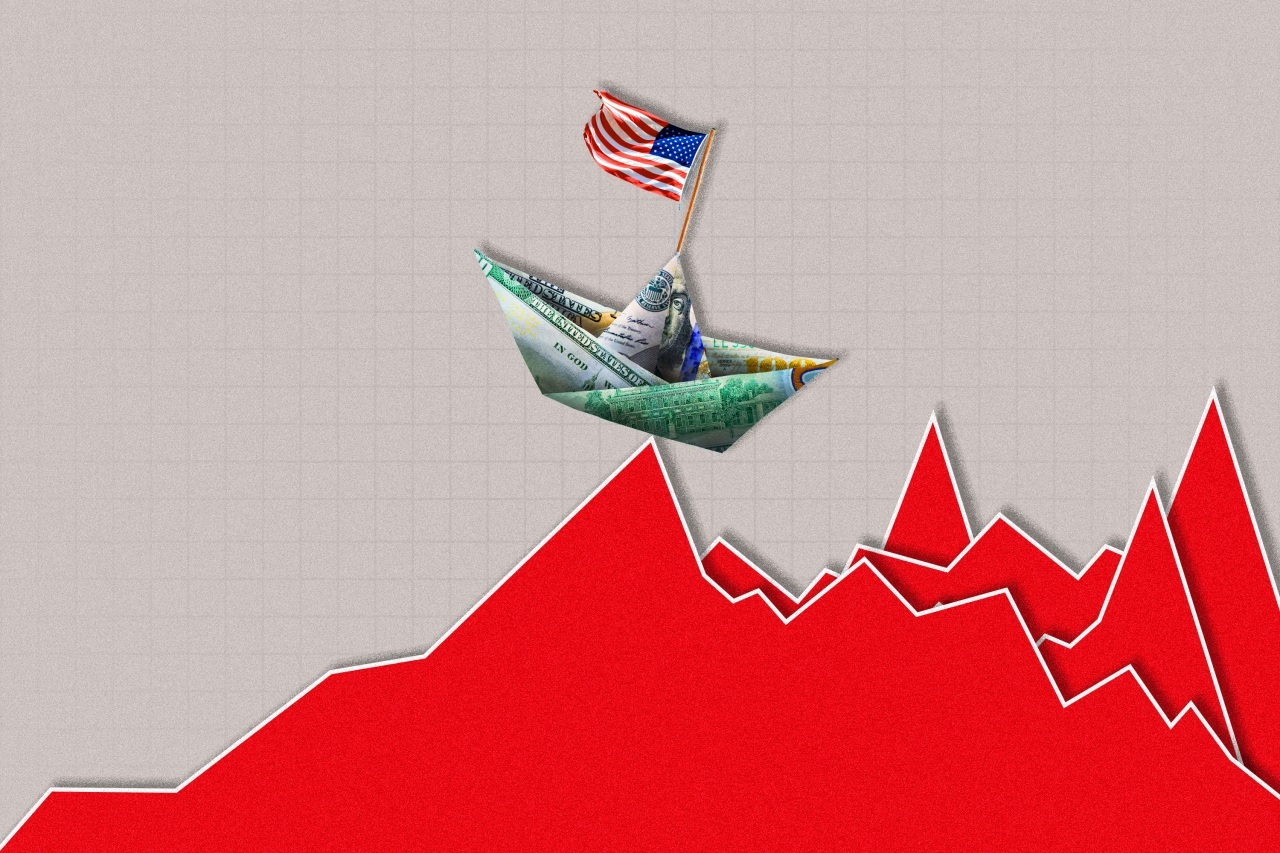

September is casting a cloud of intrigue over the US economy . Investors are holding their breath as they await the Federal Reserve’s interest-rate decision in 10 days, while an even more important battle is shaping the future of the institution itself: the race for Fed chairman, a position whose power affects the pocketbooks of every American and the stability of the global economy.

President Donald Trump has officially confirmed the "three-horse race" of the top three candidates to replace Jerome Powell in May next year: Christopher Waller, Kevin Hassett and Kevin Warsh.

For investors, businesses and policymakers, who will become the next "conductor" of the Fed and how they will steer the US economic ship is no longer an academic question but a trillion-dollar unknown.

Stormy September: Jerome Powell's dilemma

Before we get to the future, let’s look at the current, stressful situation for Fed Chairman Jerome Powell. The Fed is almost certain to cut interest rates at its September 16-17 policy meeting. The question is not whether, but how much—a quarter or a half of a percentage point.

The decision comes against a paradoxical backdrop. On the surface, the macro numbers remain solid. GDP growth in the second quarter was 3.3%, and White House chief economic adviser Kevin Hassett even forecasts it could reach 4%. The “wealth effect” from rising stock markets and real estate prices is still driving consumer spending. Business investment, fueled by billions of dollars poured into artificial intelligence (AI), is up 8%.

But beneath the surface are worrying cracks. Manufacturing is still contracting and the housing market is weak. But Mr. Powell’s biggest concern is the labor market. The economy added a disappointing 22,000 jobs in August. The unemployment rate edged up from 4.2% to 4.3%.

Experts say this figure may be being “artificially suppressed” by the phenomenon of “labor hoarding”. After the shock of post-Covid-19 staff shortages, many businesses are trying to retain employees even when they are not using their full capacity. For the first time in four years, the number of job seekers has officially exceeded the number of vacant positions. The phenomenon of “job hopping” in search of better opportunities has been replaced by the mentality of “holding on to a job” to stay safe.

And over all of this, the specter of AI hangs in the balance. A survey by The Wall Street Journal found that companies are using phrases like “holding back on hiring” and “using less humans.” Business leaders admit that budget meetings now revolve largely around “jobs that will disappear in the next 18 months.”

It is the potential weakness in the labor market that worries Mr. Powell more than inflation, which is still above the Fed’s 2% target. He and his colleagues seem to believe that the upward pressure from tariffs is temporary and that the trend toward disinflation will soon return.

In that context, a rate cut is seen as a necessary remedy. But it will never be enough to satisfy President Trump, who has demanded a reduction of up to 3 percentage points. And it is this relentless pressure that has paved the way for the race to find Mr. Powell's successor.

September is a dangerous month for the US economy, according to experts. Investors are worried as history shows that September is often the weakest month for the market (Photo: iStock).

Three-Horse Race: 3 Men, 3 Futures for the Fed

President Trump's confirmation of his shortlist shows he is serious about reshaping the Fed to his liking. Each candidate represents a very different path.

Christopher Waller - The Pragmatic "Insider"

With the highest odds on online betting platforms (27-28%), Fed Governor Christopher Waller is considered the safest candidate. He is an "insider" who understands the Fed's operating system.

What’s interesting about Waller is his shift in perspective. In 2021, he was among the first to call for higher interest rates to fight inflation, correctly predicting that this would not lead to mass unemployment. Now he’s leading the charge for easing, and he was the dissenting vote in July when the Fed decided to keep rates unchanged.

In his speech on August 28, he made it clear: "Based on what I know now, I would support a 25 basis point cut. I am concerned that the labor market situation could deteriorate rapidly." This stance shows a pragmatism, a willingness to change policy based on new data, but still within the Fed's independent framework.

Choosing Waller could be a more moderate change than the other candidates.

Kevin Hassett - "The extended arm" of the White House

As director of the National Economic Council, Kevin Hassett has been the most vocal supporter of President Trump’s policies. He has been a strong advocate of trade and tariff policies and has publicly echoed Trump’s criticism of the Fed under Powell.

His statement on August 3 made that clear: "The President was frustrated because he thought that many other countries had lowered interest rates, while the US had not. He was also concerned that there might be political factors influencing the way these numbers were calculated."

Hassett represents a scenario in which the Fed's independence could be seriously challenged. If he is appointed, the line between monetary policy and the government 's political goals could be blurred.

Kevin Warsh - The Radical "Reformer"

Kevin Warsh, a former Fed governor, is the most unlikely candidate but could also bring the most profound change. Once the Fed’s main liaison to Wall Street during the 2008 crisis, he quickly turned against quantitative easing policies, arguing that they had drawn the Fed too deeply into fiscal policy.

Warsh wants more than just a rate cut. He sees it as “the beginning of institutional change.” He wants to “take the financial markets out of the equation by taking the Fed out of the fiscal realm, out of politics.” His vision is a retrenched Fed focused on the real economy rather than financial markets. Trump nearly appointed Warsh in 2018 and later admitted he regretted not doing so.

Choosing Warsh would be a gamble, a sweeping overhaul that could reshape the role of central banking in the 21st century.

President Donald Trump has just confirmed the three leading candidates to replace Federal Reserve (Fed) Chairman Jerome Powell as Kevin Hassett, Kevin Warsh and Christopher Waller (Photo: CoinGape).

Choosing the Fed Chairman and the Fate of America

More than just an internal Washington story, the race for the Fed hot seat takes place in the context of the US facing long-term structural challenges.

The Supreme Court will rule in October on whether the president has the authority to impose tariffs without congressional approval. A ruling in Trump’s favor would give the government unprecedented economic power, threatening to turn the United States into a fortress surrounded by tariff walls, impoverishing people and subduing businesses.

In that scenario, a new Fed led by someone like Hassett or even Warsh would likely be guided by “fiscal dominance.” Put simply, the Fed would likely be forced to keep interest rates low to reduce the cost of servicing the government’s ever-expanding budget deficits. This would be a disaster, likely causing inflation to return and international investors to lose confidence, demanding higher interest rates to finance US debt.

Meanwhile, on the international stage, the US dollar’s position is being challenged. China, along with the BRICS, is trying to dethrone the “king dollar” as the global trade and reserve currency. A politicized Fed and a dollar that the president is actively trying to devalue to limit imports will only fuel these efforts.

The September rate cut was just a blip. The real storm will be the choice of who will take the Fed’s hot seat next year. The choice of the next Fed chair is not just a personnel change, but a defining decision about the future of central bank independence, the role of monetary policy, and how the United States faces the enormous economic and geopolitical challenges of the next decade.

Source: https://dantri.com.vn/kinh-doanh/ghe-nong-fed-giua-bao-kinh-te-va-cuoc-dua-tam-ma-kich-tinh-20250907230507237.htm

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] General Secretary To Lam receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/3814a68959e848f586178624b6bd66e5)

Comment (0)