Closing the trading session, according to MXV, soybean prices were under pressure in the context of weather in the South American region showing many positive signs of change.

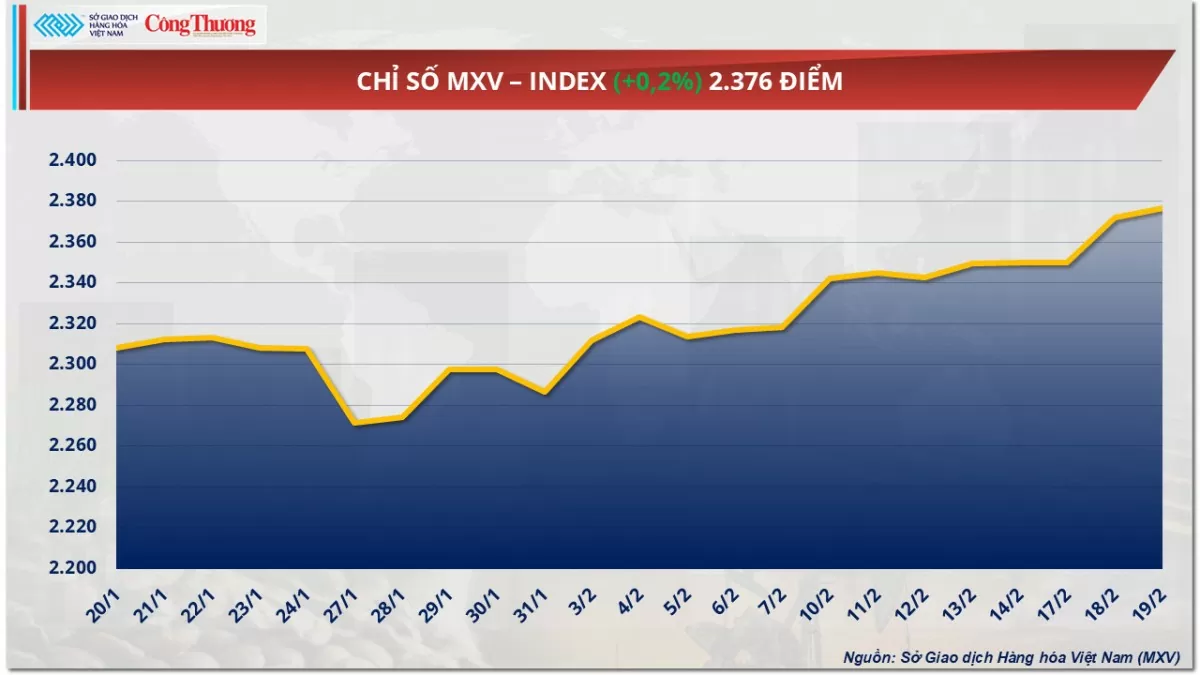

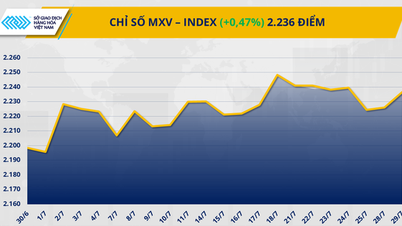

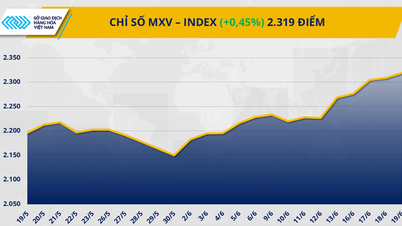

The Vietnam Commodity Exchange (MXV) said that the world raw material market had a relatively mixed and volatile performance in yesterday's trading session. The weather situation in South America showed many positive signs, putting pressure on the prices of agricultural products. Meanwhile, green continued to dominate the energy market when natural gas prices increased for the 8th consecutive session, Brent oil also extended its increase to the third session. At the close, the dominant buying force supported the MXV-Index to increase by 0.2% to 2,376 points - the highest level in more than 9 months.

|

| MXV-Index |

Soybean prices weaken amid weather pressure

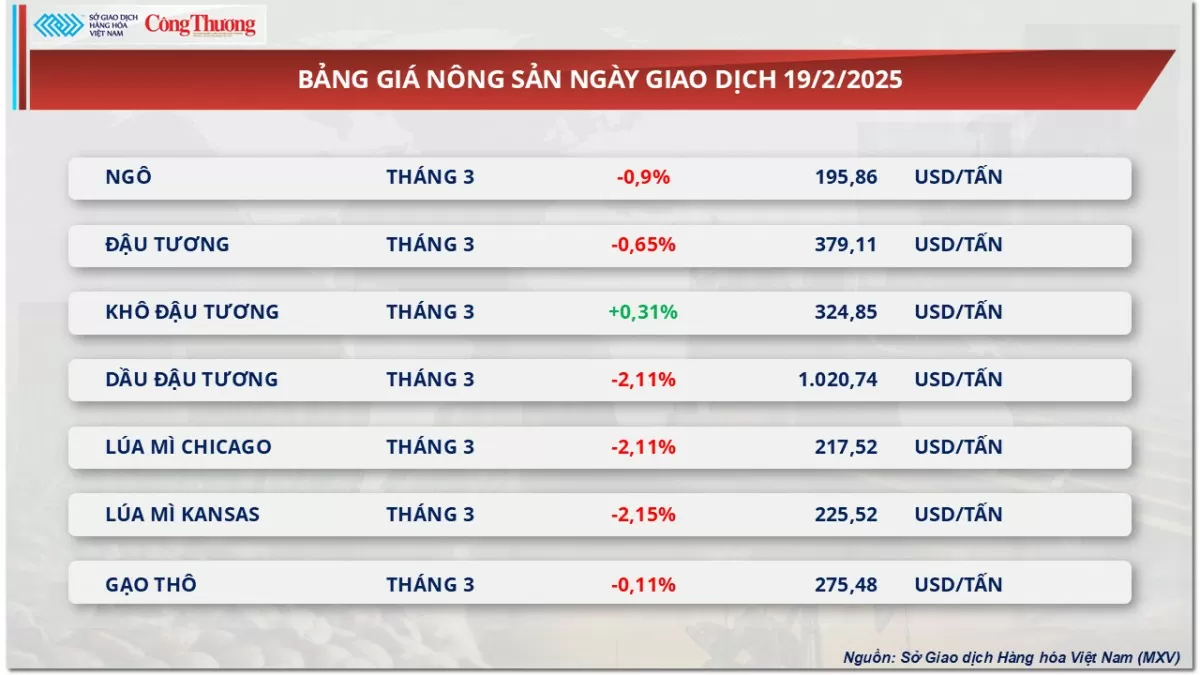

According to MXV, 6 out of 7 agricultural products decreased in price in yesterday's trading session. Notably, soybean prices ended a three-session increase streak when they decreased by more than 0.5% to 379 USD/ton. The market moved relatively sideways in both directions when prices received light buying pressure in the morning session and then reversed and closed in the red. According to MXV, soybean prices were under pressure in the context of the weather in the South American region showing many positive signs.

|

| Agricultural product price list |

According to a report from World Weather, the weather in this region is currently quite favorable with rain alternating with sunny days, creating favorable conditions for crops and harvesting activities in Argentina and southern Brazil. At the same time, it also helps the Midwest and Central South regions to speed up the harvest in a short time.

However, the market still received support from positive trade moves. Taiwan (China) announced plans to buy soybean meal and corn from the US to address the trade deficit. At the same time, US President Donald Trump is aiming for a more comprehensive trade deal with China. Mr. Trump expressed interest in a deal that includes large investments and a commitment from China to buy more US products. Currently, China is the largest buyer of US soybeans, so the above information has contributed to the decline in prices.

The markets for soybean meal and soybean oil have also been mixed. Soymeal prices have risen slightly on the back of positive demand prospects from Taiwan and Thailand. The Thai feed industry is proposing to buy about $2.8 billion worth of US agricultural products annually, including 3 million tonnes of soybean meal and 4 million tonnes of corn, to narrow the $35 billion trade surplus and avoid the threat of tariffs on exports.

Natural gas prices rose for the eighth consecutive session.

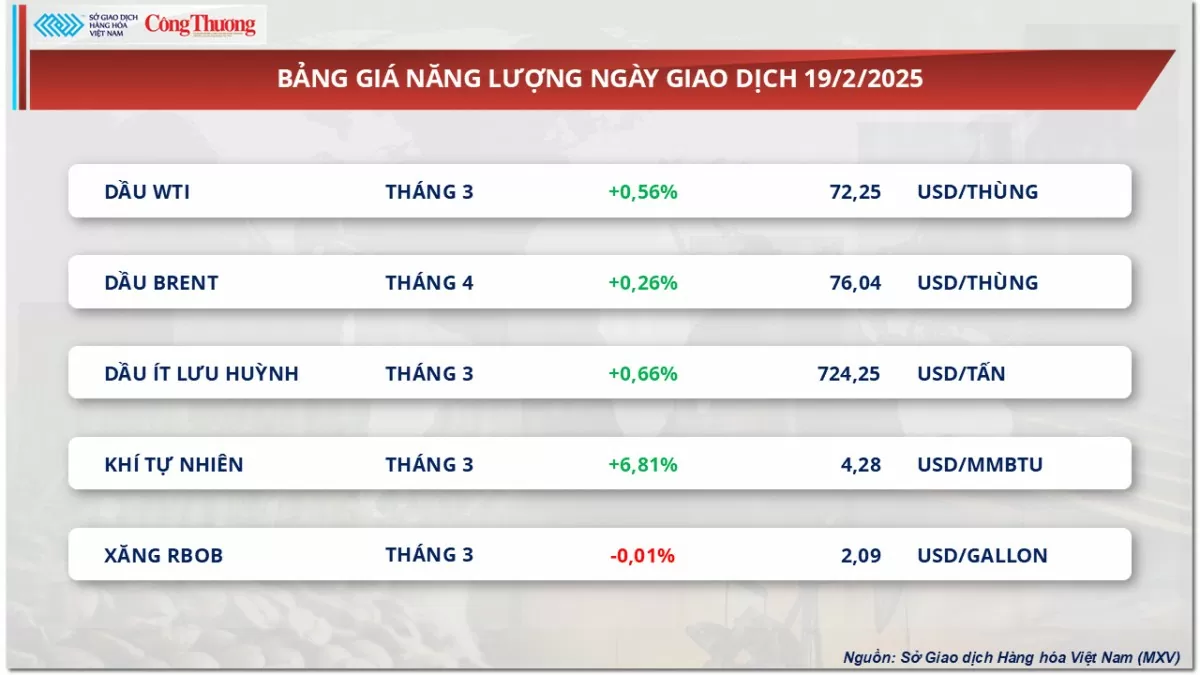

Green continued to dominate the energy market in yesterday's trading session. Natural gas attracted attention when it closed up nearly 7% to $4.28/MMBtu - the highest level since January 2023 as a cold Arctic air swept through, increasing heating demand and threatening supply due to the risk of freezing production.

According to Maxar’s latest forecast models, colder temperatures are expected to grip the central and eastern United States through early March. Natural gas demand has skyrocketed, with current consumption at 122.9 Bcf/d, up 21% from the same period last year.

On the supply side, U.S. dry gas production was 106.1 billion cubic feet per day, slightly above last year’s level but still vulnerable to severe weather disruptions. Gas inventories fell 100 billion cubic feet in the week ending February 7, more than the expected 91 billion cubic foot draw, according to the latest report from the U.S. Energy Information Administration (EIA). U.S. natural gas inventories remain 2.8% below the five-year seasonal average, adding to the tightness of the market.

In the crude oil market, at the end of the trading session on February 19, oil prices continued to rise. Of which, Brent oil prices increased slightly by 0.02 USD, equivalent to about 0.3% to 76.04 USD/barrel, while WTI oil increased by 0.4 USD, equivalent to about 0.6%, reaching 72.25 USD/barrel.

|

| Energy price list |

According to MXV, drone attacks on Russian oil infrastructure have had a significant impact on market supply. Notably, the Caspian Pipeline Consortium (CPC) - the main crude oil export route from Kazakhstan - has seen a 30-40% drop in oil flows following an attack on a pumping station.

In the US, the North Dakota Pipeline Authority estimated that production in the state would fall by up to 150,000 barrels per day. The cold weather also pushed natural gas prices up 6.81% to $4.28 per million British thermal units (MMBtu).

In addition, according to the latest information, the Organization of the Petroleum Exporting Countries and allies such as Russia and Kazakhstan may decide to postpone plans to increase supply in April.

The market is now awaiting data on US oil inventories from trade groups American Petroleum Institute (API) and EIA today and tomorrow.

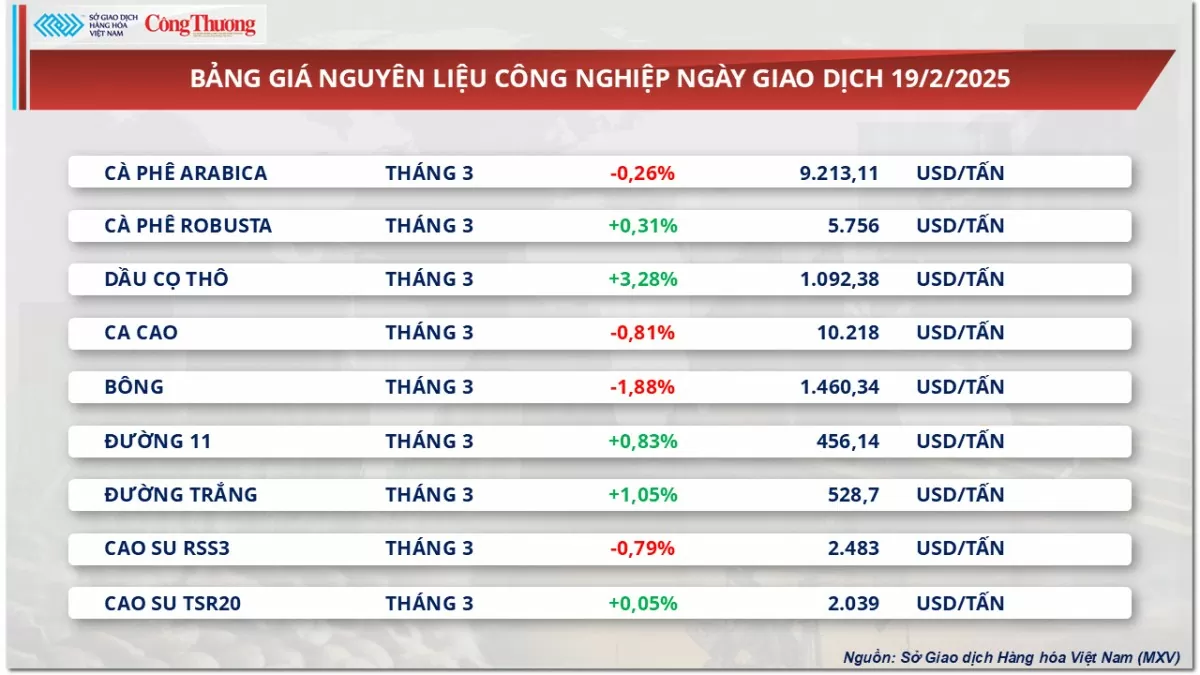

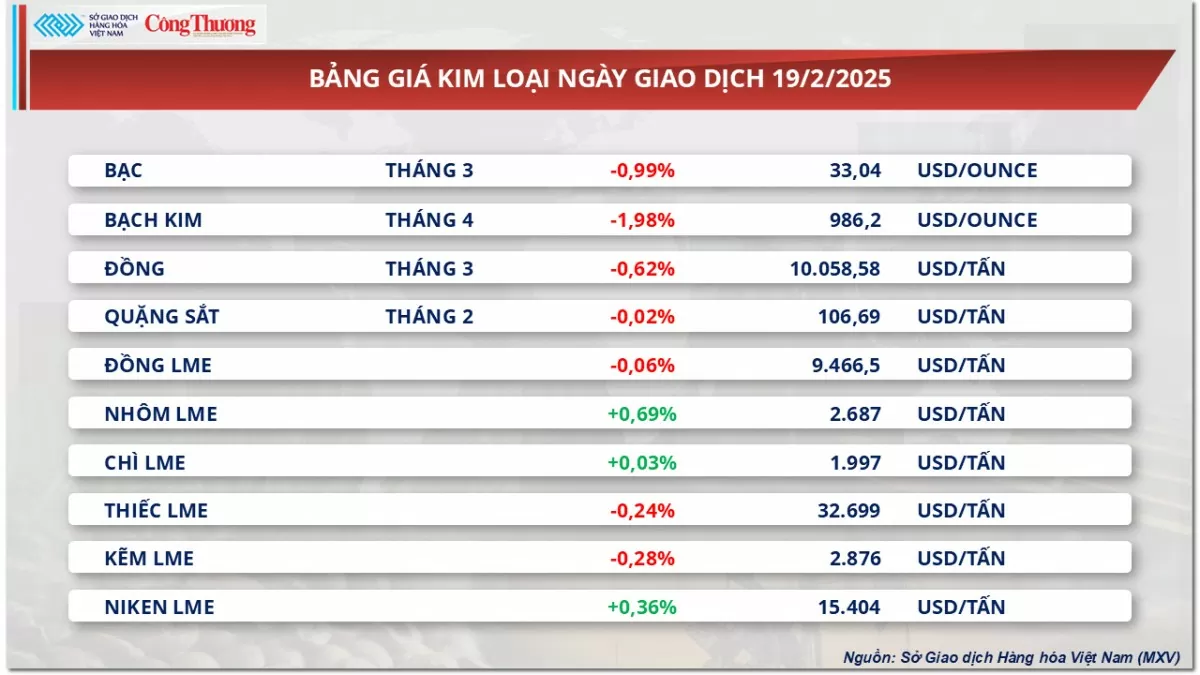

Prices of some other goods

|

| Industrial raw material price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-ngay-202-gia-dau-tuong-suy-yeu-374718.html

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)