Gold price today (June 28): In line with developments in the world gold market, domestic gold prices simultaneously fell below 67 million VND/tael.

Domestic gold price today

Domestic gold prices fell to 67 million VND/tael this morning. Currently, the domestic precious metal prices are listed specifically as follows:

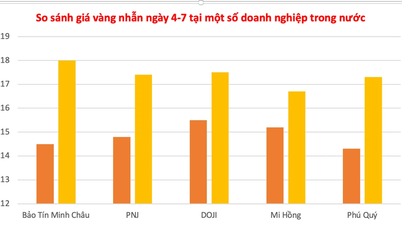

DOJI brand gold price in Hanoi is listed at 66.35 million VND/tael for buying and 66.95 million VND/tael for selling. In Ho Chi Minh City, this brand gold is buying at the same price but selling at 50,000 VND lower than in Hanoi.

|

| Domestic gold prices fell early this morning. Photo: thanhnien.vn |

SJC gold price in Hanoi and Da Nang is currently being bought at 66.35 million VND/tael and sold at 66.97 million VND/tael. In Ho Chi Minh City, SJC gold is still being bought at the same price as in Hanoi and Da Nang but sold at 20,000 VND lower.

PNJ Gold is buying at 66.45 million VND/tael and selling at 66.95 million VND/tael. Bao Tin Bao Tin Minh Chau Gold is listed at 66.42 million VND/tael for buying and 66.93 million VND/tael for selling.

Domestic gold price updated at 5:30 am on June 28 as follows:

Yellow | Area | Early morning of June 27 | Early morning of June 28 | Difference | ||||

Buy | Sell out | Buy | Sell out | Buy | Sell out | |||

Unit of measurement: Million VND/tael | Unit of measurement: Thousand dong/tael | |||||||

DOJI | Hanoi | 66.45 | 67.05 | 66.45 | 66.95 | -100 | -100 | |

Ho Chi Minh City | 66.45 | 67 | 66.45 | 66.95 | -100 | -50 | ||

SJC | Ho Chi Minh City | 66.4 | 67 | 66.35 | 66.95 | -50 | -50 | |

Hanoi | 66.4 | 67.02 | 66.35 | 66.97 | -50 | -50 | ||

Da Nang | 66.4 | 67.02 | 66.35 | 66.97 | -50 | -50 | ||

PNJ | Ho Chi Minh City | 66.5 | 67 | 66.45 | 66.95 | -50 | -50 | |

Hanoi | 66.5 | 67 | 66.45 | 66.95 | -50 | -50 | ||

Bao Tin Minh Chau | Nationwide | 66.47 | 66.98 | 66.42 | 66.93 | -50 | -50 | |

World gold price today

World gold prices reversed and decreased early this morning with spot gold falling 9.9 USD to 1,913.7 USD/ounce. August gold futures last traded at 1,923.8 USD/ounce, down 9.2 USD compared to early the previous day.

Rising bond yields pushed the precious metal lower as the factors driving gold’s rally faded. The yield on the 10-year U.S. Treasury note rose to 3.83 percent in the early morning hours, increasing the opportunity cost of holding non-interest-bearing assets like gold.

Experts predict that gold is at risk of falling to $1,900/ounce in the short term as the US Federal Reserve (Fed) and the European Central Bank (ECB) continue to commit to more interest rate hikes in the future to achieve the goal of price stability.

The latest US macro data has reinforced the case for a Fed rate hike. Specifically, the Conference Board report showed that the consumer confidence index rose to 109.7 in June, the best level since January 2022. This pushed the recession forecasts further away, supporting another 25 basis point increase by the Fed. Other data, including a surge in new home sales in May, also reinforced the possibility of the Fed raising interest rates in the future.

According to the CME FedWatch tool, there is a 77% chance the Fed will raise rates by another 25 basis points in July. “We assess that the increase in July will be significantly lower than we previously forecast,” the economists said.

In Europe, ECB President Christine Lagarde warned that inflation is now in a new phase and could last for some time, signaling more rate hikes to come. "Unless there is a material change in the outlook, we will continue to raise interest rates in July," Lagarde said.

The market is forecasting the ECB's final interest rate to be 4%, which means there could be one more rate hike in the summer and another in the fall.

|

World gold reversed to decrease. Photo: Kitco |

Despite the most aggressive tightening of monetary policy in decades over the past year, central banks have yet to achieve price stability. A recent OMFIF survey found that rising prices were among the top three short-term economic concerns for 85% of central banks this year. "Not a single respondent expects inflation to fall to target in major economies in the next 12-24 months," the report said.

This week, International Monetary Fund (IMF) Deputy Managing Director Gita Gopinath said that while inflation has come down significantly, service sector inflation remains high and is expected to take longer to return to target.

The gold market is now awaiting comments from Fed Chairman Jerome Powell at the ECB's annual policy conference in Sintra, Portugal. Expectations of further rate hikes, especially in the US, are likely to continue to weigh on the gold market, according to an analyst at Commerzbank. Central bankers, including Powell, are likely to continue to adopt a more hawkish tone at the Sintra meeting.

In this environment, gold is at risk of falling below $1,900 an ounce, said Edward Moy, senior market analyst at OANDA. “It has been pretty bad for gold since early May and if expectations for the Fed to continue its aggressive tightening path increase, that could push gold down to $1,900 an ounce,” Moy said.

With the domestic gold price decreasing and the world gold price listed at Kitco at 1,913.7 USD/ounce (equivalent to nearly 54.7 million VND/tael if converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between the domestic and world gold prices is currently over 12 million VND/tael.

TRAN HOAI

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)