At the workshop, experts in the field of finance and accounting shared in-depth updates on new tax policies on invoices and documents according to Decree 70/2025/ND-CP, Circular 32/2025/TT-BTC and notes on non-cash payments according to Decree 181/2025/ND-CP.

Decree 70/2025/ND-CP takes effect from June 1, 2025, regulating the application of electronic invoices to all business households and individuals.

A notable new point is that households and individuals doing business with an annual revenue of 1 billion VND or more will have to use electronic invoices generated from cash registers connected to transfer data to tax authorities.

The Decree encourages consumers to request invoices through loyalty and reward programs, and clearly stipulates the time of invoice issuance for exported goods and services in large quantities.

Circular No. 32/2025/TT-BTC specifically regulates the creation, management and use of electronic invoices, notably expanding the authorization to create electronic invoices; providing detailed instructions on sample numbers, invoice symbols and new regulations for financial leasing activities. The Circular guides the application of electronic invoices in some special cases...

In addition, it helps businesses grasp the core contents and new points of the Law on Value Added Tax, guides on handling operations directly on the software, effectively managing invoices and digital transformation solutions using AI.

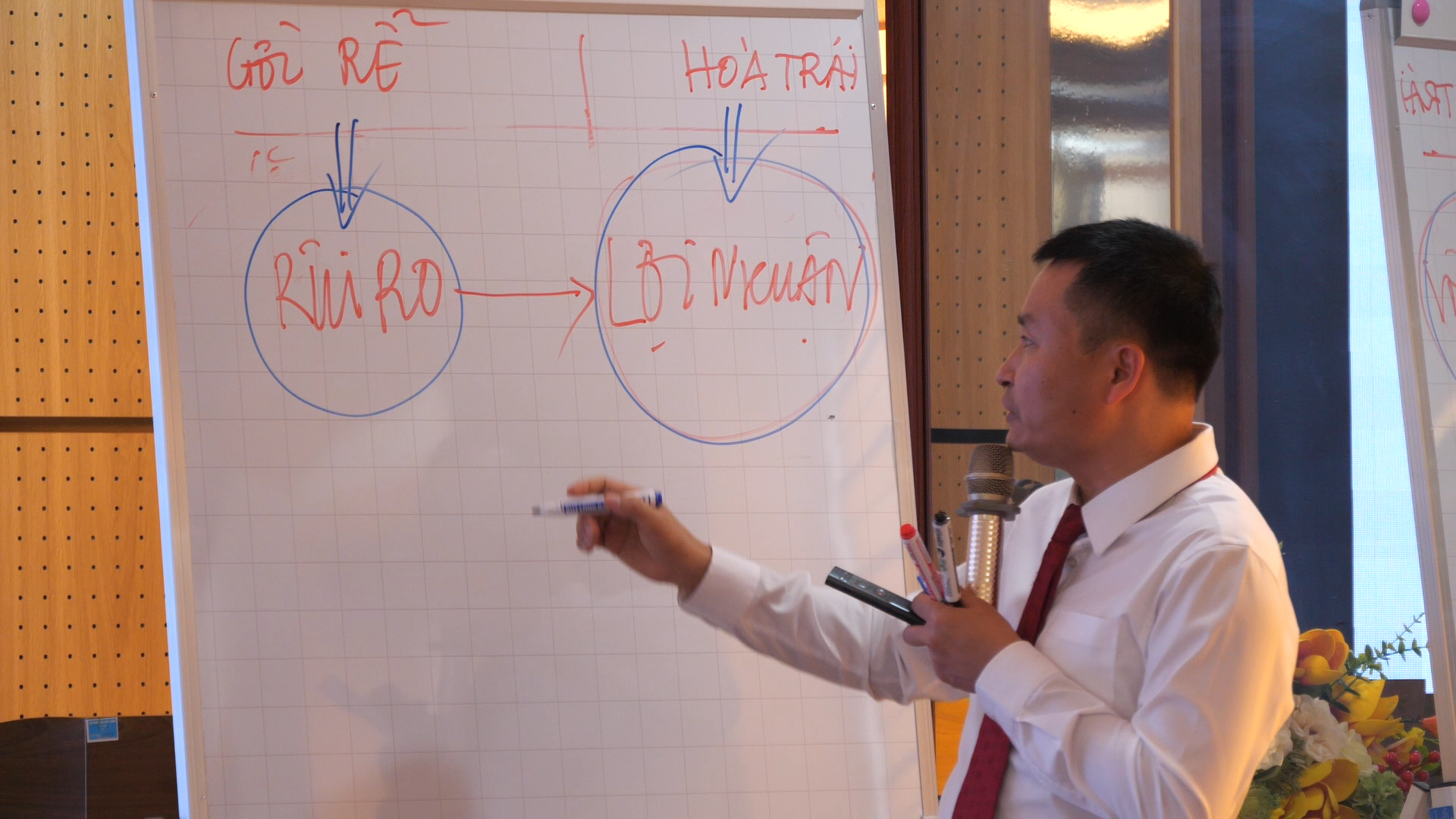

The workshop is a forum for businesses to ask questions and discuss unclear points and difficulties in practice. Through this, it helps businesses quickly and accurately grasp new regulations, creating conditions for organizations and businesses to proactively adapt, properly implement regulations, minimize legal risks in the process of declaring, paying taxes and refunding taxes, contributing to promoting transparency and efficiency in tax management.

Source: https://baolaocai.vn/hoi-thao-cap-nhat-chinh-sach-thue-moi-ve-hoa-don-chung-tu-cho-doanh-nghiep-post882414.html

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)