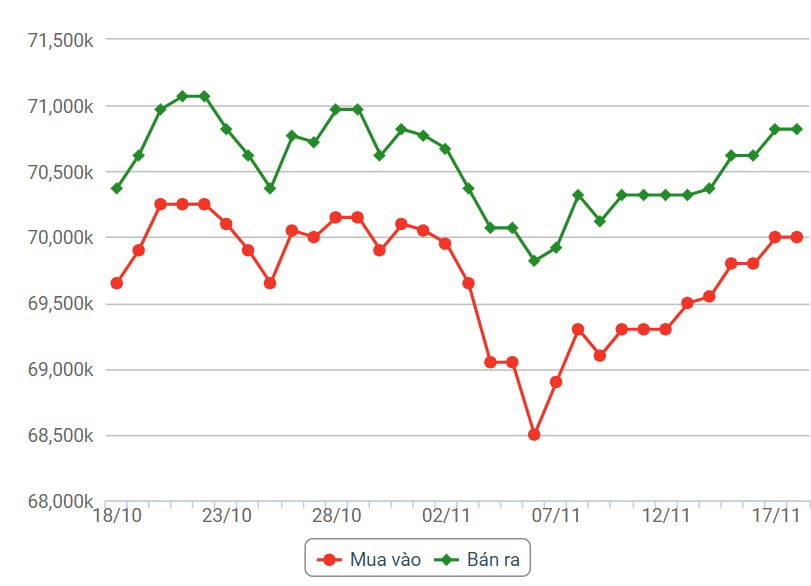

Domestic gold price

Domestic gold price fluctuations

World gold price fluctuations

World gold prices remained unchanged despite the USD's decline. At 5 p.m., the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 103.685 points (down 0.53%).

Gold is still a safe haven asset favored by many investors during this time due to geopolitical tensions in some regions of the world that still tend to escalate.

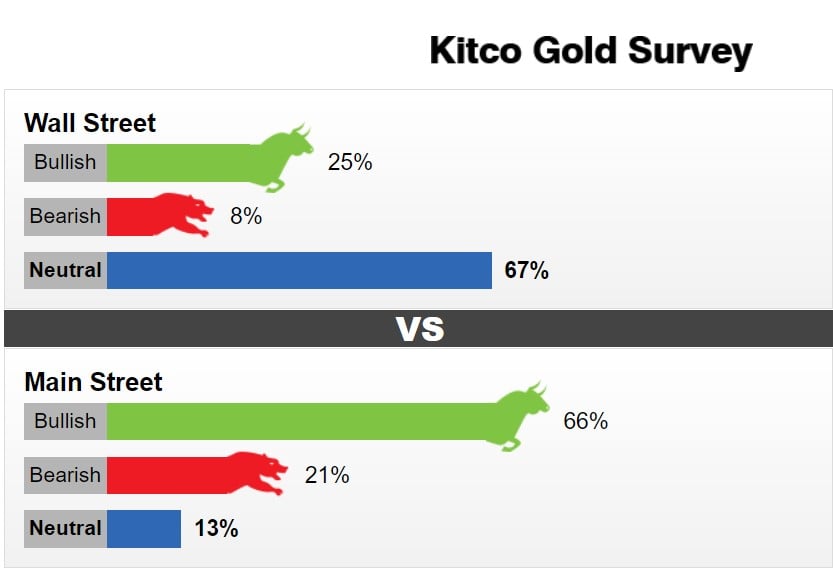

The latest Kitco News weekly gold survey shows that retail investors remain strongly bullish for next week, but most analysts have turned neutral on the short-term outlook for gold.

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey. Like last week, three experts, or 25%, predicted gold prices would rise next week. Only one expert, or 8%, predicted gold prices would fall. Meanwhile, 67% were neutral on gold next week.

Meanwhile, 595 votes were cast by investors in Kitco's online polls. Market participants were even more optimistic than in last week's survey.

394 retail investors, or 66 percent, expect gold to rise next week. Another 125, or 21 percent, expect prices to fall. Meanwhile, 76 respondents, or 13 percent, are neutral on the precious metal’s near-term outlook.

After the recent rally, gold is vulnerable to negative news, but the medium-term outlook for gold is strong, said Adrian Day, president of Adrian Day Asset Management.

This expert believes that at some point, the Fed and other central banks will ease the tightening before inflation is controlled and that decision will trigger a strong recovery in the gold market. However, this is not likely to happen.

In the same vein, senior commodities broker Daniel Pavilonis of RJO Futures said that while gold prices continue to react to economic indicators, recent developments do not provide a clear direction for the direction of the precious metal. According to this expert, there will be no information that can provide momentum for gold next week and gold will trade around current levels.

Meanwhile, market analyst Everett Millman of Gainesville Coins said that the Fed may have finished raising interest rates and the gold market will be interested in when to cut interest rates. According to him, lower interest rates are basically the biggest bullish driver for gold, except in the event of a recession. Accordingly, the gold market in the near term will be stable until a clearer picture of the economy is seen.

Colin Cieszynski, chief market strategist at SIA Wealth Management, is neutral on gold, saying he expects no major moves in the gold market over the next 10 days amid a lack of economic data and a shortened trading week as the US enters the Thanksgiving holiday.

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)