Antimony is used in fire retardants, military equipment and the semiconductor industry... A company specializing in producing this semi-metal in Ha Giang recorded a stock price increase of nearly 700% after 1 year - since China restricted antimony exports.

Many mineral stocks increased "hotly" after China restricted the export of a series of "rare goods" of the world to the US - Photo: QUANG DINH

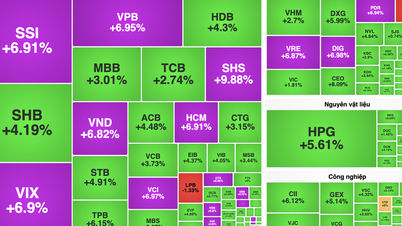

The stock market last week remained gloomy with liquidity not improving compared to the period before Tet holiday.

However, while the VN30 group of stocks is under considerable pressure in the context of continued foreign cash withdrawal, some mineral industry stocks that are quite "strange" to many investors have had positive performance.

Why is HGM stock price increasing so much?

For example, the code HGM of Ha Giang Mechanical and Mineral Joint Stock Company experienced many consecutive sessions of increase and ceiling price increase, becoming a "phenomenon" on the stock exchange.

At the end of the session on February 14, HGM's market price jumped to nearly VND360,000/share, up 60% after 1 month and up 680% after 1 year. This surge made HGM the most expensive stock on the stock exchange.

Looking at the one-time "king" of the stock market price, VNZ of VNG Corporation, is now only 358,000 VND/share, still lower than HGM at the end of last week's session.

HGM's dramatic change has taken place in the past year. Remember, in March 2022, HGM shares received a notice from HNX about the possibility of mandatory delisting due to the annual financial statements in 3 years (2019, 2020, 2021) having an exceptional audit opinion.

At that time, HGM shares had very poor liquidity in the market and the market price was around 40,000 VND/unit. The situation has changed since the second half of 2024, this code has continuously increased vertically.

HGM is a mineral enterprise headquartered in Ha Giang, established in 2006. Owning the Mau Due Antimony refinery, HGM is known as a large antimony producer in Vietnam.

Introducing on its website, this company said it has the right to exploit Mau Due Antimony mine in Ha Giang, which includes three ore bodies, and is exploiting ore body II with reserves of about 372,000 tons of ore with an antimony content of nearly 10%.

Regarding business performance, HGM recorded net revenue of more than VND 370 billion for the whole year of 2024, 2.1 times higher than in 2023. Profit after tax reached VND 185 billion, 3.4 times higher.

Mineral stocks rise after China move?

According to research, antimony (Sb) is a metalloid element (or semi-metal, a type of element that has some properties of metals and some properties of non-metals).

Antimony is "hot" because it is used as a raw material for many industries both now and in the future. This material is used to produce bearings, machine shafts, auto parts, batteries, and in the defense sector (to create grenade shells and explosives).

This precious mineral is also widely used in the high-tech field, as a main component in semiconductors, circuit boards, electrical switches, fluorescent lighting, high-quality transparent glass, batteries, etc.

The US Department of the Interior has long listed antimony and related compounds as critically important minerals. Since World War II, Washington has been one of the world's leading consumers of the mineral, most of which is used in weapons production.

Despite being stuck in a tense relationship with China, the US still has to "bite the bullet" to buy antimony from this country, with about 63% of the antimony the US is using originating from China.

However, near the end of last year, China announced it would begin restricting exports of a variety of antimony-related products.

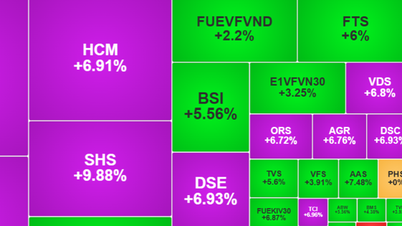

Recently, in addition to HGM, shares of several other mineral companies also increased sharply after information appeared that China continued to announce restrictions on exports of other key minerals to the US.

The move is said to be in response to the US government's announcement of export restrictions on 24 types of chip manufacturing equipment and three types of important software serving semiconductor development to China.

Many mineral stocks increase "hotly"

Returning to the Vietnamese stock market, Masan High-Tech Materials Corporation’s MSR shares have increased by nearly 60% in just 1 month, reaching a price of VND19,700/unit. This company was established in 2010 with the goal of carrying out mineral and resource exploitation activities of Masan Group.

Not only MSR, some other mineral mining companies also increased their ceiling prices for many consecutive sessions such as KSV of TKV Minerals Corporation (Vimico) or BKC of Bac Kan Minerals.

KSV's market price alone increased by 120% after 1 month and 940% after 1 year, reaching the price range of 280,000 VND/share.

Source: https://tuoitre.vn/mot-doanh-nghiep-viet-ban-loai-khoang-san-ca-the-gioi-can-gia-co-phieu-tang-gan-700-20250215153023631.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)