|

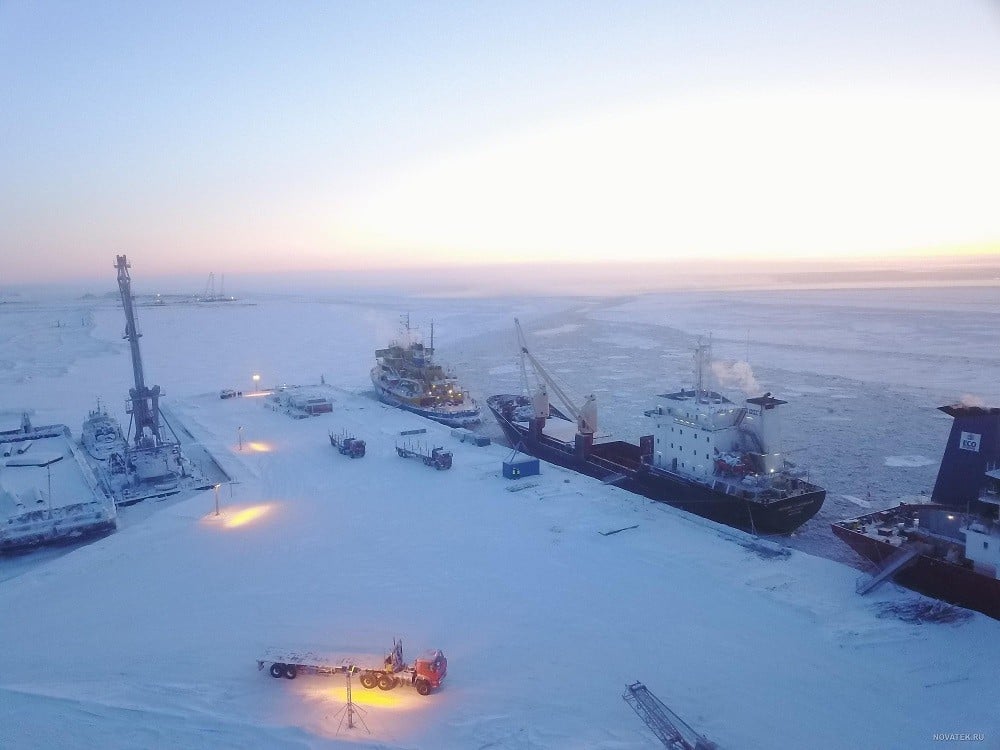

| LNG-2 liquefied natural gas project in Russia's Arctic. (Source: Novatek) |

In 2023, the West actively discussed the possibility of “detaching” from Russia in terms of energy resources, especially liquefied natural gas (LNG). The US aimed to “stifle” Russia’s key Arctic LNG-2 project. But in the end, Europe really realized that it was impossible to give up Russian LNG, at least at this stage.

Europe increases LNG imports from Russia

Europe was very lucky during the hot season. In the summer of 2022, the question was: Will the European Union (EU) have enough gas to avoid freezing in the upcoming cold winter? Then the weather turned on the side of the Old Continent, the region witnessed a mild winter.

However, a warm winter is a gift, not a guarantee. Therefore, despite EU sanctions on Russian energy sources, European countries' purchases in the summer of 2023 are still very active.

By early November 2023, underground gas tanks in Europe were filled to the limit - 99.63%. And LNG purchases from Russia played an important role in this.

Recently, the Spanish newspaper La Vanguardia quoted the authors of a study at the US-based Institute for Energy Economics and Financial Analysis (IEEFA) as saying: “After Russia launched a special military campaign in Ukraine (February 2022), the EU tried to abandon Russian pipeline gas and LNG.

However, figures show an increase in imports from Russia and some European countries even allowing their ports to transship and/or re-export Russian LNG.”

Russia's main LNG customer among EU countries is Spain. From January to September 2023, the country imported 5.21 billion m3 of LNG, followed by France (3.19 billion m3 ) and Belgium (3.14 billion m3 ). Spain and Belgium increased their purchases by 50% compared to the same period in 2022.

According to data from January to October 2023 from Enagaz (one of Spain's largest energy companies), Russia is the second largest LNG supplier and the third largest gas supplier to Spain, accounting for 18% of the country's imported fuel market share.

According to IEEFA, Europe paid 16.1 billion euros for all gas originating from Russia in 2022. In 2023, this trend did not change.

“If you look at the volumes of LNG purchased, they are already around 14 billion m3 . Despite numerous trade sanctions, EU countries have paid Russia 12.5 billion euros between January and September 2023 alone,” the study said.

Meanwhile, according to Standard & Poor's report, in 11 months of 2023, 13.5 million tons of Russian LNG were shipped to Europe, slightly lower than the whole of 2022 (14 million tons).

On the one hand, many European companies have long-term contracts to buy Russian gas – and these contracts continue to be fulfilled. On the other hand, in Spain, Moscow operators have registered in the system, from which users can make purchases.

“Another important aspect is that Spain has one of the largest regasification plants in the EU, making it a hub for the transport and re-export of LNG to Europe,” explains Mariano Marco, director of the Energy Transition Unit at the University of Barcelona.

“Spain re-exported 1.05 billion m3 of LNG between January and September 2023, with re-exports to Italy almost doubling compared to the same period last year,” the expert added.

Can't "escape Russia" on gas

On this issue, the newspaper El Periodico de la Energia recently wrote: Europeans are ready to take LNG from Russia for speculative purposes - they receive the cargo at their ports and immediately resell it to other countries. The explanation is simple - we do not buy it for ourselves, but to resell it. Therefore, "the EU turns a blind eye to 21% of the total volume of LNG purchased from Russia".

In July-August 2023, Russia’s main LNG plants in Sakhalin and Yamal significantly reduced production for maintenance work. However, LNG exports began to increase again in the fall.

In November 2023, Russia exported a record amount of LNG to Europe - 1.75 million tons, and experts believe that in December the figure will be even higher.

Countries considered “unfriendly” to Russia, which just a few months ago declared a complete refusal to buy LNG from Moscow, are now talking about resuming imports. In October 2023, the Czech Republic will start buying LNG from Russia again. Meanwhile, on December 10, the Netherlands made a similar decision.

Several major European companies already have long-term agreements to buy Russian pipeline gas and LNG. Austria's state-owned OMV has a contract with Gazprom until 2040.

In July 2015, France's Engie and Russia's Yamal signed a 23-year LNG supply agreement. In 2018, the contract was taken over by France's Total.

Total CEO Patrick Pouillant said there was “no intention to end relations with the Russians, at least until the EU imposes a firm ban on all gas purchases from Moscow”.

Meanwhile, the Belgian company Flikus has a 20-year contract with the Russian group Yamal, and also does not want to end the cooperation.

In addition, the Spanish company Nature, which has signed an agreement to purchase Russian LNG until 2042 (2.7 million tons per year), is also in no hurry to cut ties. As early as February 2022, President of Nature Francisco Reynes expressed his opinion on the view that “it is necessary to overcome the EU's gas dependence on the Russian Federation”.

“Nature has always done two things: its obligations and the terms of the contract. There has to be a good reason for terminating the contract. And today there is no reason for that,” he said.

|

| Russian President Vladimir Putin launches the first line of the Arctic LNG-2 project in Murmansk, Russia, July 2023. (Source: AFP) |

According to Western sources, the share of Russian LNG in the total volume of liquefied gas purchased by the EU is 7.3%. In terms of LNG supply to the bloc, Russia ranks second, just behind the US, pushing Qatar down to third place.

This situation is “unpopular” with Washington, which hopes to force Europe to use only American LNG. At the White House, Assistant Secretary of State Jeffrey Payatt declared: “Our goal is to strangle the Arctic LNG-2 project, Russia’s largest LNG project.”

Sanctions on the Arctic LNG-2 project will not only affect Europe. Among the shareholders of the project is the Japanese group Mitsui, which owns 10% of the shares. Mitsui will not receive dividends in cash, but in goods, 2 million tons of LNG per year, equivalent to 3% of Japan's total imports. For the Land of the Rising Sun, gas plays a very important role. About 30% of the total electricity used in this country is produced from gas.

It is known that by 2023, Russia plans to supply about 32 million tons of LNG to the international market. The operation of all three LNG-2 vessels in the Arctic will increase this figure by 20 million tons. The first vessel is expected to be delivered in the first quarter of this year.

The US exported 133.7 million tonnes of LNG in 2023, including 86 million tonnes to Europe. Therefore, Russia's deployment of the LNG-2 project in the Arctic will become a serious obstacle for Washington on the path to world LNG market hegemony.

By 2027, according to the EU plan, several new LNG plants will be operational in the US. Another is under construction in Qatar. Increased production in these countries will also increase the volume of products supplied to foreign markets.

Therefore, Europeans could completely abandon Russian LNG, which is cheaper, and switch to US and Qatari LNG. By then, the process of transferring European industrial giants to the US could be completed, reducing the real need for energy resources on the old continent.

However, it is also possible that economic interests will determine the EU’s decision to continue buying LNG from Russia. In any case, Moscow should not waste time guessing whether Europeans will use gas. Moreover, the maximum demand for energy resources today (and in the future) is in China, India and other Asian countries, which are considered to have great potential for Russia.

Source

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of Vietnamese Lawyers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1760026998213_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam visits Kieng Sang Kindergarten and the classroom named after Uncle Ho](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1760023999336_vna-potal-tong-bi-thu-to-lam-tham-truong-mau-giao-kieng-sang-va-lop-hoc-mang-ten-bac-ho-8328675-277-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

Comment (0)